The history of Walt Disney

The history of Walt Disney

Walt Disney arrived in California in the summer of 1923 with dreams and determination, but little else. He had made a short film called Alice's Wonderland(爱丽丝梦游仙境), and he planned to use it as his "pilot" film to sell a series of these Alice Comedies to a distributor. On October 16, 1923, a New York distributor, M. J. Winkler, contracted to release the Alice Comedies, and this date became the formal beginning of The Walt Disney Company.

October 16 ,1923----The Walt Disney Company, which was going to become a leading name in family entertainment for much of the 20th century, was founded by Disney brothers—Walter Disney and Roy Oliver Disney.

In 1927----sound had been added to motion pictures, and a process for making movies in color was developed a few years later. Disney and his staff made imaginative use of sound and color.

In the 1930s---- During the Great Depression in the USA. At that time, people aspired to be happy. Disney established a kingdom for people all over the world with their own cartoon art. The monarch of this magic kingdom is no man but a mouse -- Mickey Mouse(米老鼠). Disney himself provided Mickey Mouse’s voice.

In 1932----the Disney cartoon in color called Flowers and Trees《花与树》was the first cartoon in full Technicolor.

In 1937----Disney issued the first full-length animated(长篇动画片) film to be produced by a studio, Snow White and the Seven Dwarfs(白雪公主与七个小矮人). It became one of the most popular movies in history.

Disney’s later full-length animated films included Pinocchio《木偶奇遇记》 (1940), Dumbo(小飞象) (1941), Bambi (小鹿班比)(1942), Cinderella(灰姑娘) (1950), Alice in Wonderland(爱丽丝梦游仙境) (1951), Peter Pan(彼得潘) (1953), Lady and the Tramp(小姐与流浪汉) (1955), Sleeping Beauty(睡美人) (1959) and The Jungle Book (森林王子)(released in 1967, after his death).

In 1940---- Disney released the second animated film Pinocchio《木偶奇遇记》and it was the first time that Disney won two big music awards,which performed well at the box-office(票房).

During World War II----With limited staff and little operating capital, Disney's feature films during much of the 1940s were "package films," or collections of shorts, such as The Three Caballeros(三骑士) (1943) and Melody Time (旋律时刻)(1947), which performed poorly at the box-office.

In 1950----The release of Cinderella (灰姑娘)proved that feature-length animation

could still succeed in the marketplace.

Other releases of the period included Alice in Wonderland (爱丽丝漫游仙境)(1951) and Peter Pan (1953) before the war began, and Disney's first all-live action feature, Treasure Island (金银岛)(1950). Other early all-live-action Disney films included The Story of Robin Hood and His Merrier Men (1952), The Sword and the Rose (宝剑与玫瑰)(1953), and 20,000 Leagues Under the Sea (海底两万里)(1954).

On July 18, 1955----Walt Disney opened Disneyland to the general public.

On December 15, 1966----Walt Disney died of lung cancer, and Roy Disney took over as chairman, CEO, and president of the company. One of his first acts was to rename Disney World as "Walt Disney World," in honor of his brother and his vision. on December 20, 1971, Roy Disney died of a stroke

1972-84: Theatrical malaise(戏剧性的派系之争) and new leadership

Despite the success of the Disney Channel and its new theme park creations, Walt Disney Productions was financially vulnerable. Its film library was valuable, but offered few current successes, and its leadership team was unable to keep up with other studios

1985-2004: The Eisner era

In 1984, Where the Toys Come From( this is the children documentary)

In June of 1994, The Lion King.. (狮子王)

In 1995 A Goofy Movie(高飞狗) and Toy Story(玩具总动员)

In 1998, The Lion King II,(狮子王2)

In 1999-2004 Toy Story 2(玩具总动员2), (1999) Air Bud 3: World pup (《神犬也疯狂3:世界杯》), (2000) Lady and the Tramp II: Scamp's Adventure( 《小姐与流氓2:狗儿逃家记》), (2001) Monsters, Inc(怪物公司) (2001), Lilo and Stitch(星际宝贝) (2002) Finding Nemo(海底总动员), (2003) Freaky Friday(怪诞星期五), (2003) 101 Dalmations 2: Patch's London Adventure(101忠狗:伦敦大冒险) (2003)

From 2005 to the present

On July 8, 2005 ,Walt Disney Parks and Resorts celebrated the 50th Anniversary of Disneyland Park on July 17, and opened Hong Kong Disneyland on September 12 On January 23, 2006, it was announced that Disney would purchase Pixar(皮克斯动画工作室) in an all-stock transaction worth $7.4 billion.

On December 31, 2009, Disney Company acquired the Marvel Entertainment, Inc.(是全球最著名的动漫工厂之一) for $4.24 billion.

In May 2010, the company sold the Power Rangers brand (Power Rangers is a long-running American entertainment )

第二篇:3.walt disney

MICHAEL G. RUKSTAD

DAVID COLLIS 9-701-035REV: JANUARY 5, 2009

The Walt Disney Company: The Entertainment King

I only hope that we never lose sight of one thing—that it was all started by a mouse.

— Walt Disney

The Walt Disney Company’s rebirth under Michael Eisner was widely considered to be one of the great turnaround stories of the late twentieth century. When Eisner arrived in 1984, Disney was languishing and had narrowly avoided takeover and dismemberment. By the end of 2000, however, revenues had climbed from $1.65 billion to $25 billion, while net earnings had risen from $0.1 billion to $1.2 billion (see Exhibit 1). During those 15 years, Disney generated a 27% annual total return to shareholders.1

Analysts gave Eisner much of the credit for Disney’s resurrection. Described as “more hands on than Mother Teresa,” Eisner had a reputation for toughness.2 “If you aren’t tough,” he said, “you just don’t get quality. If you’re soft and fuzzy, like our characters, you become the skinny kid on the beach, and people in this business don't mind kicking sand in your face.”3

Disney’s later performance, however, had been well below Eisner’s 20% growth target. Return on equity which had averaged 20% through the first 10 years of the Eisner era began dropping after the ABC merger in 1996 and fell below 10% in 1999. Analysts attributed the decline to heavy investment in new enterprises (such as cruise ships and a new Anaheim theme park) and the third-place performance of the ABC television network. While profits in 2000 had rebounded from a 28% decline in 1999, this increase was largely due to the turnaround at ABC, which itself stemmed from the success of a single show: Who Wants To Be a Millionaire. Analysts were starting to ask: Had the Disney magic begun to fade?

The Walt Disney Years, 1923–1966

At 16, the Missouri farm boy, Walter Elias Disney, falsified the age on his passport so he could serve in the Red Cross during World War I. He returned at war’s end, age 17, determined to be an artist. When his Kansas City-based cartoon business failed after only one year,4 Walt moved to Hollywood in 1923 where he founded Disney Brothers Studio5 with his older brother Roy (see Exhibit 2). Walt was the creative force, while Roy handled the money. Quickly concluding that he would never be a great animator, Walt focused on overseeing the story work.6

A series of shorts starring “Oswald, the Lucky Rabbit” became Disney Brothers’ first major hit in 1927. But within a year, Walt was outmaneuvered by his distributor, which hired away most of ________________________________________________________________________________________________________________

Professor Michael G. Rukstad, Professor David Collis of the Yale School of Management, and Research Associate Tyrrell Levine prepared this case. This case was developed from published sources. HBS cases are developed solely as the basis for class discussion. Cases are not intended to serve as endorsements, sources of primary data, or illustrations of effective or ineffective management.

Copyright ? 2001, 2005, 2009 President and Fellows of Harvard College. To order copies or request permission to reproduce materials, call 1-800-545-7685, write Harvard Business School Publishing, Boston, MA 02163, or go to http://www.hbsp.harvard.edu. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means—electronic, mechanical, photocopying, recording, or otherwise—without the permission of Harvard Business School.

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

701-035 The Walt Disney Company: The Entertainment King Disney’s animators in a bid to shut Disney out of the Oswald franchise.7 Walt initially thought he could continue making Oswald shorts with new animators and a new distributor, but after reading the fine print of his contract, he was devastated to learn that his distributor owned the copyright.

Desperate to create a new character, Walt modified Oswald’s ears and made some additional minor changes to the rabbit’s appearance. The result was Mickey Mouse. When Mickey failed to elicit much interest, Walt tried to attract a distributor by adding synchronized sound—something that had never been attempted in a cartoon.8,9 His gamble paid off handsomely with the release of Steamboat Willie in 1928.10 Overnight, Mickey Mouse became an international sensation known variously as “Topolino” (Italy), “Raton Mickey” (Spain), and “Musse Pigg” (Sweden). However, the company was still strapped for cash, so it licensed Mickey Mouse for the cover of a pencil tablet—the first of many such licensing agreements. Over time, as short-term cash problems subsided, Disney began to worry about brand equity and thus licensed its name only to “the best companies.”11

The Disney brothers ran their company as a flat, nonhierarchical organization, in which everyone, including Walt, used their first names and no one had titles. “You don’t have to have a title,” said Walt. “If you’re important to the company, you’ll know it.”12 Although a taskmaster driven to achieve creativity and quality, Walt emphasized teamwork, communication, and cooperation. He pushed himself and his staff so hard that he suffered a nervous breakdown in 1931.13 However, many workers were fiercely committed to the company.

Despite winning six Academy Awards and successfully introducing new characters such as Goofy and Donald Duck, Walt realized that cartoon shorts could not sustain the studio indefinitely. The real money, he felt, lay in full-length feature films.14 In 1937, Disney released Snow White and the Seven Dwarfs, the world’s first full-length, full-color animated feature and the highest-grossing animated movie of all time.15 In a move that would later become a Disney trademark, a few Snow White products stocked the shelves of Sears and Woolworth’s the day of the release.

With the success of Snow White, the company set a goal of releasing two feature films per year, plus a large number of shorts. Next, the company scaled up. The employee base grew sevenfold, a new studio was built in Burbank, and the company went public in 1940 to finance the strategy.

Disney survived the lean years of World War II and the failure of costly films like Fantasia (1940) by producing training and educational cartoons for the government, such as How Disease Travels.16 Disney made no new full-length features during the war, but re-released Snow White for the first time in 1944, accounting for a substantial portion of that year’s income.17 Subsequently, reissuing cartoon classics to new generations of children became an important source of profits for Disney.

After the war, the company was again in difficult financial straits. It would take several years to make the next full-length animated film18 (Cinderella, 1950), so Walt decided to generate some quick income by making movies such as Song of the South (1946) that mixed live action with animation.19 Further diversification included the creation of the Walt Disney Music Company to control Disney’s music copyrights and recruit top artists. In 1950, Disney’s first TV special, One Hour in Wonderland, reached 20 million viewers at a time when there were only 10.5 million TV sets in the U.S.20

With the release of Treasure Island in 1950, Disney entered live-action movie production and, by 1965, was averaging three films per year. Most were live-action titles, such as the hits Old Yeller (1957), Swiss Family Robinson (1960), and Mary Poppins (1964), but a few animated films like 101 Dalmatians (1961) were also made. To bolster the film business, Disney created Buena Vista Distribution in 1953, ending a 16-year-old distribution agreement with RKO. By eliminating distribution fees, Disney could save one-third of a film’s gross revenues. And to further improve the bottom line, Disney avoided paying exorbitant salaries by developing the studio’s own pool of talent. 2

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

The Walt Disney Company: The Entertainment King 701-035 Observed one writer: “Disney himself became the box office attraction—as a producer of a predictable family style and the father of a family of lovable animals.”21

Disney expanded its television presence in 1954 with the ABC-produced television program Disneyland (followed the next year by the very popular Mickey Mouse Club, a show featuring pre-teen “Mouseketeers” as hosts). Walt hoped Disneyland would both generate financing and stimulate public interest in the huge outdoor entertainment park of the same name, which he had started designing two years earlier at WED Enterprises (WED being Walt’s initials). This was kept separate from Disney Productions to provide an environment where Walt and his “Imagineers” could design and build the park free of pressure from film unions and stockholders.

The park was a huge risk for the company, as Disney had taken out millions of dollars in bank loans to build it. But the bet paid off. The enormous success of Disneyland, which opened in 1955, was a product of both technically advanced attractions and Walt's commitment to excellence in all facets of park operation. His goal had been to build a park for the entire family, since he believed that traditional parks were “neither amusing nor clean, and offered nothing for Daddy.”22 Corporate sponsorship was exploited to minimize the cost of upgrading attractions and adding exhibits.23 To conserve capital, Disney also licensed the food and merchandising concessions. Once the park had generated sufficient revenue, the company bought back virtually all operations within the park.24 Disneyland’s success finally put the company on solid financial footing.25

With Disneyland still in its infancy, Walt dreamed of starting another theme park. In 1965, he secretly purchased over 27,000 acres of land near Orlando, Florida on which he planned to build Walt Disney World and EPCOT—an “experimental prototype community of tomorrow.” However, Walt was never able to see his dream come to fruition; he died just before Christmas 1966. “He touched a common chord in all humanity,” said former President Dwight Eisenhower. “We shall not soon see his like again.”26

Walt Disney’s philosophy was to create universal timeless family entertainment. A strong believer in the importance of family life, the company was always oriented to fostering an experience that families could enjoy together. As Walt Disney said, “You’re dead if you aim only for kids. Adults are only kids grown up, anyway.”

The huge number of “firsts” that the company could claim were a tribute to the success of this philosophy, but Disney recognized that they were not without risk. “We cannot hit a home run with the bases loaded every time we go to the plate. We also know the only way we can ever get to first base is by constantly going to bat and continuing to swing.”

Disney attempted to retain control over the complete entertainment experience. Cartoon characters, unlike actors, could be perfectly controlled to avoid any negative imagery. Disneyland had been constructed so that once inside, visitors could never see anything but Disneyland. According to Walt, “The one thing I learned from Disneyland [is] to control the environment. Without that we get blamed for things that someone else does. I feel a responsibility to the public that we must control this so-called world and take blame for what goes on.”27

The Post-Walt Disney Years, 1967–1984

The realization of Walt Disney World and EPCOT consumed Roy O. Disney, who succeeded his brother as chairman and lived just long enough to witness the opening of Walt Disney World in 1971. The theme park almost instantly became the top-grossing park in the world, pulling in $139 million from nearly 11 million visitors in its first year. Its two on-site resort hotels were the first hotels operated by Disney. To generate traffic in the park, Disney opened an in-house travel company to

3

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

701-035 The Walt Disney Company: The Entertainment King work with travel agencies, airlines, and tours. Disney also started bringing live shows, such as “Disney on Parade” and “Disney on Ice,” to major cities all over the world.

The next major expansion was Tokyo Disneyland, announced in 1976. Although wholly owned by its Japanese partner, it was designed by WED Enterprises to look just like the U.S. parks. Disney received 10% of the gate receipts, 5% of other sales, and ongoing consulting fees.

Film output during the years of theme park construction declined substantially. Creativity in the film division seemed stifled. Rather than push new ideas, managers were often heard asking, “What would Walt have done?” The result was more sequels rather than new productions. To help stem the decline in its film division in the late 1970s and early 1980s, Disney introduced a new label, Touchstone, to target the teen/adult market, where film-going remained strong.

From 1980 to 1983, the company’s financial performance deteriorated. Disney was incurring heavy costs at the time in order to finish EPCOT, which opened in 1982. It was also investing in the development of a new cable venture, The Disney Channel, launched in 1983. Film division performance remained erratic. As corporate earnings stagnated, Roy E. Disney (son of Roy O. Disney) resigned from the board of directors in March 1984. In the following months, corporate raiders Saul Steinberg and Irwin Jacobs each made tender offers for Disney with the intention of selling off the separate assets. However, oil tycoon Sid Bass invested $365 million, rescuing the company, reinstating Roy E. Disney to the board, and ending all hostile takeover attempts.28

Eisner’s Turnaround, 1984–1993

Backed by the Bass group, Eisner, 42, was named Disney’s chairman

and chief executive officer, and Frank Wells was named president and chief operating officer in October 1984.29 Eisner, a former president and chief operating officer of Paramount Pictures, had been associated with such successful films and television shows as Raiders of the Lost Ark and Happy Days. Wells, a former entertainment lawyer and vice chairman of Warner Brothers, was known for his business acumen and operating management skills. Roy E. Disney was named vice chairman. Eisner subsequently recruited Paramount executives Jeffrey Katzenberg and Rich Frank to be chairman and president, respectively, of Disney’s motion pictures and television division.

Eisner committed himself to maximizing shareholder wealth through an annual revenue growth target and return on stockholder equity exceeding 20%. His plan was to build the Disney brand while preserving the corporate values of quality, creativity, entrepreneurship, and teamwork. Concerns that the new managers would neither understand nor maintain Disney's culture faded rapidly. The history and culture of the company and the legacy of Walt Disney were inculcated in a three-day training program at Disney’s corporate university. As part of the training, all new employees, including executives, were required to spend a day dressed as characters at the theme parks as a way to develop pride in the Disney tradition.

Eisner viewed “managing creativity” as Disney’s most distinctive corporate skill. He deliberately fostered tension between creative and financial forces as each business aggressively developed its market position. On the one hand, he encouraged expansive and innovative ideas and was protective of creative efforts in the concept-generation phase of a project. On the other hand, businesses were expected to deliver against well-defined strategic and financial objectives. All businesses (see Exhibit

3), including individual films and TV shows, were expected to have the potential for long-run profitability. Nevertheless, spending was readily approved if necessary to achieve creativity.

One of the new management’s top priorities was to rebuild

Disney’s TV and movie business. Disney had stopped producing shows for network television out of 4

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.Eisner takes the helmRevitalizing TV and movies

The Walt Disney Company: The Entertainment King 701-035 concern that it would reduce demand for the recently launched Disney Channel. But Eisner and Wells believed that a network show would help create demand by highlighting Disney’s renewed commitment to quality programming. In early 1986, The Disney Sunday Movie premiered on ABC. According to Eisner, the show “helped to demonstrate that Disney could be inventive and contemporary. . . . It put us back on the map.”30 During this time, Disney produced the NBC hit sitcom Golden Girls and the syndicated non-network shows Siskel & Ebert at the Movies and Live with Regis & Kathie Lee. Eisner also created a syndication operation to sell to independent TV stations some of the TV programming that Disney had accumulated over 30 years.

Disney’s movie division was nearly as moribund when Eisner and Wells took over. Disney’s share of box office had fallen to 4% in 1984, lowest among the major studios, and Eisner contended that not one of the live-action movies that Disney had in development seemed worth making. However, in Eisner’s first week at Disney, an agent called him with the script to what would become Down and Out in Beverly Hills, Touchstone’s first R-rated movie. While Disney had risked alienating its core audience with the film, no backlash materialized.

Beginning with that movie, 27 of Disney’s next 33 movies were profitable, and six earned more than $50 million each, including Three Men and a Baby and Good Morning Vietnam. For the industry as a whole, an estimated 60% of all movies lost money. By 1988, Disney Studios’ film division held a 19% share of the total U.S. box office, making it the market leader. “Nearly overnight,” said Eisner, “Disney went from nerdy outcast to leader of the popular crowd.”31 During this run, Disney began releasing 15 to 18 new films per year, up from two new releases in 1984. Releases under the Touchstone label were primarily comedies, with sex and violence kept to a minimum. Live-action releases under the Walt Disney label were designed for a contemporary audience but had to be wholesome and well plotted.

Katzenberg, who was known for his ability to identify good scripts, for his grueling work ethic (scheduling staff meetings for 10 p.m.), and for his dogged pursuit of actors and directors for Disney projects, convinced some of Hollywood’s best talent to sign multideal contracts with Disney. Under Katzenberg, Disney pursued strong scripts from less established writers and well-known actors in career slumps and TV actors rather than the highest-paid movie stars. The emphasis was on producing moderately budgeted films rather than big-budget, special effects-laden blockbusters. Management held movie budgets to certain target ranges that acted as a “financial box” within which the creative talent had to operate. Films were closely managed to ensure that they would come in on time and near their target budgets, which were set below the industry average.32

Disney’s animation division was slower to turn around, in part because animated movies took so long to produce. Disney decided to expand its animation staff and to accelerate production by releasing a new animated feature every 12 to 18 months, instead of every 4 to 5 years. Disney also invested $30 million in a computer animated production system (CAPS) that digitized the animation process, dramatically reducing the need for animators to draw each frame by hand. In 1988, Disney spent $45 million on Who Framed Roger Rabbit, a technically dazzling movie that combined animation with live action. The movie was uncharacteristically expensive for Disney, but the gamble paid off with the top earnings at the box office in 1988 ($220 million). Additional profits came from the merchandise, as the movie was Disney’s first major effort at cross-promotion. By the time of the premiere, Disney had licensing agreements for over 500 Roger Rabbit products, ranging from jewelry to dolls to computer games. McDonald’s and Coca-Cola also did promotional tie-ins.

Unlike Disney’s television and movie business,

Disney’s theme parks had remained popular and profitable after the deaths of Walt and Roy Disney. However, the new management team updated and expanded attractions at the parks. Disney spent tens of millions of dollars on new attractions such as “Captain EO” (1986) starring Michael Jackson.

5

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.Maximizing theme park profitability

701-035 The Walt Disney Company: The Entertainment King Investments in the parks were offset by attendance-building strategies designed to generate rapid revenue and profit growth (see Exhibit 4). These included for the first time national television ads, as well as special events, retail tie-ins, and media broadcast events. Disney also lifted restrictions on the numbers of visitors permitted into its parks, opened Disneyland on Mondays when it had previously been closed for maintenance, and raised ticket prices (see Exhibits 5 and 6). Despite the ticket hikes, market research showed that guests felt they received value for their money.

The Disney Development Company was established to develop Disney’s unused acreage, primarily in Orlando, where only 15% of the 43 square miles had been exploited. It proceeded to aggressively expand its activities, which included a several-thousand-room hotel expansion at Disney World (and the company’s first moderately priced hotel) and a $375 million convention center.

As the business units expanded after 1984, overlaps among

them began to emerge. Promotional campaigns with corporate sponsors in one business needed to be coordinated with similar initiatives by other Disney businesses. It was also unclear how, for example, to allocate the minute of free advertising granted to Disney during The Disney Sunday Movie.

Like many diversified companies, Disney employed negotiated internal transfer prices for any activity performed by one division for another. Transfer prices were charged, for example, on the use of any Disney film library material by the various divisions. While Eisner and Wells encouraged division executives to resolve conflicts among themselves, they made it clear that they were available to arbitrate difficult issues. Senior management’s position was that disputes should be settled quickly and decisively so that business unit management could get on with their jobs.

Nevertheless, in 1987, a corporate marketing function was installed to stimulate and coordinate companywide marketing activities. A marketing calendar was introduced listing the next six months of planned promotional activities by every U.S. division. A monthly meeting of 20 divisional marketing and promotion executives was initiated to discuss interdivisional issues. A library committee was set up that met quarterly to allocate the Disney film library among the theatrical, video, Disney Channel, and TV syndication groups. An in-house media buying group was also established to coordinate media buying for the entire company.

Management also jointly coordinated important events, such as Snow White’s 50th anniversary in 1987 and Mickey’s 60th birthday the following year. A meeting of all divisions generated novel ideas, coordinated schedules, and built commitment and excitement for the year’s theme. Plans were then coordinated by the five-person corporate events department. “I think our biggest achievement to date,” said Eisner in 1987, “has been bringing back to life an inherent Disney synergy that enables each part of our business to draw from, build upon, and bolster the others.”33

Expanding into new businesses, regions, and audiencesIn the consumer products division, the Disney Stores (launched in 1987) pioneered the “retail-as-entertainment” concept, generating sales per square foot at twice the average rate for retail. The stores were designed to evoke a sense of having stepped onto a Disney soundstage. While children were the target consumers, the stores' merchandise mix of toys and apparel also included high-end collectors’ items for Disney's grown-up fans. The consumer products division also entered book, magazine, and record publishing. Hollywood Records, a pop music label, was founded in 1989 for less than $20 million, the cost of making a single Hollywood movie. In 1990, Disney established Disney Press, which published children's books, and in 1991, the company launched Hyperion Books, an adult publishing label that printed, among others, Ross Perot’s biography. Disney also established new channels of distribution through direct-mail and catalog marketing. Coordination among businesses

6

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

The Walt Disney Company: The Entertainment King 701-035

In its theme parks division, Disney’s major project was Euro Disney, which opened in 1992 on 4,800 acres outside Paris. While Disney designed and developed the entire resort, it did not have majority ownership of the business. About 51% of Euro Disney S.C.A. shares had been sold on several European exchanges, leaving Disney a 49% ownership stake. Infrastructure, attractive financing, and other incentives from the French government, as well as a heavily leveraged financial structure, kept Disney's initial investment cost to $200 million on the $4.4 billion park. In return for operating Euro Disney, the company received 10% from ticket sales and 5% from merchandise sales, regardless of whether or not the park turned a profit.

The company was adamant about maintaining its adherence to the Disney formula for family recreation, pointing to Tokyo Disneyland as evidence of the formula's universal appeal. Despite important cultural differences, Tokyo Disneyland had defied its critics and performed well, welcoming its 100 millionth guest in 1992. The French were more suspicious, warning of a potential “Cultural Chernobyl,”34 so Eisner enlisted a former professor of French literature to be Euro Disney president and oversee the park's development according to both Disney's specifications and French sensitivities. The project required compromise by the staff as well as the guests. French cast members were required to shave, for example,35 while Disney gave in on the issue of alcohol in the park, making wine available in its restaurants.

The company had set its attendance target at 11 million visitors in the first year. During the summer, attendance was above the projected rate, but the park suffered a downturn as colder weather set in. Although Disney officials publicly emphasized their satisfaction with Euro Disney, the project required considerable fine-tuning. The company slashed hotel and admission prices, laid off workers, and deferred its management fees for two years.

At its other parks, Disney added attractions and stepped up expansion of its hotels and resorts to encourage longer stays and attract major conferences such that hotel occupancy rates at the resorts in Anaheim, Orlando, Tokyo, and Paris averaged well over 90% year-round.36 In addition to the creation of the nightlife complex Pleasure Island37 and a new water-based attraction, Typhoon Lagoon, Disney World grew with the construction of Splash Mountain and the expansion of the Disney-MGM Studios Theme Park. In California, Disneyland opened Toontown, a new section based on the Roger Rabbit movie. Between 1988 and 1994, the company spent over $1 billion on theme park expansion.

In movies, Disney began to release a series of highly profitable and critically successful animated features (see Exhibit 7). The Little Mermaid (1989) was followed by Beauty and the Beast (1991)—the first animated film ever nominated for a Best Picture Oscar—and by Aladdin (1992). In live action, having once felt the need to apologize publicly for the partial nudity in Splash (1984), Disney settled comfortably into the industry mainstream, releasing films like Pretty Woman through its Touchstone studio. Hollywood Pictures was then established in 1990 as the third studio under the Disney umbrella, and in 1993, the company acquired Miramax, an independent production studio making low-budget art films such as Pulp Fiction (1994). Disney increased its volume of movie output from 18 films a year in 1988—the most in Disney's history—to an ambitious 68 new films in 1994 (see Exhibit

8). However, between 1989 and 1994, fewer than half of the company's films grossed more than $20 million, and many earned less than half that amount.

As the home video industry grew, Buena Vista Home Video (BVHV) pioneered the “sell through” approach, marketing videos at low prices (under $30) for purchase by the consumer (instead of charging $75 and selling primarily to video rental stores). At 30 million copies, Aladdin in 1993 became the best-selling video of all time (followed by Beauty and the Beast). BVHV achieved the same market leadership role overseas, with marketing and distribution in all major foreign markets.

7

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

701-035 The Walt Disney Company: The Entertainment King In 1992, Disney spent $50 million to acquire a National Hockey League expansion team based a few miles from Disneyland in Anaheim. Inspired by the box office popularity of a Disney movie, Eisner named the team The Mighty Ducks, the name of the team in the movie. Shortly thereafter came the sequel, D2: The Champions, featuring a soundtrack by Queen, produced by Disney's Hollywood Records label. The Mighty Ducks had a natural partner in Disney-owned KCAL-TV,38 following a trend among media companies toward purchasing sports teams as a source of programming. Nor did the Ducks' prospects end with traditional sports marketing, given the potential for other cross-marketing opportunities. In 1993, 80% of the money spent on NHL merchandise went for “Duckwear.”39

Late in 1993, Disney unveiled its first Broadway-bound theater production—a stage version of Beauty and the Beast. The $10 million show was a hit on Broadway. Although notoriously risky, Disney quickly recouped its estimated $400,000-per-week operating costs. Eisner and Katzenberg were directly involved in the production's development—offering creative guidance, calling for rewrites, and restaging scenes.40 The following year, Disney made a $29 million deal to restore the New Amsterdam Theater on West 42nd Street in New York, giving a substantial boost to the city's beleaguered efforts to revive the district and giving Disney a home on Broadway. Eisner regarded theater as a long-term stand-alone business: “Our plans for the New Amsterdam Theater mark our expanding commitment to live entertainment.”41

Turmoil and Transition, 1994–1995

At the beginning of 1994, Disney’s projects seemed to be progressing satisfactorily. Disney’s newest animated feature, The Lion King, would break box office records by year’s end. Film revenues and related merchandise sales for The Lion King would eventually total more than $2 billion, with net income reaching $700 million. At the same time, Euro Disney (renamed Disneyland Paris in 1994) was finally getting on track after a Saudi prince and a number of European banks worked out a deal with the company by midyear to refinance the park, which had lost over $1 billion since 1992. Yet, a series of upheavals would rock the foundations of the company during the course of 1994.

On April 4, 1994, Disney President Wells was killed in a helicopter crash in Nevada. The loss of Wells created a void within the company that could not immediately be filled. As one observer put it, “[Wells] was a practical Sancho Panza to Eisner's mercurial Quixote, a tough-as-nails negotiator and lawyer-cum-numbers guy who freed Eisner to do what he does best—think creatively about everything from movies to international theme parks.”42 Eisner assumed the combined title of president and chairman while redistributing Wells's former responsibilities selectively among members of Disney's top management. Just weeks after Wells’s death, Eisner, 52, underwent quadruple bypass heart surgery. Although Eisner barely let up following the surgery (running the company by phone within days after the procedure), the jockeying to replace Wells gained momentum. At the center of this was Katzenberg.

Katzenberg openly aspired to build on his success as head of the film division by assuming Wells’s position as Disney president. Within Disney, Katzenberg reportedly was seen as a highly effective studio operative but not a corporate strategist, where he was at odds with Eisner about Disney's direction on such issues as music business expansion and theme park development.43 After his bid for a corporate role was rebuffed by Eisner, Katzenberg left the company—the second step in dismantling the triumvirate widely considered to be responsible for Disney's resurgence after 1984. Katzenberg soon joined forces with director/producer Steven Spielberg and David Geffen of Geffen Records to form the entertainment company Dreamworks. Shortly after Katzenberg’s departure, a series of key executives either left the company or changed roles.

8

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

The Walt Disney Company: The Entertainment King 701-035 Acquisition of ABC

In July 1995, Disney announced it was buying CapCities/ABC to own a programming distribution channel.44 Without the input of investment bankers, Disney bought ABC for $19 billion in the second-largest acquisition in U.S. history. The acquisition made Disney the largest entertainment company in the U.S. and provided it with worldwide distribution outlets for its creative content. ABC included the ABC Television Network (distributing to 224 affiliated stations) and 10 television stations, the ABC Radio Networks (distributing to 3,400 radio outlets) and 21 radio stations, cable networks such as the sports channels ESPN and ESPN2, several newspapers, and over 100 periodicals.45 The deal also transformed Disney from a company with a 20% debt ratio to one with a 34% debt ratio ($12.5 billion) after the takeover.

The merger was likened to a marriage between King Kong and Godzilla. Barry Diller observed that while Disney and CapCities/ABC were ideal partners, “the only negative [was] size. It’s a big enterprise, and big enterprises are troublesome.” Michael Ovitz, then chairman of talent firm Creative Artists Agency, said the merger gave Disney global access. But despite “synergy euphoria” in Hollywood and on Wall Street, some observers were skeptical about the merger due to the maturity of the network television business, the purchase price (22 times its estimated 1995 earnings), and the difficulties of creating synergy through vertical integration. Some suggested that synergy would be better “accomplished through nonexclusive strategic alliances between the companies.”46

A year after the merger, there were press reports of a culture clash between executives at ABC and Disney. “Insiders say Disney’s micro-management has left many at ABC unhappy and anxious,” wrote one Wall Street Journal reporter. “The congenial atmosphere that once dominated the network’s top ranks is gone; in its place is the high-pressure culture of Disney, which often pits executives against each other.”47 In addition, some ABC executives were uncomfortable with how ABC was being used to cross-promote Disney brands. ABC, for example, had aired a special on the making of the animated film, The Hunchback of Notre Dame, after the film opened to disappointing ticket sales.48 According to The Wall Street Journal, the initiative came from ABC executives.49 “The ABC people are a part of our team and they are interested in the well-being of the entire organization,” said a Disney spokesman. “I think we’d have been faulted for not using that kind of synergy.”50

ABC had also struck several deals with Disney rivals before the merger to develop programming. ABC and Dreamworks, for example, had agreed to finance jointly the cost of developing new TV shows. “We needed access to production talent,” said one ABC executive of the deal.51 Disney felt that such arrangements were no longer economical after the merger because Disney had its own production studio, and therefore terminated such agreements.52

Disney Slumps to the End of the Century

After acquiring ABC, Disney’s financial performance began to deteriorate, particularly in 1998 and 1999. “It’s impossible to predict the day that growth will be back,” said Eisner. “I think it’s coming, but it’s not coming tomorrow. We have not given up our goal of 20% annual growth.”53 Disney’s board of directors voted to cut Eisner’s bonus from $9.9 million in 1997 to $5 million in 1998 and to $0 the following year. But growth returned in 2000—sooner than most analysts expected—on the strength of the company’s broadcast and cable operations and its theme parks division.

ABC had been the top-rated network at the time of the merger but had fallen to third place. However, ABC returned to the top in 2000, largely due to the success of the prime-time game show, Who Wants To Be a Millionaire, which was broadcast three times a week and which raised the ratings of the shows airing immediately afterwards (see Exhibit 9). “Television networks have fixed costs,” said one analyst. “So when the revenues begin to materialize, all that flows to the bottom line and

9

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

701-035 The Walt Disney Company: The Entertainment King that’s great news for profits.”54 Furthermore, the cable operations were estimated, by 1999, to be worth more than the $19 billion Disney paid for the entire CapCities/ABC acquisition.55 ESPN had become the most profitable TV network in the world, more profitable in absolute terms than the major broadcast networks. However, profitability was hurt by the rising cost of programming, especially sports. In 1998, ABC and ESPN paid $9 billion for the right to air NFL games through 2005.

In live-action films, Disney’s approach to filmmaking had changed dramatically. Joe Roth, who replaced Katzenberg as head of Disney’s live-action movies in 1994, began putting out big-budget, star-driven “event” movies such as Con Air (1997) and Armageddon (1998). “This is not a commodity business,” said Roth. “The [movies] people will want to watch need to stand out.”56 He had also argued that the change was necessary because of the growing impact of international audiences, who were attracted to movies with big-name stars and with expensive special effects that transcended language barriers. In 1999, however, several costly box-office bombs led Roth to scale back budgets. When Roth had taken over in 1994, the average budget for a live-action Disney movie was $22 million (versus an industry average of $30 million).57 That figure had risen to $55 million by 1999 (and an industry average of $52 million).58 The cost of producing animated films had also risen rapidly in recent years.59 Tarzan (1999) cost an estimated $170 million. These figures did not include marketing and distribution costs, which typically totaled over $50 million for a Disney animated film.60

Disney’s home video division had been a major driver of growth during the 1990s, largely as a result of the decision to release its animated classics on video. By the end of the decade, however, revenues were dropping. Disney decided to make all but 10 of its animated films permanently available. The remaining 10—Disney’s most popular animated titles—would follow the old rotation schedule. Only one would be on the shelves each year, and its release would be promoted by a companywide marketing campaign. Disney also expected the growing market for digital video discs (DVDs) to boost its home video division as consumers switched from VCRs to DVD players and repurchased the classic Disney titles on DVD.

Through 2000, Disney maintained its position as market leader in theme parks. The strategy in the theme park division was to turn all of its parks into destination resorts—places where tourists would spend more than one day. As of 2000, only Walt Disney World qualified. The average tourist spent three days at Walt Disney World but only one day at Disneyland, Disneyland Paris, and Tokyo Disneyland. The company believed that the key to turning a park into a destination resort was to build more than one park at a site. Walt Disney World, for example, included EPCOT, Disney-MGM Studios, and Disney’s Animal Kingdom (each with separate admission gates). By 2002, Disney planned to open second parks at Disneyland (California Adventure in 2001), Tokyo Disneyland (DisneySea in 2001), and Disneyland Paris (Disney Studios in 2002). In November 1999, Disney announced that it was also forming a partnership with Hong Kong’s government to build a new $3.6 billion theme park on an island six miles west of central Hong Kong, scheduled to open in 2005.

Disney also made a major push onto the Internet, with uneven results. In 1996, Disney began selling its products online, but in 1997 it failed in its launch of a subscription service called the Daily Blast. In 1999, Disney merged its Internet assets with the search engine Infoseek.61 This entity operated Disney’s Web sites (including Disney.com, ESPN.com, and ABCNews.com) and set up a portal called the GO Network (), which was a gateway to the Web similar to Yahoo.62 While Disney had planned to compete with the major portals, traffic at Go.com lagged behind that of its rivals. In response, Disney shut down the Go.com portal in 2001, laying off 20% of its 2,000 Internet employees. Disney said it would focus on e-commerce and on providing news and entertainment content through its individual Web sites. “You can view this as a strategy change,” said one Disney executive. “[Go.com] did not have a leadership position. On the other hand, we have been extremely successful with our commerce and content sites.”63

10

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

The Walt Disney Company: The Entertainment King 701-035

During the slump, Eisner concluded that Disney needed to pare back operations that had become bloated during the company’s long run of success.64 In 1999, Disney began a cost-cutting plan that was projected to save $500 million a year starting in 2001. Eisner refocused attention on the leaner marketing of products, reduced film budgets and output, and tightened cost control in its TV production unit.65 He also conducted a major review of capital spending, with an eye toward eliminating businesses that could not show a healthy return. Club Disney, a chain of shopping mall play centers, was closed as a result, as were the ESPN Stores. Disney also began selling “non-strategic” assets such as Fairchild Publications, a magazine subsidiary acquired in the ABC deal. Eisner’s Strategic Challenges

Managing Synergies

Eisner believed that Disney’s ability to leverage its brand and create value depended on corporate synergy. According to Eisner, the key to Disney’s synergy was Disney Dimensions, a program held every few months for 25 senior executives from every business. As of 2000, over 300 people had been through the program, which Eisner described as a “synergy boot camp.” Participants traveled to corporate headquarters in Burbank, Walt Disney World, and ABC in New York to learn about the company. They cleaned bathrooms, cut hedges, and played characters in the park. From 7 a.m. to 11 p.m. for eight days, participants were not allowed to handle their regular duties. Eisner explained:

Everyone starts off dreading it. But by the third day, they love it. By the end of the eighth

day, they have totally bonded. . . . When they go back to their jobs, what happens is synergy, naturally. When you want the stores to promote Tarzan, instead of the head of animation for Tarzan calling me, and me calling the head of the Disney Stores, what happens is the head of Tarzan calls the head of the stores directly.

Disney also had a synergy group, reporting directly to Eisner, with representatives in each business unit. The group’s purpose was to “maximize synergy throughout the company . . . serve as a liaison to all areas, [and] keep all businesses informed of significant and potentially synergistic company projects and marketing strategies.”66 Divisions filed monthly operating reports in which they were expected to discuss new cross-divisional projects. Eisner was said to award larger bonuses to those who had been most committed to synergy. “This award system,” said Dennis Hightower, a former Disney executive, “forced us to look left and right and to build bridges between divisions.”67 When business units clashed over production and marketing plans, Eisner stepped in to referee.

Synergy boosted revenues through cross-promotion. A prime example was Disney’s leverage of its animated movie investments. Typically, in the year before a movie’s release, creators from Disney animation made presentations to the heads of the consumer products, home video, and theme parks units. Participants then brainstormed on product options and reconvened monthly to update one another. Once divisions had their strategies in place, Disney approached its licensing partners, who paid a royalty for the privilege of marketing and selling the Disney brand. With the help of this cross-merchandising, Disney intended each new animated film to function as its own mini-industry. However, Disney claimed its primary focus remained entertainment, not licensing. “The film does come first,” said a Disney spokesman. “Without the original product, the merchandise wouldn’t come to anything.”68 The theme parks also worked to increase merchandise sales. Several years after the parks in Japan and Europe had opened, consumer product sales had more than tripled in Japan and risen 10-fold in Europe.69

Synergy affected the scope of Disney’s business geographically, horizontally, and vertically. Geographically, the company sought to generate greater international sales, especially in Europe and Japan. In 1999, Disney generated about 21% of its revenue from abroad, while other global brands

11

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

701-035 The Walt Disney Company: The Entertainment King such as Coca-Cola and McDonald’s had figures of 63% and 61%, respectively.70 “If there’s one single realm that can put our company back on the growth track, it is the overseas market,” said Eisner.71 “If we can drive per capita spending levels on Disney merchandise in Britain, France, Germany, Italy and Japan to 80% of the U.S. level, it would generate $2 billion a year in incremental annual revenue.”72 In 1999, consumers in Europe spent 40% as much, per capita, on Disney products as those in the United States. In Japan, the figure was 80%.73 Disney planned to better integrate its overseas operations. In the past, each division had opened its own foreign office. Disney decided to consolidate its foreign offices under regional executives, including a CFO and brand manager. Part of the idea was to save money by renting shared office space and coordinating advertising, but the real focus was on creating more synergy through cross-promotion.

Horizontally, Disney sought to enter new types of entertainment. For example, it began developing new regional venues within the United States to make the Disney experience more accessible, including ESPN Zones -- sports restaurants with interactive sports attractions -- and DisneyQuests multistory facilities with a range of virtual and interactive attractions (such as elaborate video games) for both kids and adults. Similarly Disney expanded into cruise ships and educational retreats. The company packaged its cruises with visits to Disney World near its home port. Eisner said the company was unlikely to sell the ships even if they produced a low return on capital because they helped bring families to Disney World. The Disney Institute, opened in 1996 at Walt Disney World, focused on fitness and “adventures in learning” rather than purely on entertainment.74 It catered to adults and families with older children by offering courses such as animation, landscape design, and culinary arts.

Vertically, the company’s major initiatives involved the Internet and TV. Disney saw the Internet as a possible distribution channel for its film library and its sports and news programming, among other content. “Our goal is to lead in this space because we know that soon it will be where entertainment in the home consolidates,” said Eisner.75 In TV, ABC developed more of its own content—like a movie studio. Other studios began to wonder if ABC would still buy shows from them.76 Eisner contended that if he heard about an interesting show while walking Disney’s hallways, he would urge ABC to run it. If “it ends up being ER, then that is strategic planning,” he said.77

Synergy also affected Disney’s costs. In August 1999, Eisner merged Touchstone Television into a division of ABC to save an estimated $50 million a year78 and increase cooperation. However, the restructuring involved moving a New York business to Los Angeles and, by some accounts, created a culture clash.79 Synergy drove lower costs in theme parks as well. “It would make no more sense to build a completely different theme park in each new locale than it would to completely change the Lion King stage play every time it opened in a new city,” a company report said.80 With this rationale, the new Disney Studios Park next to Disneyland Paris included popular attractions from Disney-MGM Studios.

But synergy had its limits. For example, the effectiveness of movie tie-ins was dropping: “In the past decade, moviemakers have been able to wring ever-higher royalty rates from licensees of toys, clothing, and other goods. But the payoff has been shrinking. Mattel Inc. felt the pinch when several recent Disney pics . . . passed $100 million at the box office but did little for toy sales.”81

In 1999, Disney decided to reduce the number of its licensed products by half, having reached a peak of over 4,000 in 1994. “This became far too many relationships to productively manage,” said Eisner. “By having broader relationships with fewer licensees, we will be able to more effectively build new merchandise campaigns to strengthen such established characters as Winnie the Pooh.”82 As part of this strategy, the company decided to place less emphasis on merchandise tied to Disney’s latest film releases and more emphasis on products featuring its core characters. For example, Disney launched a national TV ad campaign in fall 2000 promoting a new line of Mickey Mouse clothing. 12

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

The Walt Disney Company: The Entertainment King 701-035 Managing the Brand

As Disney entered new businesses, it increasingly faced the prospect of damaging its brand. Perhaps the most publicized example was the controversy over the ABC show Ellen. Sparked by the 1997 disclosure that the title character of the show was a lesbian, the Southern Baptists, the country’s largest Protestant church, organized a boycott of all Disney products because Disney had departed from “traditional family values.” In addition, Catholic groups objected to the Miramax movie Priest (1994), which featured a gay cleric; animal rights activists protested Disney’s treatment of animals at the Animal Kingdom theme park; and Arab-Americans decried what they felt were stereotypical portrayals in the movie Aladdin.83 Moreover, Disney’s Hong Kong theme park had been delayed for two years because of Kundun (1997), a Disney movie about the Dalai Lama that the Chinese government found objectionable.

At the same time, some felt Disney was hamstrung by its wholesome image. The Disney Channel ranked a distant third in ratings for kids aged 2 to 11, behind Nickelodeon and Time-Warner’s Cartoon Network. Both networks exploited Disney’s emphasis on wholesome programming based on myths, history, and fairy tales by putting on more contemporary shows. “The Nickelodeon opportunity was to get inside the lives of today’s kids,” said Herb Scannell, Nickelodeon’s president. “We’ve been contemporary. [Disney has] been traditional.”84 The same was perhaps true in the consumer products division. “Many of Disney’s products were designed for a ‘kinder, simpler time’—the days before video games,” said one analyst.85

Managing Creativity

Disney had hired Michael Ovitz but he left with a $100 million-plus severance package after 14 ineffective months on the job. Noone was hired to replace him as president in 1996. In his autobiography, Work in Progress, Eisner talked about the importance of finding a president with a strong background in finance, dispute mediation, and labor relations who could free Eisner to focus on broad company issues and the creative side of Disney’s businesses. He believed ABC Group Chairman Robert Iger was such a person and promoted him to president and COO in January 2000.

One of Eisner’s traditional techniques for managing creativity was the “gong show,” a weekly meeting in which Disney employees in each division would brainstorm for new ideas. However, the gong show had slowly fallen into disuse. Eisner explained:

The Little Mermaid came out of a gong show, and so did Pocahontas. Lots of ideas came

out of those meetings, and people had a great time. Gong shows still go on in the animation business, but they’ve sort of faded off in other parts of the company. That’s part of getting big and successful. Suddenly, very, very important people don’t want to put themselves into the position of getting “gonged.” Not everybody likes having his or her idea dismissed.86

Disney had a strategic planning unit that was a financial check on Disney’s various divisions. Put into place by Wells and former CFO Gary Wilson, the system encouraged conflict by pitting division managers against the strategic planning department. “You always have to fight your colleagues to show your worth,” said one Disney executive.87 Eisner’s “feeling is that [if] you put a lot of smart people in a room and listen to them duke it out . . . the best idea will pop out,” said another Disney executive.88 Strategic planners were assigned to each of Disney’s business units and reported to the head of strategic planning, who reported to Eisner. Some insiders felt that too much conflict was built into Disney’s culture. “My rule of thumb was, if you ever have a meeting with more than five other people, you’re in big trouble,” said one Disney executive who had recently had a project rejected.89

13

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

701-035 The Walt Disney Company: The Entertainment King Between 1994 and January 2000, approximately 75 high-level executives left the company.90 Some observers wondered whether Disney was putting too much emphasis on controlling costs and thus driving away its creative talent. “It’s not as fun a place as it used to be,” said Ryan Harmon, a former Imagineer. “It’s just money, money, money. The creative side doesn’t rule anymore.”91 Other Disney executives cited Disney’s combative culture and Eisner’s increasingly autocratic management style as reasons for leaving.92 Eisner countered that Disney’s turnover was not unusual given the company’s size and success. “Every headhunter head hunts Disney,” he said. “Where would you go? You go to the companies that do very well. It may not be convenient, but it’s a compliment.”93

Disney’s Strategy for Growth: Smart or Dumbo?

When Eisner arrived at Disney, there were 28,000 employees. By 2000, the number had ballooned to 110,000, reflecting Disney’s ever-growing number of businesses. Did Disney still have a coherent strategy for its business mix? Did Eisner’s 20% growth target still make sense, particularly when Disney faced ever-increasing competition across all its businesses (see Exhibit 10)?

Some observers worried that the company had simply become too large to accommodate Eisner’s management style. “Can a [$25] billion enterprise, with its efforts flung throughout the world, be creatively run by a single person?” asked one executive at a rival studio. “It didn’t get to be that business with one creative head.”94 Did Eisner—the man credited with Disney’s rebirth—now need to change his approach to running his entertainment empire?

14

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

701-035 -15-

Exhibit 1 The Walt Disney Company Financial Data, 1983–2000 ($ millions)

1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996a 1997 1998 1999 2000

Revenues

Theme parks and

resorts $1,031 $1,097 $1,258 $1,524 $1,834 $2,042 $2,595 $3,020 $2,794 $3,307 $3,441 $3,464 $3,960 $4,502 $5,014 $5,532 $6,139 $6,803

Studio Entertainment

(film)

165 245 320 512 876 1,149 1,588 2,250 2,594 3,115 3,673 4,793 6,001 6,471 6,981 6,586 6,166 5,994

0 4,078 6,522 7,433 7,970 9,615

Consumer Products 111 110 123 130 167 247 411 574 724 1,082 1,425 1,798 2,151 3,688 3,782 3,165 2,954 2,622

Media Networks 0 0 0 0 0 0 0 0 0 0 0

Internet & Direct

Marketing

0 0 0 0 0 0 0 0 0 0 0 0 NA NA 174 260 206 368

Total 1,307 1,656 1,701 2,166 2,877 3,438 4,594 5,844 6,112 7,504 8,529 10,055 12,112 18,739 22,473 22,976 23,435 25,402

Operating Income

Theme parks and

resorts 190 186 255 404 549 565 785 889 547 644 747 684 861 990 1,136 1,288 1,479 1,620

Studio Entertainment

(film) -33 1 34 52 131 186 257 313 318 508 622 856 1,074 895 1,079 749 154 110

Consumer Products 57 54 56 72 97 134 187 223 230 283 355 426 511 577 893 810 600 455

Media Networks 0 0 0 0 0 0 0 0 0 0 0 0 0 871 1,699 1,757 1,580 2,298

Internet & Direct

Marketing

0 0 0 0 0 0 0 0 0 0 0 0 NA NA -56 -94 -93 -402b

Total 214 242 345 528 777 885 1,229 1,425 1,095 1,435 1,724 1,966 2,446 3,033 4,751 4,015 3,687 4,081

Selling, General, &

Admin.

26 60 50 66 70 96 120 139 161 148 164 162 184 309 367 282 244 350b

Net Income

23%

10%

25%

9%

13%26%11%24%22%

10%

25%

20%

93 98 174 247 445 522 703 824 637 817 300 1,110 1,380 1,214 1,966 1,850 1,300 920

16%

7%

17%

23%

17% 18%

8% 2%

19% 6%

20% 20%

18%

9%

21%

23%

19%

9%

23%

20%

16%

3%

11%

34%

18%

5%

12%

29%

16%

4%

10%

30%

13%

3%

6%

27%

13%

2%

4%

22%

Total Assets 2,381 2,739 2,897 3,121 3,806 5,109 6,657 8,022 9,429 10,862 11,751 12,826 14,606 36,626 37,776 41,378 43,679 45,017

Ratios

Operating Margin (%) 14% 11% 17% 21% 25%

ROA (%)

ROE (%)c

4% 4% 6% 8% 12%

7% 9% 15% 17% 24%

Total Debt/Assets 19% 31% 28% 18% 15%

Stock Performance

Index Disney Stock 100 131 218 394 471 563 1,165 906 960 1,447 1,460 1,545 2,195 2,647 3,499 3,387 3,011 3,226

Index S&P 500 100 151 186 231 215 252 325 300 353 399 428 416 562 701 903 1,089 1,295 1,218

from September 2009 to March 2010.

Source: Annual reports.

aReorganization in 1996.

bApproximately half of SG&A was due to an increase in sales and marketing in the Internet division.

cROE was –1.7% in 1940, 6.7% in 1945, 11.7% in 1950, 15.6% in 1955, –6.2% in 1960, 21.5% in 1965, 10.0% in 1970, 10.0% in 1975, 12.6% in 1980.

701-035 -16-

Exhibit 2

Film

Short cartoons

Watch licensing

Feature cartoons

International magazine

Comic book, doll licensing Comic strips Tablet licensing TV/Radio Theme Parks Consumer Products Other

Disney Timeline and When Disney Entered New Businesses (exits are shaded)

Year Event

1923 Walt Disney Productions founded

1928 Mickey Mouse introduced

1929

Record licensing

1930

Mickey Mouse pencil tablets licensed Mickey Mouse comic strip, comic book, and doll licensed

1933 First music record licensed

Ingersoll makes Mickey Mouse watches

1934 Le Journal de Mickey published in France

1937 Snow White and the Seven Dwarfs debuts

1940 Initial public stock offering

Disney studio moves to Burbank

Live-action movies

TV specials—children

Film distribution

TV series—children

Real estate

development

TV programming—adults

TV syndication

Nightclubs

Record label—pop music

International retail stores

Book publishing—children

Fast food

Retail stores

Arena shows

Record label—soundtracks

Fantasia debuts (first stereo sound)

1949 Seal Island (first true-life adventure short)

Walt Disney Music Co. formed

1950 Treasure Island released

One Hour in Wonderland airs

1952 WED Enterprises founded to design Disneyland

1953 Buena Vista Distribution Co. formed

1954 Disneyland TV show begins to air

1955

Home video distribution

Cable channel—kids

Movies—adults

Int’l theme park

Disneyland opens Theme park

Mickey Mouse Club TV show premiers

1966 Walt Disney dies

1969 Disney on Parade tours

1971 Walt Disney World opens Theme resort

1980 Buena Vista Home Video division formed

1982 EPCOT Center opens

1983 Tokyo Disneyland opens

Disney Channel debuts

1984 Michael Eisner and Frank Wells hired

Touchstone label created

Arvida Corp. acquired

1985 Disney produces The Golden Girls for NBC

1986 Disney begins to syndicate TV programs

1987 First Disney Stores open

KCAL, a Los Angeles TV station, purchased

Arvida sold

TV stations Real estate

development

1989 Disney-MGM Studios Theme Park opens

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

Pleasure Island nightlife complex opens

Hollywood Record label formed

1990 First international Disney Store opens in London

Disney Press established

Mickey’s Kitchens open

701-035 -17-

Exhibit 2 (continued)

Film

Time-shares

Book publishing—adults

Hockey

Theater operations

Broadway shows

Educational

retreats

Sports complex

Indoor playparks

Sports-themed retail

TV and radio networks Educational software and

video games Newspapers (four, as part of ABC deal)

Baseball

Planned community

Internet content provider

Internet subscription service

Radio programming—children

Cruise line

Newspapers

Internet search engine, corporate intranets

Sports-themed restaurants Regional interactive entertainment facilities

Int’l cable channel

Indoor playparks

Sports-themed retail

Internet portal

Fast food

TV/Radio Theme Parks Consumer Products Other

Year Event

1991 Time share started: Vacation Club

Hyperion Books established

1992 Euro Disney (later, Disneyland Paris) opens

Beauty and the Beast nominated for Best Picture

National Hockey League awards Disney a team

Mickey’s Kitchens closed

1993

Disney buys Miramax studios Independent films— adults

1994 Wells, president and COO, dies

Lion King debuts

Disney buys theater in Times Square

Disney’s first Broadway show, Beauty and the Beast

1995 Disney announces ABC deal

Company sets up Disney Interactive

1996 Disney launches Disney.com Web site Online shopping

Disney buys 25% of Anaheim Angels baseball team

Disney Institute opens

Town of Celebration, FL, opens to residents

1997 Disney opens Wide World of Sports at Disney World

Club Disney opens at shopping malls

ESPN Stores open

Disney buys Starwave, an Internet content provider

Disney starts Daily Blast, an online subscription service

1998 Disney Magic cruise ship sets sail

Radio Disney, a radio network for children, debuts

Animal Kingdom, the fourth gate at Disney World, opens

Infoseek and Ultraseek acquired

ESPN Zones opens

DisneyQuest opens

1999 Disney and Infoseek launch the GO Network portal

Club Disneys and ESPN Stores close

2000 Aida debuts on Broadway

Disney buys 45% of CineNova in Europe

Mature-themed Broadway

shows

Corporate intranets

Internet portal

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

Disney sells Ultraseek

2001 Disney shutters Go Network

Source: Compiled by casewriters.

701-035 The Walt Disney Company: The Entertainment King

Exhibit 3Disney's Business Lines in 2000

Media Networks breaks down into two categories: Broadcasting and Cable Networks. Broadcastingincludes the ABC Television Network, the company’s ten television stations, the company’s radio

stations and the ABC Radio Network and Radio Disney. Cable Networks consists of the ESPN-brandedcable networks, The Disney Channel and the start-up cable operations, including Toon Disney andbeginning in January 2000, SoapNet.

- ABC Television Network - TV Stations

- ABC Radio Networks - Radio Stations

- ESPN

- Disney Channel - Toon Disney - SoapNet

MEDIANETWORKS

STUDIO

Studio Entertainment ;principally includes the company’s feature animation and live-actionmotion picture,home video, television and cable production, including syndication and pay TV,stage play and music production and distribution businesses.

Entertainment

Music Group

- Hollywood Records - Mammoth Records - Lyric Records

- Walt Disney Pictures - Touchstone Pictures - Hollywood Pictures - Miramax

- Buena Vista

- Buena Vista International

- Program Development - First-Run Animation - Live-Action Syndication - Pay Televisions Services

THEME PARKSAND RESORTS

Theme Parks and Resorts reflects the company’s theme park and resort activities except DisneylandParis, which is accounted for under the equity method and included in Corporate and Other Activities,its sports team franchises and its DisneyQuest and ESPN Zone regional entertainment businesses.

Imagineering

- Mighty Ducks of Anaheim - Anaheim Angels

Entertainment - DisneyQuest - ESPN Zone

- Disneyland Resort

- Walt Disney World Resort - Disney Vacation Club - Disney Cruise Line - Tokyo DisneylandCONSUMERPRODUCTS

Consumer Products licenses the name “Walt Disney,” as well as the company’s characters, visual andliterary properties, to various consumer manufacturers, retailers, show promoters and publishers

throughout the world. The company also engages in direct retail distribution principally through TheDisney Stores, and produces books and magazines for the general public in the United States and

Europe. In addition, the company produces audio and computer software products for the entertainmentmarket, as well as film, video and computer software products for the educational marketplace.

Publishing

Art Classics

Interactive

Licensing

INTERNET AND

DIRECT MARKETING

Internet and Direct Marketing represents the operations of Disney’s online activities andthe Disney Catalog. After the fiscal year end, the Internet and Direct Marketing divisioncombined with Infoseek to become Disney’s Internet entity, GO.com.

ABC

Internet Group

Commerce

International

ESPN

Internet Group

Source: Note:

The Walt Disney Company, 1999 Fact Book, p. 4. In January 2001, Disney closed the GO.com portal.

18

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

The Walt Disney Company: The Entertainment King 701-035

Exhibit 4Top 30 Amusement Parks Worldwide (attendance in millions)

1983 Attendance

1991 Attendance

1999 Attendance

CAGR 1983–1991

CAGR 1991–1999

Rank

2. 3. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 19. 21. 22. 23. 23 26. 27. 28. 28. 30.

Park and Location

1. Tokyo Disneylanda

Disneyland, Anaheim, CAa EPCOT, Walt Disney World, FLa Everland, Kyonggi-Do, South Korea Universal Studios Florida, Orlando Blackpool (England) Pleasure Beach Lotte World, Seoul, South Korea Yokohama (Japan) Sea Paradise Universal Studios, Universal City, CA SeaWorld Florida, Orlando Huis Ten Bosch, Sasebo, Japan Nagashima Spa Land, Kuwana, Japan Busch Gardens, Tampa Bay, FL

SeaWorld California, San Diego Knott’s Berry Farm, Bueno Park, CA Universal’s Islands of Adventure, Orlando Paramount’s Kings Island, OH Cedar Point, Sandusky, OH Ocean Park, Hong Kong Suzuka (Japan) Circuit

Tivoli Gardens, Copenhagen, Denmark Six Flags Great America, Gurnee, IL Santa Cruz Beach Boardwalk, CA

10.2 15.8 17.5 5.6 1.3 9.9 11.6 13.4 2.0 1.8 10.1 14.4 10.1 4.5 (4.3) N/A N/O N/A N/O N/O 3.6 N/O N/O 3.0

N/A 6.9 N/A 4.5 N/O 4.6 N/O N/O 2.9

8.6 8.1 6.9 6.1 6.7 5.1 4.0 4.0 3.9

N/A N/O N/A N/O N/O 3.1 N/O N/O (0.4)

N/A 2.0 N/A 3.9 N/O 1.3 N/O N/O 3.8

Magic Kingdom, Walt Disney World, FLa 12.6 18.0 15.2 4.5 (2.1)

N/O 12.5 N/O N/O 4. Disneyland Parisa N/O

Disney-MGM Studios, FLa N/O 6.8 8.7 N/O 3.1 Animal Kingdom, Walt Disney Worlda N/O N/O 8.6 N/O N/O

3.0 3.9 4.7 3.3 2.4

Six Flags Great Adventure, Jackson, NJ 3.1 3.0 3.8 (0.4) 3.0

2.9 3.8 3.6 3.4 (0.7) 3.2 N/O

4.0 N/O

3.6 3.4

2.8 N/O

(1.3) N/O

2.6 2.9 3.3 1.4 1.6 2.4 3.0 3.3 2.8 1.2 N/A N/A N/O 5.0 2.3

N/A 2.5 N/O 4.0

3.3 3.3 3.2 3.1

N/A N/A N/O (2.8)

N/A 3.5 N/O (3.1)

23. Morey’s Piers, Wildwood, NJ

Six Flags Magic Mountain, Valencia, CA 2.5 3.2 3.2 3.1 0

2.6 3.1 1.5 2.2

2.3 3.0 3.0 3.4 0

Source: Amusement Business, Los Angeles Times, Toronto Globe & Mail, The San Diego Union-Tribune, and The Wall Street Journal.

N/A—Not available.

N/O—Not yet open.

aWorldwide Disney theme park attendance grew at a CAGR of 5.7% from 1983 to 1991 and at a CAGR of 3.2% from 1991 to

1999. Attendance at Disney’s Florida theme parks grew at a CAGR of 7.1% from 1983 to 1991 and at a CAGR of 1.0% from 1991 to 1999. Attendance at Walt Disney World and Disneyland grew at a CAGR of 4.8% between 1983 and 1987.

19

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

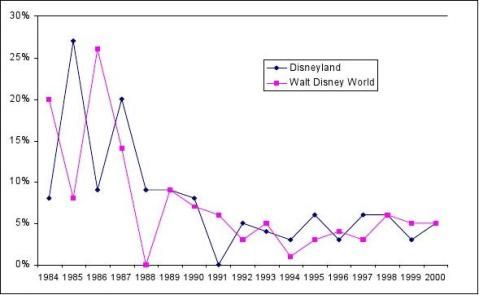

701-035 The Walt Disney Company: The Entertainment King Exhibit 5Annual Increase in Adult Ticket Prices (%)

Source:

Note: Walt Disney Co. and Amusement Business. Between 1983 and 1987, ticket price increases at the parks accounted for about $300 million of incremental revenue.

Exhibit 6 Average Adult Admission Prices at Select U.S. Parks

CAGR CAGR

Park and Location 1985 1990 1995 2000 1985–1990 1990–2000 Six Flags Great America, Gurnee, IL $14 $20 $26 $39 7.4 6.9 Six Flags New England, Agawam, MA 12 17 22 33 7.2 6.9 Cedar Point, Sandusky, OH 14 20 27 38 7.4 6.6 Paramount’s Kings Island, Kings Island, OH 14 21 27 39 8.4 6.4 SeaWorld Florida, Orlando 15 25 36 46 10.8 6.3 Paramount’s Carowinds, Charlotte, NC 13 19 26 35 7.9 6.3 Dorney Park, Allentown, PA 12 17 25 31 7.2 6.2 Knott’s Berry Farm, Buena Park, CA 13 21 29 38 10.1 6.1 Paramount’s Kings Dominion, Doswell, VA 14 20 28 36 7.4 6.1 Six Flags Over Texas, Arlington 14 20 28 36 7.4 6.1

Six Flags Magic Mountain, Valencia, CA 14 22 29 39 9.5 5.9 Busch Gardens, Williamsburg, VA 15 21 29 37 7.0 5.8

Six Flags Great Adventure, Jackson, NJ 15 23 31 40 8.9 5.7 Worlds of Fun, Kansas City, MO 13 19 25 32 7.9 5.4 Disneyland, Anaheim, CA 17 28 33 41 10.5 3.9 Walt Disney World, Lake Buena Vista, FL 20 33 39 46 10.5 3.4 Source:

Note:

Compiled by casewriters from Amusement Business data and Los Angeles Times, Toronto Globe & Mail, San Diego Union-Tribune, and The Wall Street Journal. In 1983, adult one-day tickets for Disney World and Disneyland were $15 and $12, respectively.

20

This document is authorized for use only by Yang Li in Corporate and Business Strategy taught by Anu Wadhwa

from September 2009 to March 2010.

701-035 -21-

Exhibit 7