中国汽车网站用户研究报告

研究背景与目的

随着经济的发展,有车一族已经不再是少数精英群体,在大中城市,私家车已经逐渐普及。有越来越多的人开始关注汽车、谈论汽车、拥有汽车网络迅速发展,已成为大众获取信息的重要渠道之一,也是大众获取汽车相关信息的主要渠道。因此,汽车相关网站正在不断成长和发展,逐渐成为网络信息的重要组成部分

本文从互联网对于网民的影响入手,对网民的互联网行为做了初步研究,并分别对汽车网站上的用户和腾讯汽车频道用户基本情况做了大致描述

关于本次研究中网民对于汽车的消费和使用行为及态度等更多内容参见腾讯“08汽车网站用户研究”

汽车网站用户获取汽车相关信息的渠道对于汽车相关信息,网络在他们的购车决策过程中所扮演的角色最为重要。

此外,朋友介绍对于他们而言也比较重要,他们经常通过朋友获取一些信息,并且这些信息对他们的购车决策也产生了重要的作用;

现场销售人员的介绍虽然不是一个经常性的信息获取途径,但是该渠道对于购车决策的作用不可小视。

从用户购车决策的过程中去看网站对他们的价值

网络对于购车者而言是一个重要知识库,能帮助他们做好知识的储备,然后在实地看车的过程中借助自己的知识储备全面审视自己中意的品牌。

网上查询汽车信息基本会按照这个流程

网民所关注的网上汽车信息

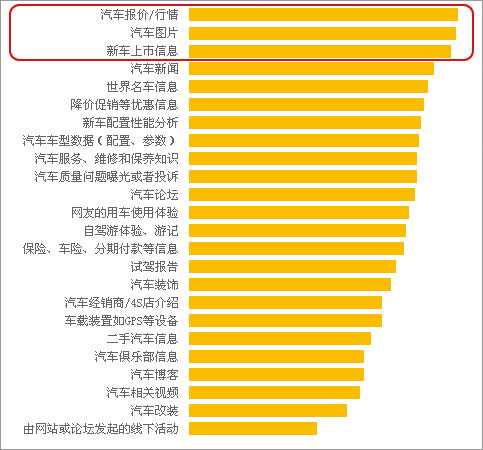

汽车报价和行情、汽车图片和新车上市信息是用户最关注的三个核心信息

其次,汽车新闻、世界名车信息、降价促销等优惠信息、新车配置性能信息以及车型数据信息也得到了50%以上的用户的关注

汽车信息关注

浏览汽车相关信息最经常使用的网站类型

浏览汽车相关信息的时候,用户最经常上门户网站的汽车频道;并且目前无车一年内准备新购车的用户对于门户网站的依赖性更强。

专业汽车网站是用户浏览汽车相关信息时,第二经常使用的网站类型;而目前有车一年内再购用户对于专业汽车网站的使用率高于目前无车一年内新购的用户。

用户在汽车网站的参与度

腾讯汽车频道用户在网站的参与度要高于总体汽车网站的平均水平。

未来一年内有购车计划的用户,在汽车网站的参与度要高于没有购买计划的用户,他们更喜欢讨论和发表言论。特别是目前有车而且未来一年内准备再购买的用户,他们的活跃度最高。

汽车网站用户的其他网络行为

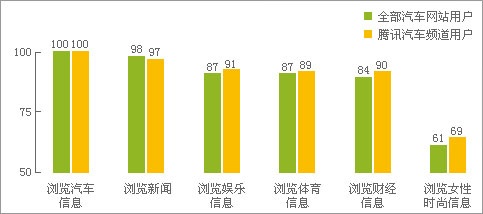

除汽车相关信息之外,汽车网站用户也上网浏览新闻、娱乐、体育、财经、女性时尚等相关信息。

腾讯用户在各类信息的浏览比例都高与总体,说明腾讯汽车频道用户的网络使用和浏览更丰富。

腾讯产品的使用情况

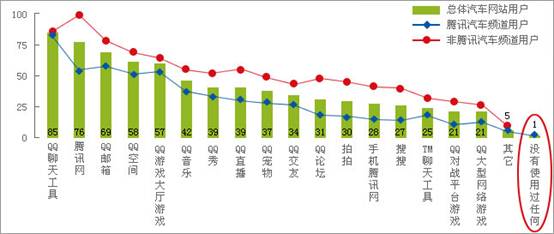

腾讯丰富的各类产品,无论对于腾讯汽车频道还是其他汽车网站用户,都有很好的覆盖。在总体汽车网站用户中,表示平时没有使用过任何腾讯产品的用户,仅占1%

QQ聊天工具覆盖了总体汽车网站(腾讯&非腾 讯)85%的用户。腾讯网覆盖了总体汽车网站76%的用户;而其他汽车网站(非腾讯汽车)用户也有56%会访问腾讯网。总体汽车网站用户中,近70%使用 QQ邮箱;而其他汽车网站(非腾讯汽车)用户中,有近60%使用QQ邮箱。

用户描述

汽车网站的用户到底是怎样的人群?这些人的教育程度如何?其收入情况如何?

通过本部分的调查,我们希望可以对汽车网站用户以及腾讯汽车频道用户有一个初步的认知

汽车网站用户描述

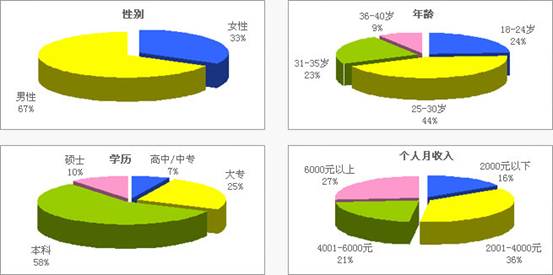

男性为主;25-35岁之间为主,平均年龄28岁。

高学历,本科以上为主;高收入,平均个人月收入5252元。

腾讯汽车频道网站用户描述

腾讯汽车频道用户,相对整体汽车网站用户年龄稍年轻,而相对市场平均水平相比,腾讯用户的学历和收入要高于市场平均水平,更加年轻有为。一般也认为,用户受教育程度越高,其就业获得高薪酬的概率越大,相对购买潜力越高。

一般市场营销认为“最具购买潜力”的用户群(年龄段在26-35岁之间,属于就业数年后一定财富积累的人群),在腾讯用户比例中也超过62%,可见其用户人群的潜力。

第二篇:中国汽车研究报告-英文版

China Aims to Reach the Level of Advanced Countries in 2010

by Promoting Reorganization of Companies

Under the New Automobile Industry Development Policy

Outline of China's new auto policy and Chinese business plans

by automakers worldwide

In June 1, 2004, the Chinese government officially announced and enforced the Automobile Industry Development Policy (new auto policy), which replaces the Industrial Policy for the Automobile Industry

(formulated in 1994) as a new signpost and policy for development of the automotive industry. The new auto policy does not change the current move toward the expansion of a partnership with foreign automakers. The new policy aims to make China join with major auto producing countries by the standards of developed countries in 2010 using a partnership with foreign capital as the driving force.

In line with the announcement of the new auto policy and Auto China 2004 (the 8th Beijing Motor Show), which opened on June 9th, the announcement of Chinese business plans was successively made by

automakers worldwide. The scale of Chinese business by major global automakers, including plans already revealed by each automaker, will amount to more than 7.3 million a year in several years.

→

■China, focusing on the balance of development, aims to take a place among major auto producing countries by 2010

China's vehicle production surpassed 3.2 million (including 1.15 million passenger cars), the production target for 2005 under the Tenth Five-Year Plan (2001-2005) for the Automotive Industry in China, which was announced in June 2001. The production volume amounted to 4.44 million in 2003 (including 2.19 million passenger cars).

Against the backdrop of rapid growth and under the Automobile Industry Development Policy (issued in June 2004), which serves as guidance for China's automobile policy, the following objective has been set: The fostering of China's automotive industry into a core industry of the national economy by 2010, the

forming of industry into an exporting industry including, as the subject of the policy, cooperative development with related industry and transportation infrastructure and the fostering of a sound automobile consumer market while preventing severe maladjustment from occurring due to a rapid growth.

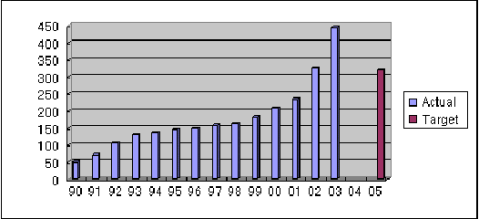

■China's Output of Automobiles (10,000 units)

Note: The target figure for 2005 is 3.2 million under the Tenth Five-Year Plan

(2001-2005) for the Automotive Industry in China (which was compiled in

2001). Output went beyond 3.2 million to a total of 3.25 million in 2002.

Output amounted to 4.44 million in 2003. Output totaled 1.35 million in

1994, when Industrial Policy for the Automobile Industry was formulated

as China's first industrial policy.

■Objectives by 2010 under China's Automobile Industry Development Policy

■Fostering a large automobile corporate group with a market share of more than 15% and an independent management plan

As a principle of policy operation, integration is maintained of a basic role of resource allocation based on market mechanisms and macroeconomic adjustment by the government. One of the policies that bring the principle into shape is mandatory formulation of a development plan by a large-scale automobile corporate group, which mutually complements a medium- and long-term development plan that National Development & Reform Commission designs. Large-scale automobile groups themselves formulate their own

development plans based on the medium- and long-term plan and carry out the plan independently as it wins approval from National Development & Reform Commission.

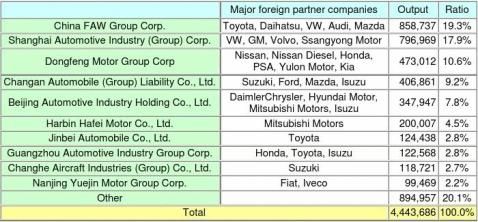

One of the requirements to become a large-scale corporate group is having a 15% share of the market in China; currently two groups, China FAW Group Corp. (FAW Group) and Shanghai Automotive Industry (Group) Corp. (SAIC Group) have a marketshare of 15%. The new auto policy supports automakers

developing into large-scale automobile corporate groups in the form of resource restructuring or encourages an automaker to form an alliance by complementing each company's advantage and sharing resources. Participation by foreign capital into such reorganization is also encouraged. The new auto policy supports

large auto corporate groups jointly in foreign auto groups consolidating/reorganizing automakers inside and outside of China, thus expanding their business range. In such a case, the restriction that limits the number of foreign shareholders to as many as two is not applied.

As for a recent actual example, GM and SAIC (1) will jointly purchase the former Daewoo Motor's

production facility in Shandong Province and (2) plan to bring Jinbei GM Automobile under the umbrella of Shanghai GM. A wide variety of similar potentials have opened for other companies that have expanded into China.

Note: As a measure to expand the range of independent management, a notification system was introduced into a portion of investment that was required to win approval. For instance, in the case of production of a new model which is required to receive authorization from multiple government agencies, companies, if they meet the requirements, are able to obtain approval through notification and the government's announcement in a shorter time than before.

Investments that are stipulated as subject to the notification system are as follows: (1) Investment in expansion of production capacity and increases in a variety of similar products by self-financing (2) Investment in motorcycles and motorcycle engines (3) Investment in vehicles, and parts for agricultural vehicles and motorcycles.

■To streamline the structure of the industry by promoting selection and

reorganization and by tightening conditions on the establishment of new

automakers

After 2000, when vehicle production in China surpassed 2 million, the number of companies that had

entered into the field of vehicle production by taking over slumping automakers and other means increased rapidly; an accumulated total of those companies has amounted to 24 since 2000. Including those new

entrants, more than one third of the 117 automakers were reported to be suffering from a deficit at the end of 2002.

Under the new auto policy, a system that leads corporate realignment is introduced to expand the scale of companies and profit, to increase concentration of industry, and to prevent small automakers where production and management capability is lower from proliferating.

Authorization of production to automakers had previously been referred to as permanent qualifications, but the new auto policy makes clear provisions for the shut down of automakers. In concrete terms, names of automakers that fail to sustain management are made public and those companies are prohibited from transferring qualification of production to non-automobile companies. In addition, companies whose names are made public are encouraged to shift into production of specialty vehicles and automotive parts, or to reorganize with other automakers.

Proliferation of automakers that are lacking in the technological base is restricted by other aspects. The new auto policy sets mandatory requirements for technologies including automobile safety, environmental protection, fuel saving, and anti-theft at the level that is compliant with mandatory requirements in the

international standard for vehicle technologies, thus establishing a certification system for automakers and products.

Companies and products that fail to meet conditions for certification are eliminated from notification; therefore, business activities of those companies are virtually terminated. Moreover, under the new auto policy, requirements for approval for production by companies include requirements for capability for design and development, production facility, stability of production and quality control capability, capability for sales and after-sales service.

Conditions for the establishment of a new automaker are tightened. Clearly indicated conditions include the attachment of R&D facilities with an investment of more than 500 million RMB, a total investment of more than 2 billion RMB, and self-financing of more than 800 million RMB. Companies that enter into production of passenger cars and heavy-duty trucks are also required to manufacture their engines.

In addition, the lowest annual production volume is clearly indicated for companies that manufacture passenger cars and heavy-duty trucks from scratch.

■Conditions of approval for a new investment in the new auto policy

Note: The lowest annual production volume is clearly indicated as part of conditions regarding production of

passenger cars and heavy-duty trucks.

Four-cylinder engine passenger cars: 30,000. 6-cylinder engine passenger cars: 50,000. Heavy-duty trucks: 10,000.

■The new auto policy succeeds in restrictions on vehicle production by foreign capital while restrictions are not applied to investment in the establishment of an export base

The new auto policy succeeds in restrictions on foreign automakers concerning the number of Chinese joint venture partners to two companies in terms of passenger cars and commercial vehicles (two

companies in terms of motorcycle as well), respectively, and also to a restriction of ownership stake of 50% or less. The new policy makes it clear that foreign automakers that are tied through management rights are regarded as the same company.

Although standards for management rights are not made public, if we set a standard at one third of the total share, Mazda is regarded as being the same company as Ford and Nissan is regarded as the same as Renault. In the meantime, as it was reconfirmed that foreign automakers are able to establish a tie up with two Chinese companies, a joint venture with Guangzhou Automotive Industry by Toyota, which is currently forming an alliance with China FAW, is expected to win approval at an early date.

The new auto policy was also designed to respond to the agreement in 2002, when China joined the WTO. The limit on the ownership stake of 50% is a restriction accepted when the country joined WTO. There are no provisions including balance of foreign currency on investment by foreign companies, balance of import and export, requirements for nationalization (in an investment in automobile production, a local-content ratio of auto-parts of 40% or over was required before), and requirements for export.

Incidentally, though standards for approval for production of vehicles to be exported and of automotive engines in the export and machining area are not made clear, nor are restrictions on the number of joint venture partners and the ratio of ownership stake applied. There is a greater potential for business

development using China as an export base; like the example of Honda's specialized export plant, Honda Automobile (China) Co., Ltd., which began production in Guangzhou City (65% owned by Honda, 10% by Dongfeng Motor Corp., and 25% by Guangzhou Automotive Industry).

Note: Outline of the agreement in the field of automobiles in 2002, when China joined the WTO is as follows:

(1) Lowering of tariffs: Import tariffs on passenger cars will gradually be lowered to 25% by July 1,

2006. The tariffs on buses will also be reduced to 25% by 2005. Those on trucks will be lowered to 15, 20, 25% between 2004 and 2005 (the ratio is different by GVW and the type of fuel).

(2) Quantitative restriction on imports: It will be completely abolished in 2006, until such a time when the import quota will gradually be expanded.

(3) Compliance with TRIM agreement (Agreement on Trade-Related Investment Measures): Balance of foreign currency, balance of import and export, demand for nationalization, and demand for export will be eliminated from requirements of approval for investment plans from abroad.

(4) Liberalization in the field of distribution: Restrictions on entry by foreign capital into wholesale/retail sale of automobiles will completely be abolished in three years.

(5) Entry into auto financing by non-bank financial institutions: Restrictions will be eliminated at the same time as the entry into the WTO.

■A new restriction on the import of auto-parts is introduced, requesting automakers

to spin off their auto-parts divisions

Though the standard for a local-content ratio in terms of vehicle production was abolished, import controls were introduced to foster auto-parts industry and suppliers.

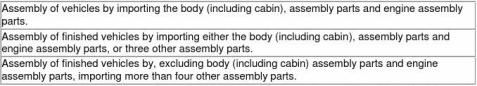

In such a case where automakers manufacture finished vehicles by importing core components, the

automakers need to report to customs house as well as to the Ministry of Commerce of the P. R. China and National Development & Reform Commission. It is stipulated that if the ratio of import of core parts goes beyond a certain standard the products is regarded as an import of finished vehicles and that import tariffs on finished vehicles will be applied to imports of automotive parts. In effect, this is a regulation which requires that more than several kinds of parts by assembled vehicle be manufactured in China. It can be said that it is a system that designates nationalization of parts which adopts a selection system.

Note: Incidentally, the import of used cars and used parts, and scrapping/assembling used cars and used parts imported as scrapped products are prohibited as before.

■Cases in which tariffs on finished vehicles are imposed on imported parts

drive axle assembly, non-drive axle assembly, main frame assembly, steering assembly and brake system.

2. Import of components of assembly sets and component module parts of assembly sets and

systems is also regarded as import of assembly parts.

Moreover, to foster the auto-parts industry and companies that have a specialized field and hold

capabilities for mass-production and supply of modules a specialized development program for parts will be made by classifying the respective auto-parts. Automakers are obliged to gradually foster their auto-parts manufacturing division in-house to independent specialized suppliers for external companies.

Suppliers are urged to make efforts to expand into the global market by aggressively participating in the product development process of their customers to enhance their capabilities for system development in the core parts field and their capabilities for development/production of advanced products in the general parts field. In addition, it is stipulated that the government will preferentially provide support to suppliers which can respond to OEM supply to multiple independent automakers and to global procurement by

automakers/suppliers worldwide.

It is also stipulated that that focus will be on improvement of quality level of products and market

competitiveness in the field of material and supporting products which Automobile Industry Development Policy requires. It is written clearly that among such fields major support will be provided to the supply of sheet steel for passenger cars and to the development of design capabilities for vehicle dies.

■Establishment of R&D facilities is supported and hybrid DE technologies are stipulated as priority issues

However, models introduced from overseas partners accounted for 88% of the increased passenger car production of 2.19 million in China in 2003. It is necessary to develop advanced practical technologies by holding intellectual property rights through independent development to achieve a target of exporting

products in large numbers as one of the major auto producing countries. Yet, the principle of encouraging aggressive development of partnership with overseas companies and of combining introduction of foreign capital and independent development of products will be firmly maintained.

Support for build up of creativity for products and fostering of independent development capability by establishing R&D facilities for products are written clearly in the new auto policy. With respect to

independent development, there are various adoptable forms; such as exclusive development, joint

development, and outsourced development. The target is to secure competitiveness in the global market and to deal with problems in terms of safety and environment/energy.

Acquisition of technology for auto body development, development of technology in the product

manufacturing process, and capability for development of chassis and engines are cited as priority issues for automakers. It is also stipulated that support will be offered for companies that carry out such challenges - a large automobile corporate group or an auto-parts manufacturer.

Development of new engines and vehicles with new fuel is a challenge that the new auto policy

encourages. Among such new challenges, technologies for a hybrid vehicle and diesel engines for

passenger cars are regarded as priority issues. Regarding fuel economy of automobiles, it is written clearly that the average fuel economy of new passenger cars will be improved by more than 15% by 2010 from 2003 and that disclosure of information about fuel economy will be established as a system.

Promotion of R&D for new material for automobiles such as lightweight material, recyclable material, eco-friendly material and support for the automotive electronic industry are stated clearly. The bottom line for the ratio of material recycling will be set on a timely basis.

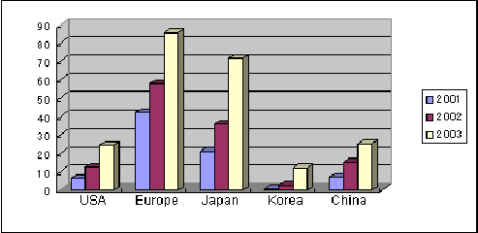

■Output of passenger cars in China by location of partner companies

(10,000 units)

Note: Production models that are based on models of foreign automakers

are summed up by region - USA, Europe, Japan, and Korea. In 2003, the

number of models introduced from European automakers including VW

totaled 860,000, accounting for 40% while that of models introduced from

Japanese automakers has recently increased to 720,000. The number of

models from the USA totaled 240,000 while that from Korea numbered

120,000. The figures of China represent proprietary models by Chinese

automakers, which include models updated by each Chinese automaker,

which were manufactured through a tie-up with foreign automakers

before. In 2003, output of such models totaled 250,000, accounting for

12% of the total output of passenger cars of 2.19 million. Incidentally,

Beijing Jeep's Cherokee and Changan Ford Automobile's Mondeo are

included in USA.

■A brand system will be introduced. Establishment of a sound automobile

consumer market is set as the objective of the policy

Industrial Policy for the Automobile Industry, a former policy formulated in 1994 covered only the

automotive industry whereas the new auto policy also covers the service fields including sales, financing, and repair/maintenance as well as transportation infrastructure. Build-up of a sales network based on a brand system and support for formation of the used car market will be supported.

The brand system will be introduced to protect the legal rights of automobile consumers and to provide good service when the consumers purchase and use automobiles. Companies that sell automotive products which they themselves manufacture are required to establish sales and service networks for its own brand vehicles as early as possible.

Though no conditions are indicated so far, the combined sales of Chinese-made and imported vehicles are considered feasible. Major automakers will be able to sell full lineups through combined sales of those vehicles.

The brand system will be introduced in 2005. Automakers, motorcycle makers, engine and auto-parts suppliers have to register their own product brands and service brand and indicate the brands on all China-made vehicles and assembly parts starting in 2005. Dealers are also required to display the service brand of all manufacturers at their dealerships.

In addition, an exclusive sales system will be introduced for passenger cars made independently by each company in 2005 and all vehicles and parts in 2006. Providing products is not permitted for dealers who are not given authority for brand sales and who do not meet operating conditions.

For the establishment of the brand system, companies are required to aggressively develop products in which they hold intellectual property rights as well as to focus on protection of those rights and to make efforts at the enhancement of brand values. At the same time, it is stipulated that sales of products that violate intellectual property rights are prohibited.

The new auto policy demands that provisions by administrative bodies and local governments which violate the Chinese government provisions and the new auto policy be abolished at each level including new car registration, consumption, and disposition to protect consumer benefits. For example, local governments' restriction on issues of license plates conflict with the new auto policy and will be abolished.

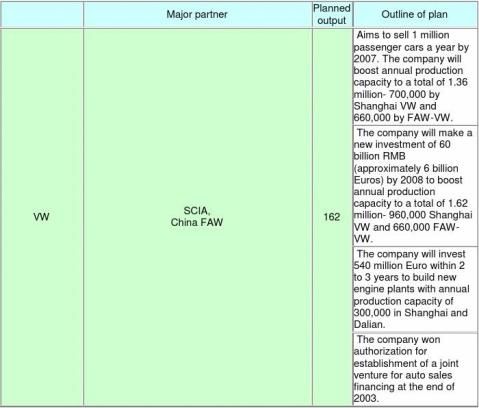

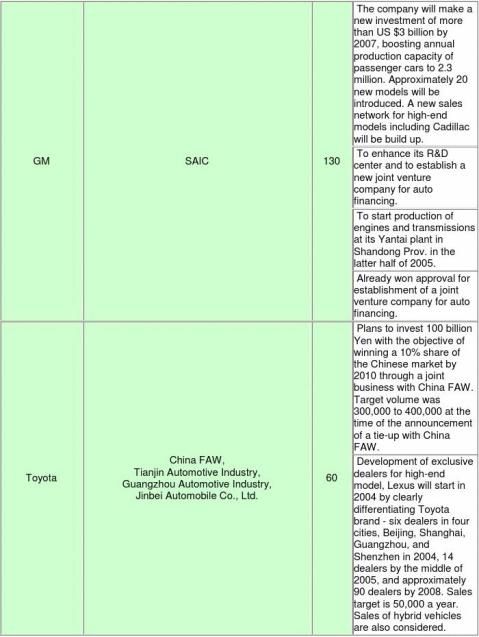

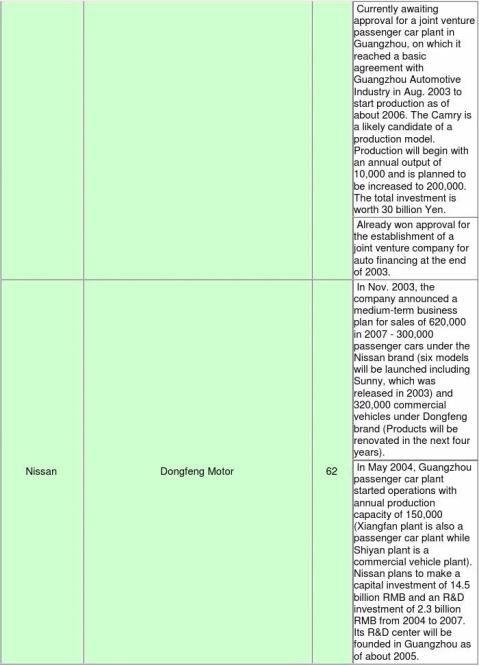

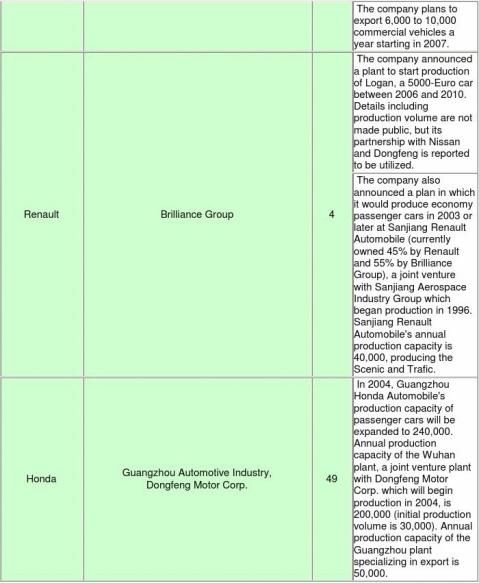

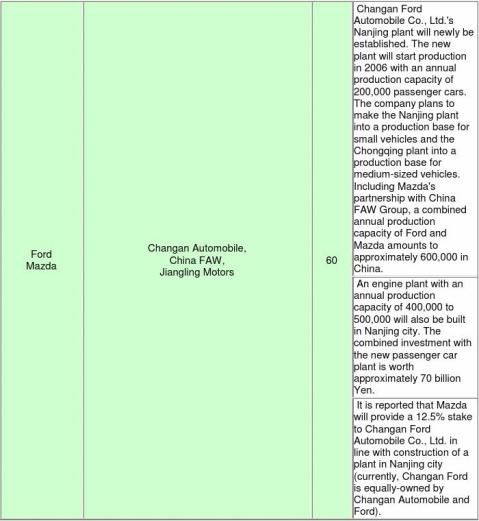

■Chinese business plans by automakers worldwide add up to more than 7.3 million vehicles

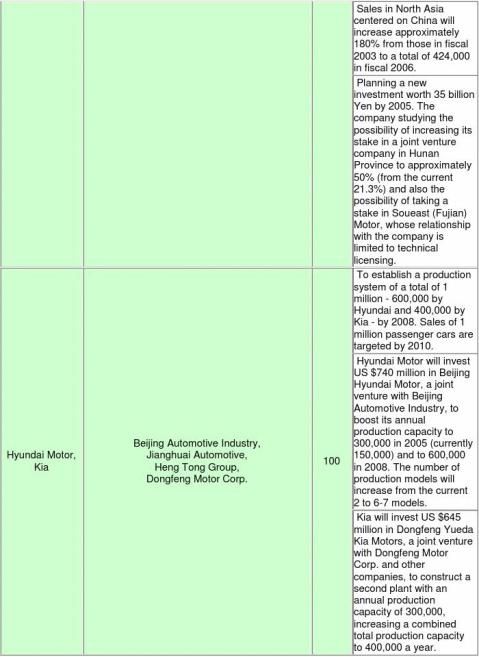

After the announcement of the new auto policy, Chinese business plans released by auto manufacturers worldwide are as follows: GM announced an investment plan in which it would invest a total of US $3 billion by 2007 to boost annual production capacity to 1.3 million. VW announced that it would build new engine plants with annual production capacity of 300,000 in Shanghai and Dalian within two to three years. Toyota announced establishment of exclusive dealers for its high-end brand model, the Lexus. Hyundai Motor released a plan to increase its annual production capacity to 600,000 with a total investment of US $740

million by 2007 (In May 2004, Kia, its subsidiary, released a plan to construct a new plant to boost the

annual production capacity to 400,000). Ford and Mazda revealed progress of an investment plan in which a second passenger car plant and an engine plant of Changan Ford Automobile Co., Ltd. would be built in Nanjing. If the plan goes smoothly, the combined annual production capacity of Ford and Mazda in China will expand to 600,000.

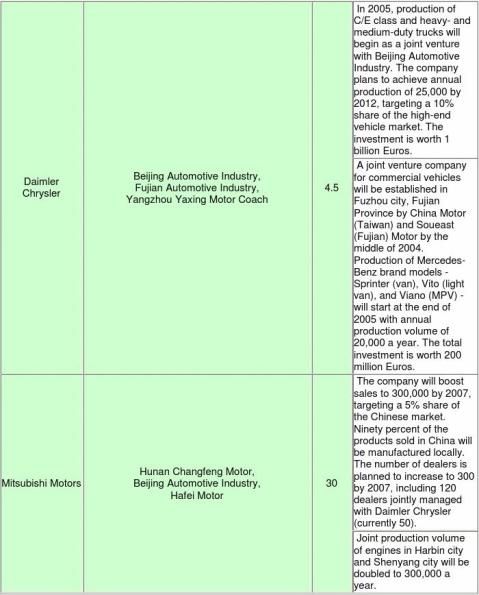

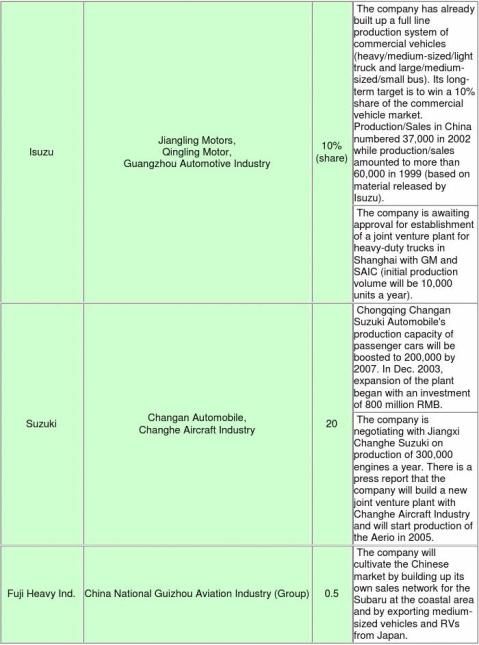

In addition, the following companies announced their plan: VW plans to boost annual the production

capacity to 1.62 million by 2008, Fiat plans to increase its capacity to 150,000 in 2006, and PSA to 300,000. DaimlerChrysler plans to manufacture 2.5 million C-class and E-class as well as 20,000 high-end light vans while BMW plans to boost its annual production capacity to 30,000. As for Japanese automakers, Toyota plans an annual production capacity of 600,000, Honda plans an annual production capacity of 500,000, and Suzuki 200,000. Nissan plans a sales volume of 620,000 in 2007 while Mitsubishi Motors plans 300,000. When we add such major automakers' plan, the scale of Chinese operations will amount to more than 7.3 million a year in a few years.

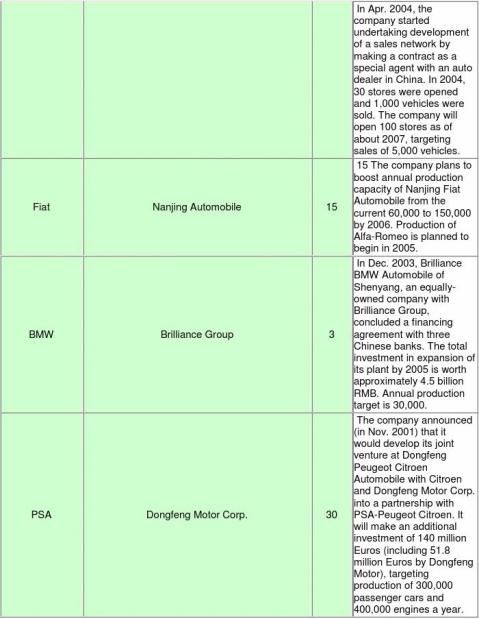

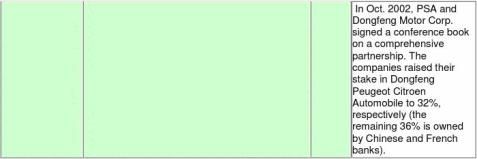

■Outline of production/sales plan in China by foreign major automakers

(Partner companies include companies whose relationship is limited to technical licensing. A simple

-

用户研究调查报告的写法

互联网用户研究调查报告PPT写法互联网用户研究一般分为定量定性分析定量即用大量数据发现问题告诉你问题是什么可能发现的仅仅是一个趋势…

-

用户调查报告总结模板

用户调查项目总结报告1目录用户调查项目总结报告11用户调查项目概述211项目名称和目标212项目时间213项目组成员214调查方法…

-

用户体验研究报告

用户体验研究报告第一章用户体验的概念用户体验UserExperience简称UX或UE是一种纯主观的在用户使用一个产品服务的过程中…

-

用户需求分析报告(范本)

用户需求分析报告范本11需求分析报告111引言当决定要开发一个信息系统时首先要对信息系统的需求进行分析需求分析要做的工作是深入描述…

-

公众号用户行为习惯研究报告

目录一前情提要二数据来源及样本详情三用户使用普通微信公众号行为习惯四用户使用商家微信公众号行为习惯一前情提要微信已成长为国内最大的…

-

网站分析报告

科技以人为本用心每个细节网站分析报告网站诊断报告综述编号FX111124lt济南广播电视大学航空学院gt分析师ZMan通过对您的网…

-

网站建设可行性分析报告

1文档编号WEBXX001版本号Version101XX网站建设可行性分析报告文档名称XX网站可行性分析报告doc项目名称XXXX…

-

网站系统分析报告

经济管理学院本科课程设计报告吉林市政府网网站系统分析小组成员:XXX专业:信息管理与信息系统系别:管理系指导教师:XXX20XX年…

-

门户网站分析报告

五大门户网站广告分析报告随着互联网络的迅猛发展和不断成熟以及电脑的普及近十年来我国网民数量也保持着几何级的增长趋势在大部分网民的上…

-

网站内容分析报告

网站内容分析报告一搜索引擎类网站百度谷歌有道即刻1网站内容特色分析百度logo是一个熊掌有猎手的意思就是表达用户在百度里能够找到有…

-

20xx年中国车市报告

20xx年中国车市的行业风向标20xx年的车市有点冷这对于已经过惯了好日子的汽车厂商和经销商来说是始料未及的据中国汽车工业协会发布…