篇一 :信用证已传真申明

Hangzhou ********* Co.Ltd

******************,Hangzhou China

Tel: +86 571 **** ****

Fax:+86 571 **** ****

BENEFICIARY STATEMENT CERTIFICATION

CONSIGNEE: **********************,INC.

PO NO: 3619***

ITEM NO:1101****

SKU NO: 13****

L/C NO: ****************

INVOICE NO:***********

Dear Sirs:

WE HEREBY STATING THAT FULL SET DOCUMENTS HAD BEEN FAXED TO ****************, FAX: ****-********, ATTN:SHIPPING DEPT.

************************ Co.Ltd

DATE:Jul.31 2014

…… …… 余下全文

篇二 :信开信用证样本

FROM:THE HONGKONG AND SHANGHAI BANKING CORP. , DUBAI

TO: THE HONGKONG AND SHANGHAI BANKING CORP. , SHANGHAI

SEQUENCE OF TOTAL 1/2

FORM OF DOC. CREDIT IRREVOCABLE

DOC. CREDIT NUMBER DBS 268330

DATE OF ISSUE 080202

EXPIRY DATE 080502 PLACE IN COUNTRY

OF BENEFICIARY

APPLICANT ABDULAH SALEM AND CO., P.O.BOX 3472, DUBAI, U.A.E.

BENEFICIARY ZHEJIANG LIGT INDUSTRIAL

PRODUCTS IMPORT

ANDEXPPORT CORP.,

191 BAOCHU ROAD,HANGZHOU,

…… …… 余下全文

篇三 :信用证实例

信用证详解

MT700-------------------ISSUE OF A DOCUMENTARY CREDIT-------------------------

SEQUENCE OF TOTAL 27: 1/1

FORM OF DOCUMENTARY CREDIT 40A: IRREVOCABLE TRANSFERABLE

DOCUMENTARY CREDIT NUMBER 20: LC51G4C087333324

DATE OF ISSUE 31C: 041119

DATE AND PLACE OF EXPIRY 31D: 050130 CHINA

APPLICANT 50: HOPE TRADING EST.,

P.O. BOX 0000 DAMMAN 31491,SAUDI

ARABIA

TEL: 88888888

BENEFICIARY 59: XYZ CORPORATION

…… …… 余下全文

篇四 :LC信用证样本

对于很多外贸新手来说,信用证(L/C)是个不小的问题,相信有不少人可能都没见过。对我来说,信用证也是新的东西,也需要学习。在此,从其它地方搬来样本,供大家参考、学习。对于原创者,表示感谢!

正题:

其实所有的信用证条款都大同小异,具体款项都是那些,下面列出一个样本供大家参考.有一个问题需要新手注意,一般韩国开过来的信用证经常用假远期,这也是韩国人的精明之处,可以用假信用证向开证行押汇,狡猾狡猾地!!

信用证样本1

SAMPLE LETTER OF CREDIT/1

(See Instructions on Page 2)

Name and Address of Bank

Date: __________________

Irrevocable letter of Credit No. ______________

Beneficiary: Commodity Credit Corporation Account Party: Name of Exporter

Address of Exporter

Gentlemen:

We hereby open our irrevocable credit in your favor for the sum or sums not to exceed a total of _______________dollars ($__________), to be made available by your request for payment at sight upon the presentation of your draft accompanied by the following statement:

(Insert applicable statement)/2

This Letter of Credit is valid until _____________________/3, provided, however, that this Letter of Credit will be automatically extended without amendment for _________________/4 from the present or any future expiration date thereof, unless at least thirty (30) days prior to any such expiration date the Issuing Bank provides written notice to the Commodity Credit Corporation at the U.S. Department of Agriculture, 14th and Independence Avenue, S.W., Room 4503, South Building, Stop 1035, Washington, D.C. 20250-1035, of its election not to renew this Letter of Credit for such additional ______________________/5 period. The notice required hereunder will be deemed to have been given when received by you.

This letter of Credit is issued subject to the Uniform Customs and Practice for Documentary Credits, 1993 Revision, International Chamber of Commerce Publication No. 500

(Name of Bank)

By: _______________________

________________________________________

-2-

INSTRUCTIONS FOR LETTER OF CREDIT ISSUED FOR DEIP BID

1. Send to: Treasurer, CCC

U.S. Department of Agriculture

14th & Independence Avenue, S.W.

Room 4503 South Building

Stop 1035

Washington, DC 20250-1035

2. If the letter of credit is to apply to any Dairy Export Incentive Program (DEIP) Invitation:

“The Commodity Credit Corporation (CCC) has a right to the amount drawn in accordance with the terms and conditions of one or more Dairy Export Incentive Program (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 1494, and the applicable DEIP Invitation(s) issued by CCC.”

If the letter of credit is to apply to a single DEIP Invitation:

“The Commodity Credit Corporation (CCC) has a right to the amount drawn in accordance with the terms and conditions of one or more Dairy Export incentive Program (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 1494, and DEIP Invitation No. ________________.

If the letter of credit is to apply to more than one specific DEIP Invitation:

“The Commodity Credit Corporation (CCC) has a right to the amount drawn in accordance with the terms and conditions of one or more Dairy Export incentive Program (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 1494, and DEIP Invitation Nos. ________________, ___________________, and _________________.”

3. Insert the last date of the month in which the 90th day after the date of the letter of credit falls (e.g., if the date of the letter of credit is March 15, 2002, the date to be inserted would be Jun 30, 2002).

4. Insert a time period of either “one (1) year” or a specific number of whole month(s) which total less than one year (e.g., “one (1) month,” “two (2) months,” etc.).

5. Insert the same time period as inserted in the previous space (e.g., “one (1) year,” “one (1) month,” etc.).

…… …… 余下全文

篇五 :一份信用证的实例分析

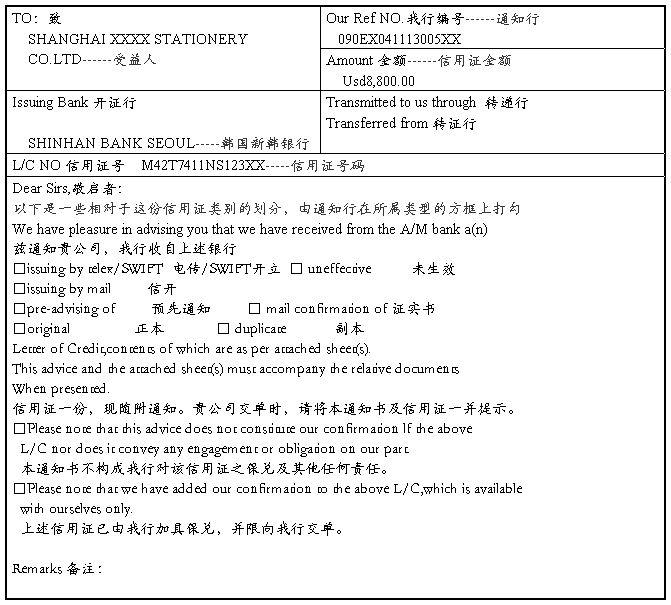

Notification of Documentary Credit------信用证通知书

ADDRESS:

上海市青浦镇青安路206号 Date 日期:

This L/C consists of 2 sheet(s),including the covering letter and attachments(s).

该信用证连同本面函及附件共2页。

If you find any terms and conditions in the L/C which you are unable to comply with and/or any

…… …… 余下全文

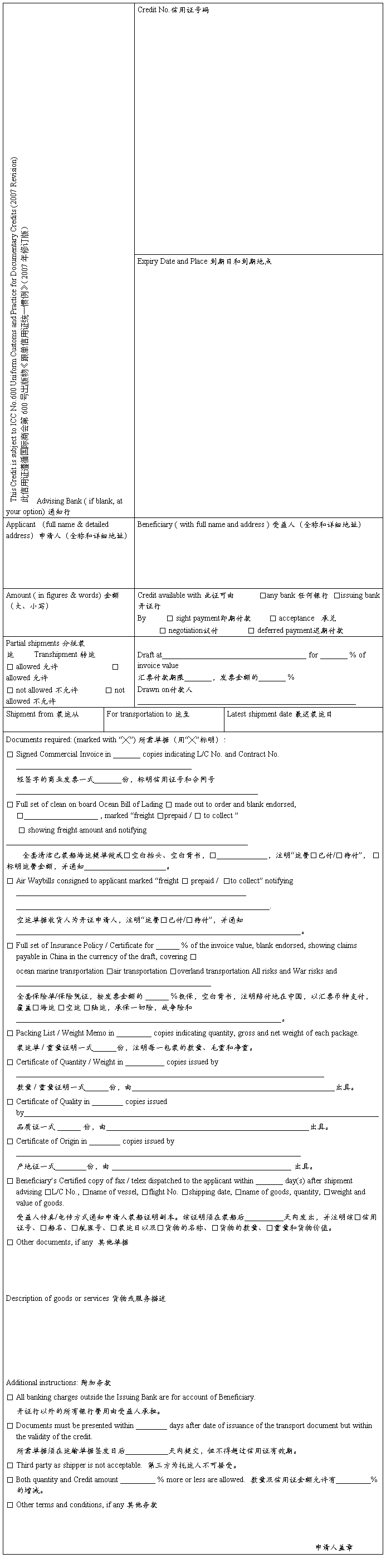

篇六 :信用证开立申请书

不可撤销信用证开证申请书

不可撤销信用证开证申请书

进口方与出口方签订国际贸易货物进出口合同并确认以信用证为结算方式后,即由进口方向有关银行申请开立信用证。开证申请是整个进口信用证处理实务的第一个环节,进口方应根据合同规定的时间或在规定的装船前一定时间内申请开证,并填制开证申请书,开证行根据有关规定收取开证押金和开证费用后开出信用证。

开证申请人(进口方)在向开证行申请开证时必须填制开证申请书。开证申请书是开证申请人对开证行的付款指示,也是开证申请人与开证行之间的一种书面契约,它规定了开证申请人与开证行的责任。在这一契约中,开证行只是开证申请人的付款代理人。

开证申请书主要依据贸易合同中的有关主要条款填制,申请人填制后附合同副本一并提交银行,供银行参考、核对。但信用证一经开立则独立于合同,因而在填写开证申请时应审慎查核合同的主要条款,并将其列入申请书中。

一般情况下,开证申请书都由开证银行事先印就,以便申请人直接填制。开证申请书通常为一式两联,申请人除填写正面内容外,还须签具背面的“开证申请人承诺书”。

TO

致_________________________行。

填写开证行名称。

…… …… 余下全文

篇七 :信用证申请书

APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDIT

开立不可撤销跟单信用证申请书

Date 日期 _________________

To: HANGZHOU CITY COMMERCIAL BANK 致:杭州市商业银行

Please issue by SWIFT an Irrevocable Letter of Credit as follows: 请通过SWIFT方式开立如下不可撤销跟单信用证:

开证申请人承诺书

致:杭州市商业银行

我公司已依法办妥一切必要的进口手续,兹谨请贵行为我公司依照本申请书所列条款开立不可撤销跟单信用证,并承诺如下:

一、 同意贵行依照国际商会第600号出版物《跟单信用证统一惯例》办理该信用证项下的一切事宜,并同意承担由此产生的一切责任。

二、 及时提供贵行要求我公司提供的真实、有效的文件及资料,接受贵行的审查监督。

…… …… 余下全文

篇八 :信用证审单要点

:(以下是审查的要点)

单证审核的重点 单证审核是保障安全收汇的关键环节,单证审核的重点是: 仁^亚^软件

1.检查L/C规定的单证份数(比如多或者少,是否是全套等); 2.检查附加条款对单证的特别要求(比如是否要求注明L/C号码、合同号码等); 3.检查所提供的文件名称和类型是否符合要求。(比如是否需要认证、出单人是否符合要求等); 4.单证之间的各类描述是否完全一致。(比如大小写、计量单位等); 5.单证出具或提交的日期是否符合要求。(比如保单日期、FORM A出单期等)。

(一).检查信用证的付款保证是否有效。

应注意有下列情况之一的,不是一项有效的付款保证或该项付款保证是存在缺陷问题的:

1.信用证明确表明是可以撤消的:可撤消信用证(REVOCABLE L/C)由于毋须通知受益人或未经受益人同意可以随时撤消或变更,应该说对受益人是没有付款保证的,对于此类信用证,一般不予接受; 信用证中如没有表明该信用证是否可以撤消,按500的规定,应理解是不可以撤消的;

2.应该保兑的信用证未按要求由有关银行进行保兑;

3.信用证未生效;

4.有条件的生效的信用证;如:“待获得进口许可证后才能生效”。

…… …… 余下全文