北京市住房贷款担保中心协议书(七号文版本)

北京市住房贷款担保中心协议书

(商 贷)

甲方(购房人):

身份证号码:

住址:

电话:

乙方(保证人):北京市住房贷款担保中心

地址:北京市海淀区北四环西路56号辉煌时代西座7-8层

电话:62695566

丙方(售房单位):

地址:

电话:

鉴于甲方购买 房屋所需贷款是由乙方承担连带责任保证,为保障各方合法利益,及时落实产权登记和办理抵押登记手续,根据《中华人民共和国合同法》、《中华人民共和国担保法》、《北京市房地产抵押登记管理办法》等有关规定,三方达成一致意见,并签署以下协议:

一、甲方同意委托丙方办理《房屋所有权证》并由丙方领取《房屋所有权证》。甲方同时承诺在丙方为其办理入住手续时,由丙方代收办理房屋所有权证书所需缴纳的契税、专项维修资金及其他相关费用,并积极配合丙方办理所购房屋的转移登记手续,如甲方违反本协议约定在入住时未交纳契税及专项维修资金及其他相关费用的,每延期一日,其应按照剩余贷款本金按照每日万分之四的标准向乙方支付违约金。

二、因甲方未缴纳契税、专项维修资金及其他相关费用导致丙方无法办理《房屋所有权证》及乙方无法办理抵押登记手续且给乙方带来损失的,甲方应赔偿乙方相应金额的损失。

三、如甲方未缴纳契税、专项维修资金及其他相关费用,丙方仍为其办理了房屋入住手续或将甲方交纳的#b@2相关费用挪作他用,导致乙方无法办理抵押登记手续,乙方承担保证责任后,有权向丙方追偿。

四、丙方取得《房屋所有权证》后10个工作日内通知乙方并将《房屋所有权证》直接交由乙方收押办理抵押登记,如因丙方未及时交证或未经乙方同意将《房屋所有权证》交给甲方或其他方,而导致乙方无法办理抵押登记手续的,乙方承担保证责任后,有权向丙方追偿。

五、甲方应积极配合乙方完成抵押登记手续,在乙方办妥抵押登记手续之前,甲方不得持有《房屋所有权证》。

六、在办理完毕该房屋的抵押登记手续取得他项权利证书后,乙方通知甲方到乙方或乙方指定机构领取《房屋所有权证》。甲方收到领取通知应立即领取。如自乙方发出书面通知后三个月内不领取《房屋所有权证》的,乙方有权将《房屋所有权证》提存,提存费用由甲方负担。

上述书面通知在下列情况下视为已被送达:如以邮递形式(应以挂号信或快递形式)送达北京市以内的地址,自投寄该文件之日起满三日;如以邮递形式(应以挂号信或快递形式)送达北京以外的地址,自投寄该文件之日起满十日;如以手递形式,于收件人签收时。

七、在本协议履行期间,甲方要求调换、转售、转让房产时,甲方或丙方必须事先通知乙方并征得乙方同意后,方可办理有关手续。如因甲方或丙方违反前述约定,造成乙方无法取得抵押权,而给乙方造成损失的,应赔偿乙方相应金额的损失。

八、在本协议履行期间,因房屋买卖合同被确认无效的或甲方要求退房的,丙方应协助甲方将尚未还清的贷款退还至乙方指定账户。若甲方或丙方违约未按此约定执行,应赔偿乙方相应金额的损失。

九、甲方联系电话、通讯地址见合同各方当事人处;甲方受托人:_______、身份证号码:__________________、联系电话:______________、_____________、地址:_________________________。甲方的联系方式发生变化,应当及时书面通知乙方,如因甲方所留地址不详造成通知无法送达的,责任由甲方承担。

十、本协议与房屋买卖合同(协议)或其他相关合同如有不同之处,以本协议为准。

十一、本协议自甲方签字,乙、丙方盖章之日起生效,丙方依本协议约定为甲方办理完毕合法有效的房屋所有权证并交付乙方后责任解除。

十二、本协议正本一式三份,甲、乙、丙三方各执一份。

甲方: 乙方: 丙方: (签字) (签章) (签章) 签约日期:

第二篇:北京市住房贷款担保中心抵押(反担保)合同

Beijing Housing Loan Guaranty Center Mortgage (Counter-Guaranty) Contract

No.: _________

Special Note

This is a standard contract made by Beijing Housing Loan Guaranty Center to facilitate mortgager (counter-guarantor) and guarantor.

Rights and obligations of concerning parties are made based on principle of fairness.

Before signing the contract, contractual parties, especially mortgager (counter-guarantor), shall carefully read articles on related obligations and breach liabilities herein, and ask for explanation if there is anything unclear. If you consent with all articles, please sign your name to confirm and promise to fulfill your obligations as agreed herein.

Mortgager (Counter-guarantor):

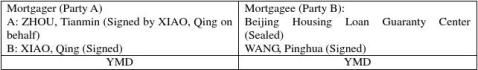

A: ZHOU, Tianmin (Signed by XIAO, Qing on behalf)

B: XIAO, Qing (Signed)

Guarantor: Beijing Housing Loan Guaranty Center

YMD

Mortgager A: ZHOU, Tianmin I.D. 42xxxxxxxxxxxx

Company: China Road & Bridge Corp. No. 1 Road Bureau P.O. 100024

Add.: 35-2-201, No. 23, South Zizhuyuan Road, Haidian Dis. P.O. 100044

Home Tel.: 68485599 Company Tel.: 64285685 Cell Phone: 133xxxxxxxx Mortgager B: XIAO, Qing I.D. 11xxxxxxxxxxxx

Company: Licheng Jiaye Trade Development Co., Ltd. P.O. 100024

Add.: 35-2-201, No. 23, South Zizhuyuan Road, Haidian Dis. P.O. 100044

Home Tel.: 68485599 Company Tel.: 80994411 Cell Phone: 133xxxxxxxx

Mortgager: Mortgager A and B (hereinafter as Party A)

Mortgagee: Beijing Housing Loan Guaranty Center (hereinafter as Party B)

Add.: 7-8/F, West Tower, Splendid Time Building, West Beisihuan Road, Haidian District, Beijing Tel.: 62695566 P.O. 100080

To protect guarantor, i.e. Party B’s legal rights in Beijing Housing Fund Management Center Loan Contract No. _____________ (hereinafter as “the loan contract”), through friendly negotiation, both parties agree to reach following agreements on Party A’s mortgage of house at No. 60201, 2/F, Building 12, Runfeng, Shuishangyuan, Chaoyang District:

Article 1 Party A agree to mortgage the following estate:

,

Owner:

Ownership Certificate No.:

Down Payment (in words):

Article 2 If the mortgaged house is jointly-owned, co-owner’s statement shall be made appendix of this contract.

Article 3 Scope of Mortgage Guaranty

(1) All guarantee responsibilities undertaken by Party B owing to borrower’s breach of

contract, including loan principal, interest and penalty;

(2) Default compensation incurred in overdue repayment period owing to Party B’s recovery

of fees against borrower;

(3) Fees incurred when realizing hypothec, including sales fee, drawing fee, auction fee,

taxes, handling fee, litigation fee, arbitration fee, execution fee, legal fee, etc.

Article 4 Party B’s guaranty period starts from the day the loan contract comes into effect, and lasts 6 months after the expiry of debt repaying period.

Article 5 When this contract is signed, Party A shall sign power of attorney to entrust Party B handling registration of mortgaged house on behalf, and submit all necessary documents.

Article 6 If Party B handles registration of mortgaged house on behalf of Party A, such procedures shall be handled in 1 month at registration department upon receipt of all necessary documents.

Article 7 During the period of handling registration, Party B shall well keep documents provided by Party A. If such documents are damaged or lost owing to Party B’s fault, re-issuance shall be made with expenses borne by Party B. If such damage or lost causes economic loss to Party A, Party B shall make compensation.

Article 8 During the hypothec existence period, Party A shall guarantee intactness of mortgaged house and accept Party B’s examination at any time.

Article 9 During the hypothec existence period, if Party A’s action decreases the value of mortgaged house, Party B has right to stop such action and ask Party A to restore its value or provide collateral with value equivalent to decreased value. If such requirement of Party B is rejected, Party B has right to exercise hypothec in advance.

Article 10 During the hypothec existence period, Party A shall notice Party B and inform transferee of the fact of mortgage if the house is transferred. With Party B’s permission, Party A may transfer the house with proceeds used to settle creditor’s rights it secured or handled deposit at Beijing Notary Office. If such proceeds are deposited, related fees shall be borne by Party A.

Article 11 Party A shall notice Party B in time if the mortgaged house is listed into demolishing scope by government. If Party A fails to provide new collateral as required by Party B, Party B has right to ask Party A settle creditor’s rights with proceeds of demolishing compensation, or handle deposit at Beijing Notary Office. If such proceeds are deposited, related fees shall be borne by Party A.

Article 12 If Party B has to undertake guaranty responsibility owing to any of following situations, Party B has right to dispose the mortgaged house as agreed herein, except that the borrower is unable to continue debt repaying obligations for being dead or disabled owing to help others, or being recognized as martyr be related government.

(1) Borrower fails to repay loan principal and interest as agreed in loan contract for 3 months

consecutively (inclusive);

(2) Borrower loses civil conduct ability without legal custodian in debt repaying period;

(3) Borrower’s inheritor, legatee or legal custodian refuse to fulfill loan contract;

(4) Other situations specified in guaranty contract.

Article 13 If Party has to undertake guaranty responsibility owing to borrower’s default, Party B has right to take following means to dispose the mortgaged house:

(1) Entrust auction office to sell the house;

(2) Transfer the house to Party B or others after discounted based on market price;

(3) Sell the house based on market price;

(4) Realize hypothec through litigation or arbitration.

Article 14 Proceeds from house disposal shall be used to settle fees based on following order:

(1) Taxes payable incurred in house disposal;

(2) Pay expenses specified in Item 3, Article 3, to realize hypothec;

(3) Repay loan principal, interest and penalty Party B paid to loaner;

(4) Repay default find Party B paid on behalf of Party A;

(5) The rest of proceeds shall be returned to Party A.

Article 15 If borrower use pre-sale house as collateral and refuses to perform loan contract, which causes Party B’s undertaking of all guaranty responsibilities, Party B may exercise buyer’s rights in pre-sale contract in subrogation.

Article 16 Default fine incurred when Party B cancels pre-sale contract in subrogation, shall be directly deducted from borrower’s down payment. The rest of down payment shall be used to compensate Party B.

Article 17 If Party B does not exercise subrogation rights, it may recover guaranty responsibility and related loss against borrower.

Article 18 This contract comes into effect from the day the collateral is registered. If pre-sale building is mortgaged, such pre-sale house shall be used as collateral.

Article 19 Any disputes incurred in contract performance shall be solved through negotiation. If failed, any party has right to lodge suit at people’s court.

Article 20 This contract is made 4 copies with same legal force.

-

贷款担保协议书

编号经中国农业银行县支行营业所以下简称贷款方与以下简称借款方充分协商签订本合同共同遵守一自年月日至年月日由贷款方提供借款方贷款元借…

-

贷款担保合同范本

贷款担保合同书编号融字第号签订地甲方被担保方住所法定代表人身份证号码电话传真邮政编码乙方担保方法定代表人住所邮政编码电话传真甲方向…

-

担保协议的范本

担保协议的范本担保协议书范本本担保协议书于年月日由以下两方在xxxx签订1公司以下称委托人住所2xxxxxx有限公司以下称担保人住…

-

贷款担保合同范本

贷款方甲方借款方乙方担保方丙方一借款种类科技三项经费二借款币别人民币三借款额大写元整小写四借款用途用于年度科技计划中项目五还款方式…

-

个人住房贷款担保合同范本

个人住房贷款担保合同范本债权人甲方保证人乙方第一条为确保甲方与以下简称借款人签订的年字号借款合同以下称借款合同的履行乙方愿意向甲方…

-

借款协议书范本

借款协议书范本出借方借款方担保方三方经过充分协商特签订本合同第一条自年月日至年月日由出借方提供借款方借款计人民币元还款计划如下第二…

-

贷款担保合同范本

贷款担保合同书编号融字第号签订地甲方被担保方住所法定代表人身份证号码电话传真邮政编码乙方担保方法定代表人住所邮政编码电话传真甲方向…

-

个人住房贷款担保合同范本

个人住房贷款担保合同范本债权人甲方保证人乙方第一条为确保甲方与以下简称借款人签订的年字号借款合同以下称借款合同的履行乙方愿意向甲方…

-

贷款担保合同范本

贷款方甲方借款方乙方担保方丙方一借款种类科技三项经费二借款币别人民币三借款额大写元整小写四借款用途用于年度科技计划中项目五还款方式…

-

贷款担保协议书

编号经中国农业银行县支行营业所以下简称贷款方与以下简称借款方充分协商签订本合同共同遵守一自年月日至年月日由贷款方提供借款方贷款元借…

-

个人汽车贷款(担保业务合作协议)

个人汽车贷款担保业务合作协议甲方:中国建设银行股份有限公司乙方:山东xx担保有限公司个人汽车贷款担保业务合作协议甲方:中国建设银行…