财务报告与分析:三友会计名著译丛 财务报表分析 第一章习题答案

Chapter 1

Introduction to Financial Reporting

PROBLEMS

PROBLEM 1-1

1. b 6. i

PROBLEM 1-2

1. o 6. e 11. h

PROBLEM 1-3

a. 2 Typically, much judgment and estimates go into

the preparation of financial statements.

b. 4 Financial accounting is not designed to measure

directly the value of a business enterprise.

The end result statements can be used as part of

the data to aid in estimating the value of the

business.

c. 4 FASB Statement of Concepts No. 2 lists

timeliness, predictive value, and feedback value

as ingredients of the quality of relevance.

d. 2 The Securities and Exchange Commission has the

primary right and responsibility for generally

accepted accounting principles. They have

primarily elected to have the private sector

develop generally accepted accounting principles

and have designated the Financial Accounting

Standards Board as the primary source.

e. 4 The concept of conservatism directs that the

measurement with the least favorable effect on

net income and financial position in the current

period be selected.

f. 3 The Internal Revenue Service deals with Federal

tax law, not generally accepted accounting

principles.

g. 5 Opinions were issued by The Accounting Principles Board.

第二篇:财务报告与分析:三友会计名著译丛 第07章习题答案

Chapter 7

Long-Term Debt-Paying Ability

PROBLEMS

PROBLEM 7?1

Earnings before interest and tax:

Net sales $1,079,143

Cost of sales ( 792,755)

Selling and administration ( 264,566)

$ 21,822

a.

b. Cash basis times interest earned:

PROBLEM 7?2

Recurring Earnings Excluding Interest

Expense, Tax Expense, Equity Earnings,

a. Times Interest Earned = and Minority Earnings

Interest Expense, Including

Capitalized Interest

Income before income taxes $675

Plus interest 60

Adjusted income $735

Interest expense $ 60

Times Interest Earned = $735 = 12.25 times per year

$60

b.

Adjusted income from (part a) $735

1/3 of operating lease payments

(1/3 x $150) 50

Adjusted income, including rentals $785

Interest expense $ 60

1/3 of operating lease payments 50

$110

Fixed Charge Coverage = $785 = 7.14 times per year

$110

PROBLEM 7?3

Recurring Earnings, Excluding Interest

Expense, Tax Expense, Equity Earning,

a. Times Interest Earned = and Minority Earnings________________

Interest Expense, Including

Capitalized Interest

Income before income taxes and

extraordinary charges $36

Plus interest 16

(1) Adjusted income 52

(2) Interest expense $16

Times Interest Earned: (1) divided by (2) = 3.25 times per year

Recurring Earnings, Excluding Interest

Expense, Tax Expense, Equity Earnings,

and Minority Earnings + Interest Portion

b. Fixed Charge Coverage = Of Rentals______________________________

Interest Expense, Including Capitalized

Interest + Interest Portion Of Rentals

Adjusted income (part a) $ 52

1/3 of operating lease payments

(1/3 x $60) 20

(l) Adjusted income, including rentals $72

Interest expense $16

1/3 of operating lease payments 20

(2) Adjusted interest expense $36

Fixed charge coverage: (1) divided by (2) = 2.00 times per year

PROBLEM 7?4

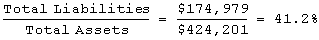

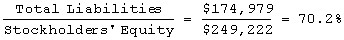

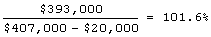

a. Debt Ratio =

b. Debt/Equity Ratio =

c. Ratio of Total Debt to Tangible Net Worth =

Total Liabilities = $174,979 = $174,979 = 70.9%

Tangible Net Worth $249,222 ? $2,324 $246,898

d. Kaufman Company has financed over 41% of its assets by the use of funds from outside creditors. The Debt/Equity Ratio and the Debt to Tangible Net Worth Ratio are over 70%. Whether these ratios are reasonable depends upon the stability of earnings.

PROBLEM 7-5

PROBLEM 7?6

a. Times Interest Earned:

Times interest earned relates earnings before interest expense, tax, minority earnings, and equity income to interest expense. The higher this ratio, the better the interest coverage. The times interest earned has improved materially in strengthening the long?term debt position. Considering that the debt ratio and the debt to tangible net worth have remained fairly constant, the probable reason for the improvement is an increase in profits.

The times interest earned only indicates the interest coverage. It is limited in that it does not consider other possible fixed charges, and it does not indicate the proportion of the firms resources that have come from debt.

Debt Ratio:

The debt ratio relates the total liabilities to the total assets.

The lower this ratio, the lower the proportion of assets that have been financed by creditors.

For Arodex Company, this ratio has been steady for the past three years. This ratio indicates that about 40% of the total assets have been financed by creditors. For most firms, a 40% debt ratio would be considered to be reasonable.

The debt ratio is limited in that it relates liabilities to the book value of total assets. Many assets would have a value greater than book value. This tends to overstate the debt ratio and, therefore, usually results in a conservative ratio. The debt ratio does not consider immediate profitability and, therefore, can be misleading as to the firm’s ability to handle long?term debt.

Debt to Tangible Net Worth:

The debt to tangible net worth relates total liabilities to shareholders' equity less intangible assets. The lower this ratio, the lower the proportion of tangible assets that has been financed by creditors.

Arodex Company has had a stable ratio of approximately 81% for the past three years. This indicates that creditors have financed 81% as much as the shareholders after eliminating intangibles from the shareholders contribution??for most firms, this would be considered to be reasonable. The debt to tangible net worth ratio is more conservative than the debt ratio because of the elimination of intangible items. It is also conservative for the same reason that the debt ratio was conservative, in that book value is used for the assets and many assets have a value greater than book value. The debt to tangible net worth ratio also does not consider immediate profitability and, therefore, can be misleading as to the firm's ability to handle long?term debt.

Collective inferences one may draw from the ratios of Arodex, Company:

Overall it appears that Arodex Company has a reasonable and improving long?term debt position. The debt ratio and the debt to tangible net worth ratios indicate that the proportion of debt appears to be reasonable. The times interest earned appears to be reasonable and improving.

The stability of earnings and comparison with industry ratios will be important in reaching a conclusion on the long?term debt position of Arodex Company.

b. Ratios are based on past data. The future is what is important, and uncertainties of the future cannot be accurately determined by ratios based upon past data.

Ratios provide only one aspect of a firm's long-term debt-paying ability. Other information, such as information about management and products, is also important.

A comparison of this firm's ratios with ratios of other firms in the same industry would be helpful in order to decide if the ratios are reasonable.

PROBLEM 7?7

Recurring Earnings, Excluding Interest

a. 1. Times Interest Expense, Tax Expense, Equity Earnings,

Earned = and Minority Earnings_________________

Interest Expense, Including

Capitalized Interest

$162,000 = 8.1 times per year

$ 20,000

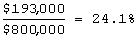

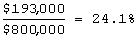

2. Debt Ratio = Total Liabilities

Total Assets

$193,000 = 32.2%

$600,000

3. Debt/Equity Ratio = Total Liabilities

Stockholders' Equity

$193,000 = 47.4%

$407,000

4. Debt to Tangible Net Worth Ratio = Total Liabilities

Tangible Net Worth

$193,000 = 49.9%

$407,000 ? $20,000

b. New asset structure for all plans:

Assets

Current assets $226,000

Property, plant, and

equipment 554,000

Intangibles 20,000

Total assets $800,000

Liabilities and Equity

Plan A

Current Liabilities $ 93,000 $200,000,000/100 =

Long?term debt 100,000 2,000,000 shares

Preferred stock 250,000

Common equity 357,000 No change in net income

$800,000

Plan B

Current liabilities $ 93,000 $200,000,000/10 =

Long?term debt 100,000 20,000,000 shares

Preferred stock 50,000

Common stock 120,000

Premium on common stock 300,000

Retained earnings 137,000 No change in net income

$800,000

Plan C

Current liabilities $ 93,000 Operating Income $162,000

Long?term debt 300,000 Interest expense 52,000*

Preferred stock 50,000 110,000

Common equity 357,000 Taxes (40%) 44,000

$800,000 Net Income $ 66,000

* $20,000 + 16% ($200,000) = $52,000

1. Recurring Earnings, Excluding Interest Expense,

Times Interest Tax Expense, Equity Earnings, and Minority Earnings

Earned = Interest Expense, Including Capitalized Interest

Plan A Plan B Plan C

2. Debt = Total Liabilities

Ratio Total Assets

Plan A Plan B Plan C

3. Debt/Equity Ratio =

Plan A Plan B Plan C

4. Debt to Tangible Net Worth =

Plan A Plan B Plan C

c. Preferred Stock Alternative:

Advantages:

1. Lesser drop in earnings per share than under the common stock alternative.

2. Not the absolute reduction in earnings that accompanied the debt alternative.

3. There would be an improvement in the Debt Ratio, Debt/Equity Ratio, and Total Debt to Tangible Net Worth Ratio.

4. Does not have the reduced times interest earned that accompanied alternative of issuing long?term debt.

Disadvantages:

1. An increase in the fixed preferred dividend charge that the firm must pay before any dividends can be paid to common stockholders.

Common Stock Alternative:

Advantages:

1. No increase in fixed obligations.

2. There would be an improvement in the Debt Ratio, Debt/Equity Ratio, and the Total Debt to Tangible Net Worth Ratio.

3. Not the absolute reduction in earnings that accompanied the debt alternative.

4. Does not have the reduced times interest earned that accompanied alternative of issuing long?term debt.

Disadvantages:

1. Maximum dilution in earnings per share of the three alternatives.

Long-Term Bonds Alternative:

Advantages:

1. Higher earnings per share than with common stock.

Disadvantages:

1. Material decline in Times Interest Earned.

2. A material increase in the Debt Ratio, Debt/Equity Ratio,

and Total Debt to Tangible Net Worth Ratio.

3. Absolute reduction in earnings.

4. Increase in the interest fixed charge that must be paid.

d. The 10% preferred stock increased the preferred dividends which are not tax deductible; therefore, the cost of these funds is the 10% amount. The 16% bonds are tax deductible and, therefore, the after-tax cost is 9.6% (16% x (1?.40).

Note to Instructor: You may want to take this opportunity to point out to the students that the alternative that should be selected is greatly influenced by the change in earnings and the specific debt structure. The conclusions in this problem would not necessarily be true with changed assumptions.

PROBLEM 7?8

a. Times Interest Earned =

Earnings from continuing operations before

income taxes and equity earnings

(1) Add back interest expense (1) $ 74,780,000

(2) Adjusted earnings (2) $ 37,646,000

$112,426,000

Times interest earned: [(2) divided by (1)] 1.99 times

per year

b. Earnings from continuing operations

Plus:

(1) Interest $ 65,135,000

Income taxes 37,394,000

(2) Adjusted earnings $140,175,000

Times interest earned: [(2) divided by (1)] 3.72 times

per year

c. Removing equity earnings gives a more conservative times interest earned ratio. The equity income is usually substantially more than the cash dividend received from the related investments. Therefore, the firm cannot depend on this income to cover interest payments.

PROBLEM 7?9

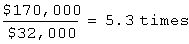

a. 1. Times Interest Earned =

2. Debt Ratio =

3. Debt Equity =

4. Debt to Tangible Net Worth =

b. No, Barker Company has a times interest earned of 5.3 times while the industry average is 7.2 times. This indicates that Barker Company has less than average coverage of its interest. Also, Barker Company has a much higher than average debt/equity, and debt to tangible net worth ratio.

c. Allen Company has a better times interest earned, debt ratio, debt/equity, and debt to tangible net worth.

PROBLEM 7-10

a. 1. Times Interest Earned =

2004: $280,000 - $156,000 = 7.29 times per year

$17,000

2003: $302,000 - $157,000 = 9.06 times per year

$16,000

2002: $286,000 - $154,000 = 8.80 times per year

$15,000

2001: $270,000 - $150,000 = 8.28 times per year

$14,500

2000: $248,000 - $147,000 = 4.39 times per year

$23,000

Recurring Earnings, Excluding

Interest, Tax Expense, Equity

Earnings, and Minority Earnings +

2. Fixed Charge Coverage = Interest Portion of Rentals

Interest Expense, Including

Capitalized Interest + Interest

Portion of Rentals

2004: $280,000 - $156,000 + $10,000 = 4.96 times per year

$17,000 + $10,000

2003: $302,000 - $157,000 + $9,000 = 6.16 times per year

$16,000 + $9,000

2002: $286,000 - $154,000 + $9,500 = 5.78 times per year

$15,000 + $9,500

2001: $270,000 - $150,000 + $10,000 = 5.31 times per year

$14,500 + $10,000

2000: $248,000 - $147,000 + $9,000 = 3.44 times per year

$23,000 + $9,000

3. Debt Ratio = Total Liabilities

Total Assets

2004: $88,000 + $170,000 = 46.07%

$560,000

2003: $89,500 + $168,000 = 46.48%

$554,000

2002: $90,500 + $165,000 = 46.14%

$553,800

2001: $90,000 + $164,000 = 46.31%

$548,500

2000: $91,500 + $262,000 = 65.83%

$537,000

4. Debt/Equity = Total Liabilities

Shareholders' Equity

2004: $88,000 + $170,000 = 85.43%

$302,000

2003: $89,500 + $168,000 = 86.85%

$296,500

2002: $90,500 + $165,000 = 85.65%

$298,300

2001: $90,000 + $164,000 = 86.25%

$294,500

2000: $91,500 + $262,000 = 192.64%

$183,500

5. Debt to Tangible Net Worth = Total Liabilities

Shareholders' Equity -

Intangible Assets

2004: $88,000 + $170,000 = 91.49%

$302,000 - $20,000

2003: $89,500 + $168,000 = 92.46%

$296,500 - $18,000

2002: $90,500 + $165,000 = 90.83%

$298,300 - $17,000

2001: $90,000 + $164,000 = 91.20%

$294,500 - $16,000

2000: $91,500 + $262,000 = 209.79%

$183,500 - $15,000

b. Both the times interest earned and the fixed charge coverage are good. The times interest earned is substantially better than the fixed charge coverage because of the operating leases. Both of these ratios materially declined in 2004.

The debt ratio, debt/equity, and debt to tangible net worth materially improved between 20## and 2001. During the period 20##-2004, these ratios were relatively steady and appeared to be good. The debt to tangible net worth ratio is not as good as the debt/equity ratio because of the influence of intangibles.

-

财务报表分析心得

本学期我们专业学习了《财务报告解读与分析》这门课程,在这门课程中我也得到了不少体会与感悟:第一,我对财务报告解读与分析的看法。财…

-

财务报告分析心得体会

姓名:黄海燕班级:10市场营销(1)班学号:1001103031在对财务报告分析这门功课的学习过程中,我们知道了财务报告分析是一门…

-

财务报告分析_学习总结_学习心得

读财务报告分析有感姓名班级双管1101学号20xx152学院历史与文化产业学院读财务报告分析有感一未接触财务管理课程的肤浅感知这学…

-

财务分析心得与体会

姓名刘美玲学号20xx220xx21055任课老师高文亮20xx年6月9财务分析心得与体会日财务报告分析心得体会随着大部分的课的结…

-

财务报表分析报告(案例分析)

财务报表分析一、资产负债表分析(一)资产规模和资产结构分析单位:万元1、资产规模分析:从上表可以看出,公司本年的非流动资产的比重2…