国际结算课程实习内容

国际结算课程实习内容

1、 上网查询某个银行的网站,了解该银行开展的国际结算业务有哪些(包括贸易融资的方式),然后形成一个简

单的调研报告。

2、 根据所给资料完成一套议付结汇的单据。

根据买方开来的信用证制作有关单据。

Sequence Total

Form Doc Credit

Doc Credit Num

Date of Issue

Date/Place Exp

Applicant

Beneficiary

Curr Code, Amt

Avail With By

Drafts At

Drawee

Partial Shipmts

Transshipment

Loading on Brd

Latest Shipment

Goods Descript.

Docs Required

dd. Conditions

27 1/1 40 A IRREVOCABLE 20 BKKB1103043 31 C 091103 31 D Date 100114 Place BENEFICIARIES’ COUNTRY 50 MOUN CO., LTD NO. 443, 249 ROAD ,BANGKOK THAILAND 59 SHANGHAI FOREIGN TRADE CORP.SHANGHAI, CHINA 32 B Code USD Amount 18.000, 41 D ANY BANK IN CHINA BY NEGOTIATION 42 C SIGHT IN DUPLICATE INDICATING THIS L/C NUMBER 43 D ISSUING BANK 43 P NOT ALLOWED 43 T ALLOWED 44 A CHINA MAIN FORT, CHINA 44 B BANGKOK, THAILAND 44 C 091220 45 A 2,000 KGS ISONIAZID BP98 AT USD9.00 PER KG CFR BANGKOK 46 A DOCUMENTS REQUIRED: + COMMERCIAL INVOICE IN ONE ORIGINAL PLUS 5 COPIES INDICATING FOB VALUE, FREIGHT CHARGES AND THIS L/C NUMBER, ALL OF WHICH MUST BE MANUALLY SIGNED. + FULL SET OF 3/3 CLEAN ON BOARD OCEAN BILLS OF LADING AND TWO NON–NEGOTIABLE, COPIES MADE OUT TO ORDER OF BANGKOK BANK PUBLIC COMPANY LIMITED, BANGKOK MARKED FREIGHT PREPAID AND NOTIFY APPLICANT AND INDICATING THIS L/C NUMBER. + PACKING LIST IN ONE ORIGINAL PLUS 5 COPIES, ALL OF WHICH MUST BE MANUALLY SIGNED. 47 A ADDITIONAL CONDITION: A DISCREPANCY FEE OF USD50.00 WILL BE IMPOSED ON EACH SET OF DOCUMENTS PRESENTED FOR NEGOTIATION UNDER THIS L/C WITH DISCREPANCY. THE FEE WILL BE DEDUCTED FROM THE BILL AMOUNT. 1

Charges 71 B ALL BANK CHARGES OUTSIDE

THAILAND INCLUDING REIMBURSING

BANK COMMISSION AND DISCREPANCY

FEE (IF ANY) ARE FOR

BENEFICIARIES’ ACCOUNT.

Confirmat Instr * 49 WITHOUT

Reimburs. Bank 53 D / /

BANGKOK BANK PUBLIC COMPANY

LIMITED, NEW YORK BRANCH ON T/T

BASIS

Ins Paying bank 78

DOCUMENTS TO BE DESPATCHED IN ONE LOT BY COURIER.

ALL CORRESPONDENCE TO BE SENT TO/BANGKOK BANK PUBLIC

COMPANY

LIMITED HEAD OFFICE, 333 SILOM ROAD, BANGKOK 10500,

THAILAND.

Send Rec Info 72 REIMBURSEMENT IS SUBJECT TO

ICC URR 525

Trailer MAC :

CHK :

DLM :

-------------------------------------------------------------------End of Message------------------------------------------------------------------------ 信用证中有关缮制议付单证的条款

1. 开证行:BANGKOK BANK PUBLIC COMPANY LIMITED, BANGKOK

2. 通知行:交通银行上海分行(BANK OF COMMUNICATIONS SHANGHAI BRANCH)

3. 不可撤销跟单信用证号:BKKB1103043

开证日期:20xx年11月3日

4. 信用证有效期及地点:20101年1月14日,受益人所在国

5. 开证申请人:MOUN CO., LTD

NO.443,249 ROAD,

BANGKOK, THAILAND

6. 受益人:上海市对外贸易公司

7. 信用证金额:USD18,000.00

2

8. 允许在中国的任何银行自由议付

9. 汇票:两份见票即付,注明信用证号

10. 分批装运:不允许转运:允许从中国主要港口运至泰国曼谷

11. 最迟装船日期:20xx年12月20日

12. 货物描述:2000千克 ISONIAZID BP98

单价USD9.00/千克 CFR曼谷

13. 单据要求

(1) 商业#5@p一份正本加五份副本包括FOB价值,运费分别列明,注明信用证号码,所有必须手签。

(2) 全套(3/3)清洁已装船海运提单加两份副本,做成TO ORDER OF BANGKOK BANK PUBLIC COMPANY

LIMITED, BANGKOK抬头,注明运费预付,信用证号,通知申请人。

(3) 装箱单1份正本加五份副本,所有必须手签。

14. 所有泰国以外的银行费用包括偿付费用、不符点费用由受益人承担。

15. 偿付行:电索 BANGKOK BANK PUBLIC COMPANY LIMITED NEW YORK BRANCH

16. 寄单:一次寄单

有关缮制议付单证的要求

1. 合同号:MOU0210S03,合同日期:20xx年10月21日

2. 商业#5@p号:SHE021845,汇票号同商业#5@p号

3. 装运港口:上海

4. 货物包装:50KG/DRUM,体积0.610CBM/DRUM,总毛重2200KGS。

5. 运费:USD1760.00

6. 海运提单号:SCOISG7564

7. 船名:JENNY/03

8. 集装箱号/铅封号:UXXU4240250/0169255

9. 20'集装箱,CFS/CFS。

SHANGHAI FOREIGN TRADE CORP.

SHANGHAI, CHINA

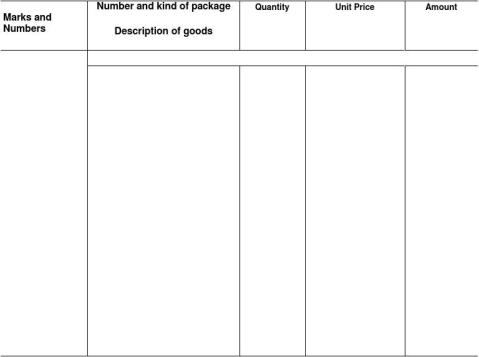

COMMERCIAL INVOICE

To: Invoice No.:

Invoice Date:

S/C No.: 3

S/C Date:

From:

To:

Issued By:

Letter of Credit No.:

TOTAL:

SAY TOTAL:

SHANGHAI FOREIGN TRADE CORP.

SHANGHAI, CHINA

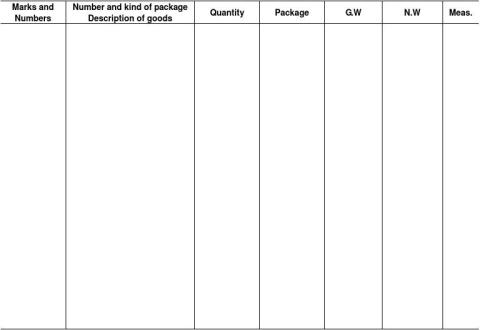

PACKING LIST

To:

Invoice No.:

4

Invoice Date: S/C No.: S/C Date:

From:

To:

Date of Shipment:

Letter of Credit No.:

SAY TOTAL:

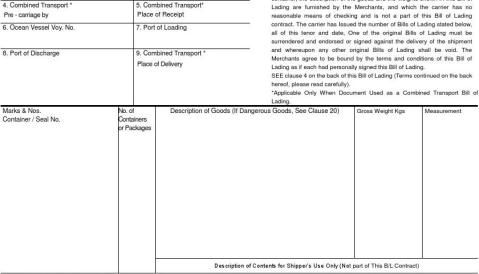

1. Shipper Insert Name, Address and Phone

中远集装箱运输有限公司

2. Consignee Insert Name, Address and Phone

COSCO CONTAINER LINES

5

TLX: 33057 COSCO CN FAX: +86(021) 6545 8984

ORIGINAL

3. Notify Party Insert Name, Address and Phone

(It is agreed that no responsibility shall attsch to the Carrier or his agents for failure to notify)

Port-to-Port or Combined Transport

BILL OF LADING

RECEIVED in external apparent good order and condition except as other-Wise noted. The total number of packages or unites stuffed in the

Subject to Clause 7 Limitation LADEN ON BOARD THE VESSEL DATE BY

6

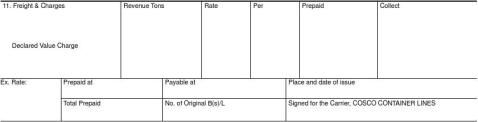

BILL OF EXCHANGE

NO.

FOR At Sight of THIS FIRST BILL OF EXCHANGE

or order the sum of

Date: ( First of the tenor and date being unpaid ) Pay to Drawn under

L/C NO.

TO. Dated

7

中国人民保险公司广州市分公司

The People’s Insurance Company of China GUANGZHOU Branch

总公司设于北京 一九四九年创立

Head Office Beijing Established in 1949

货物运输保险单

CARGO TRANSPORTATION INSURANCE POLICY

#5@p号码(INVOICE NO.) 保险单号次

合同号(CONTRACT NO.) PLC876

Policy No.

信用证号(L/C NO.)

被保险人:

Insured:

中国人民保险有限公司(以下简称本公司)根据被保险人的要求,由被保险人向本公司缴付约定的保险费,按照本保险单承担险别和背面所载条款与下列特别条款承保下列货物运输保险,特立本保险单。

This policy of Insurance witnesses that the People’s Insurance Company of China (hereinafter called “The Company”), at the request of the Insured and in consideration of the agreed premium paid to the company by the Insured, undertakes to insure the undermentioned goods in transportation subject to conditions of the Policy as per the Clauses printed overleaf and other special clauses attached hereon.

标记 包装及数量 保险货物项目 保险金额

Marks & Nos Descriptions of Goods Amount Insured

Quantity

总保险金额:

Total Amount Insured:

保费 启运日期 载运输工具

Premium AS ARRANGED Date of commencement: Per conveyance: Pessession V16 自 经 至

Form VIA To

承保险别

Conditions: 所保货物,如发生本保险单项下可能引起索赔的损失或损坏,应立即通知本公司下述代理人查勘。如有索赔,应向本公司提交保险单正本(本保险单共有 份正本)及有关文件。如一份正本已用于索赔,其余正本则自动失效。

In the event of loss or damage which may result in acclaim under this Policy, immediate notice must be given to the Company’s Agent as mentioned here under. Claims, if any, one of the Original Policy which has been issued in original (s) together with the relevant documents shall be surrendered to the Company. If one of the Original Policy has been accomplished, the others to be void.

中国人民保险公司广州市分公司

The People’s Insurance Company of China GUANGZHOU Branch

8

赔款偿付地点

Claim payable at 出单日期

Issuing Date 地址: 中国广州黄河路112号

Address: 邮编(POST CODE): 518000

王天华

Authorized Signature 电话(TEL): (020)86521049 传真

(FAX): (020)84404593

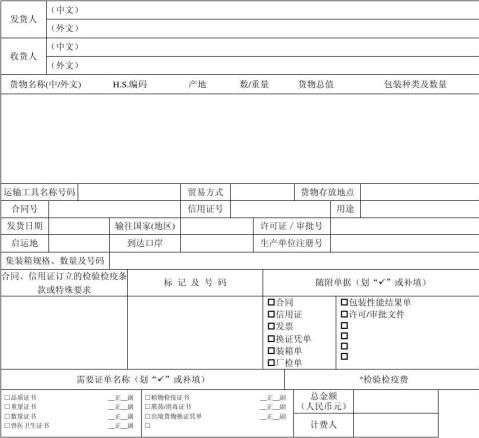

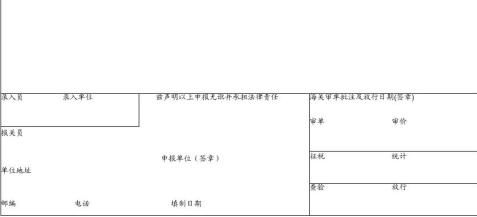

中华人民共和国出入境检验检疫

报检单位 (加盖公章): 报检单位登记号:

联系人:

电话:

出境货物报检单

* 编 号

年

月

日

报检日期:

9

注:有“*”号栏由出入境检验检疫机关填写

◆国家出入境检验检疫局制

[1-2 (2000.1.1)]

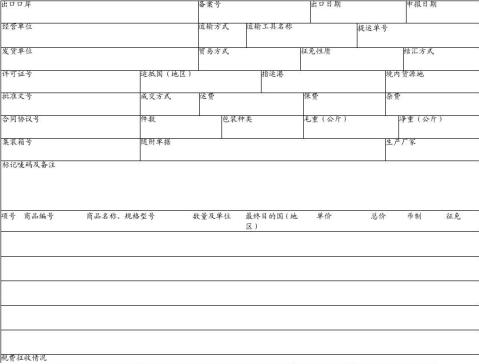

中华人民共和国海关出口货物报关单

预录入编号:

海关编号:

10

11

第二篇:国际结算课程实践报告规范

国际结算课程实践报告

一、实践任务和性质

本课程是与“国际结算”对应的实践课程。目的是通过模拟国际结算中的流通票据、国际结算的主要方式、国际结算中的单据,使学生掌握国际结算的基本知识,加强学生对所学专业理论知识的理解,培养实际操作的动手能力,提高运用国际结算基本技能的水平,也是对学生所学专业知识的一个综合检验。学生通过实验能为学习其它课程打好基础,并可以为学生毕业走上工作岗位后,缩短适应期,胜任工作奠定扎实的基础。

二、实践教学目的和要求

(一)实践教学目的

通过理论学习与上机实践相结合,使学生掌握国际贸易跟单,制单工作中关于结算方面的知识和技能;了解银行国际结算部门的相关操作流程和业务范围,要求学生理解和掌握国际结算的票据,国际结算的方式;能够运用所学的知识,进行国际结算的实际操作。选读并熟悉相关的国际惯例。

(二)实践要求

1、教师和学生都要严格遵守实习纪律。指导老师必须每天对学生进行考勤,同时进行业务指导,遇到问题及时反映,认真评定学生成绩;学生必须按规定的时间和内容进行课程实践,听从指导老师安排。学生迟到,早退,请假等按学院制度办理。凡不按要求参加课程实践的,或课程实践态度不端正的,其课程实践成绩将以不及格论处。

2、学生每次课程实践前应做好预习工作,熟悉国际结算相关理论知识,写好实验操作步骤提纲和注意点。在课程实践过程中,学生要完成课程实践相关练习,并在线提交。

3、课程实践结束时,以班级为单位,由各班班长在规定时间内将本班的课程实践报告、课程实践考勤登记册、课程实践心得体会等材料送到国贸教研室。各课程实践指导老师应及时批改课程实践报告,做好评语批注和成绩评定、上报、录入等各项工作。(注:每位同学独立完成一份课程实践报告,为了体现同学真正了解操作整个过程,我们要求学生每做完整一张单据,应将其截图,最终做成word文档。课程实践报告要求用A4纸统一打印,页面整洁。)

三、专周实践时间、内容

(一)时间:2011-2012学年第一学期(2011.09.19-2011.09.30)

(二)实践内容:以下内容在《硕研国际结算实验平台》上完成。

1、贸易商端国际结算业务汇款业务:汇款业务、托收业务、进口信用证业务、出口信用证业务

2、银行端国际结算业务:汇出汇款业务、汇入汇款业务、出口跟单托收业务、进口代收业务、光票托收、进口信用证、出口信用证

四、实践结果

(说明:以下从系统里把相应的表截图后粘贴到报告中,每个截图尽量要求不跨页,按如下顺序排序,同学生手册上顺序)

1

1贸易商端业务流程.......................................................

1.1汇款业务.............................................................

1.1.1汇出汇款申请 .....................................................

1.1.2汇款修改申请 .....................................................

1.1.3退汇申请 .........................................................

1.2托收业务.............................................................

1.2.1托收委托申请 .....................................................

1.2.2托收修改申请 .....................................................

1.2.3 代收拒付申请 ....................................................

1.2.4光票托收申请 .....................................................

1.3进口信用证业务.......................................................

1.1开证申请 ...........................................................

1.2信用证修改申请 .....................................................

1.4出口信用证业务.......................................................

1.4.1出口审证 .........................................................

1.4.2制单交单 ......................................................... 2银行端业务流程.........................................................

2.1汇出汇款业务.........................................................

2.1.1汇出汇款审核 .....................................................

2.1.2落实汇出资金 .....................................................

2.1.3汇出汇款登记 .....................................................

2.1.4电汇 .............................................................

2.1.5信汇 .............................................................

2.1.6票汇 .............................................................

2.1.7头寸偿付 .........................................................

2.1.8销账结卷 .........................................................

2.1.9汇出汇款查询 .....................................................

2.1.10汇出汇款修改 ....................................................

2.1.11撤汇通知 ........................................................

2.1.12撤汇解付结卷 ....................................................

2.2汇入汇款业务.........................................................

2.2.1汇入汇款通知 .....................................................

2.2.2汇入汇款登记 .....................................................

2.2.3汇入汇款审核 .....................................................

2.2.4解付结卷 .........................................................

2.3出口跟单托收业务.....................................................

2.1托收委托审核 ....................................................... 2

2.2托收登记 ...........................................................

2.3托收指示 ...........................................................

2.4托收修改 ...........................................................

2.5催收托收款 .........................................................

2.6收汇解付结卷 .......................................................

2.4进口代收业务.........................................................

2.4.1收单审核 .........................................................

2.4.2进口代收登记 .....................................................

2.4.3代收单到确认 .....................................................

2.4.4承兑交单 .........................................................

2.4.5付款交单 .........................................................

2.4.6拒承兑/拒付 ......................................................

2.5光票托收.............................................................

2.5.1托收委托审核 .....................................................

2.5.2光票托收 .........................................................

2.6进口信用证...........................................................

2.6.1开证审核 .........................................................

2.6.2开证登记 .........................................................

2.6.3收取保证金 .......................................................

2.6.4开立信用证 .......................................................

2.6.5到单审单 .........................................................

2.6.6来单登记 .........................................................

2.6.7到单通知 .........................................................

2.6.8付款结卷 .........................................................

2.6.9修改信用证 .......................................................

2.6.10承兑 ............................................................

2.6.11拒承兑/拒付 .....................................................

2.7出口信用证...........................................................

2.7.1来证登记 .........................................................

2.7.2信用证通知 .......................................................

2.7.3寄单登记 .........................................................

2.7.4出口审单 .........................................................

2.7.5寄单索汇 .........................................................

2.7.6收汇解付结卷 .....................................................

3

五、软件成绩

(将软件上个人的成绩截图下来)

六、心得体会

4

-

银行国际结算部实习感想

银行国际结算部实习感想当梦想照进现实,实习感想当梦想照进现实,理想遭遇磨砺,我可以被磨去的是棱角与稚气,不可以失去的是信仰和坚持。…

-

国际结算实训报告书

实训报告课程:国际计算专姓名(组员):年级班级:指导教师:20xx年x月x日[实训项目]*国际贸易结算方式操作及有关票据填写[实训…

-

国际结算实习心得实习报告

国际结算实习心得三个周末我们组6个同学一起在图书馆在自习室在宿舍查资料讨论分工填写实验报告共同完成了国际结算的实习在此期间我们不仅…

-

国际结算上机实验报告及心得体会

德州学院实验报告课程名称:国际结算实验班级:20xx级国际经济与贸易专科学号:***指导教师:***填写日期:20xx-11-28…

-

国际结算实训报告

国际结算实训报告实训时间20xx年11月15号11月24日实训地点腾飞楼A座经济管理系机房实训目的和意义国际结算作为一门科学是以国…

-

《国际结算实训》报告

《国际结算业务实训》实验报告专业:班级:学号:姓名:指导老师:1引言实习是专业教育的一个重要实践性教育环节,也给我们提供了一个走入…

-

国际结算报告

1引言随着国际贸易的迅速发展,国际结算在国际贸易中的地位日益上升。作为国贸专业的学生不仅要懂得贸易实务知识,还应了解国际结算操作流…

-

银行国际结算部实习感想

银行国际结算部实习感想当梦想照进现实,实习感想当梦想照进现实,理想遭遇磨砺,我可以被磨去的是棱角与稚气,不可以失去的是信仰和坚持。…

-

国际结算实训报告书

实训报告课程:国际计算专姓名(组员):年级班级:指导教师:20xx年x月x日[实训项目]*国际贸易结算方式操作及有关票据填写[实训…

-

国际结算实习报告

08金融吴时茂0865147144国际结算模拟实习报告一、引言随着中国在国际贸易的地位的不断上升,学习金融专业的我们要掌握有关于国…

-

国际业务学习个人总结

国际部实习小结20xx年x月初,我到滨海分行国际业务部学习国际结算。首先要感谢我行领导们给了我不断学习和锻炼的机会。下面我将这两周…