广东发展银行授信报告(沃得)

广东发展银行授信报告

Guangdong Development Bank Credit Application

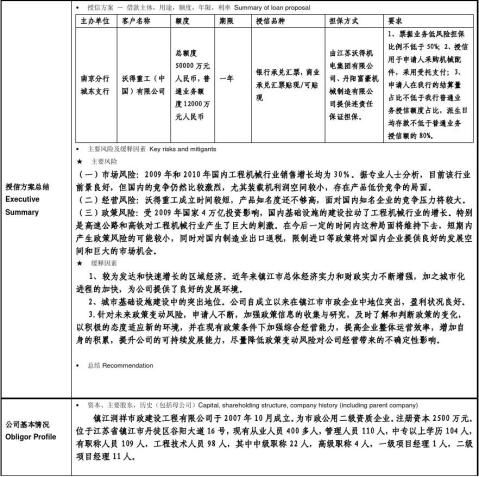

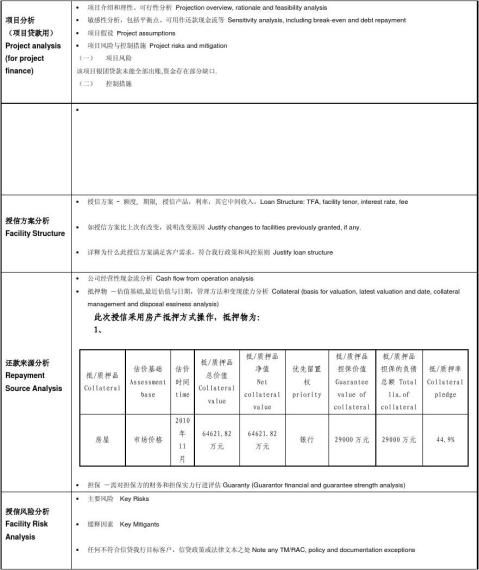

授信客户名称:沃得重工(中国)有限公司 呈报单位:南京分行城东支行 主控行: 南京分行城东支行 日期: Date 23/3/2011 授信种类: 银行承兑汇票额度 金额: TFA 人民币50000万元 期限: Tenor 一年

评级:7级(待审核) 分类: Classification 担保方式:Guaranty 保证担保、抵押 抵押物:Collateral 房屋所有权 审批级别要求:分行部门负责人/分行行长/审批中心/首席信贷官/首席风险官

Approval level required: Branch Department/Branch President/Hub/Head Office CCO/CRO 特别事项说明:Special Notes

1

2

3

4

5

6

第二篇:广东发展银行

19xx年9月,经国务院和中国人民银行批准,

广东发展银行作为中国金融体制改革的试点银行在美丽的珠江之畔成立,是国内最早组建的股份制商业银行之一。

广东发展银行是经国务院和中国人民银行批准组建、于 1988 年 9 月成立的股份制商业银行,目前注册资本为人民币 114.08 亿元,总部设在中国广州市。截止20xx年12月末,广东发展银行资本净额343亿元(人民币,下同),资产总额6665亿元,本外币各项存款余额5439亿元,各项贷款余额3809亿元。根据英国《银行家》杂志对全球 1000 家大银行排定的位次,广东发展银行连续四年入选全球银行 500 强。

信用卡:

基本介绍

19xx年3月,国内信用卡持有者第一次听到了“全额挂失前48小时失卡保障”的承诺。而推出这一举措的中资发卡机构,正是12年前发出中国第一张真正意义上信用卡的银行——广东发展银行。透过这两个“第一”,以及跨越12年的不断探索和努力,便不难看清从无到有、且竞争日益激烈的中国信用卡市场上,扎扎实实、贯穿始终的一条“广发信用卡”发展之路。

20xx年5月,国内第一张以奥运为主题的信用卡——“千禧奥运信用卡”问世。广发以敏锐的市场触觉,抓住“千禧”时机,针对国人对中国体育健儿拼搏精神的强烈认同,以及高端消费群体出国观看奥运比赛的需求,推出中国首张同时具有纪念意义和使用价值的奥运主题信用卡,也是国内银行最早以市场为导向并进行主动营销发行的信用卡。

20xx年,广发信用卡再掀业内新品高潮,国内最早的女性专属信用卡“真情卡”面世。广发经过长期调研发现,随着社会发展,越来越多的女性成为生产和消费的主力。为满足女性群体日益强烈的消费、理财需求,广发卡推出了一系列专为女性量身设计的信用卡。真情卡引进当时亚洲最新的透明卡版设计,同时整合知名女性商户品牌,提供专享折扣优惠,真正兑现了“广发真情卡,真爱女人”的承诺。20xx年7月,真情卡获得万事达卡国际组织颁发的“亚太区最佳女性卡项目奖”。

“样样行”免息分期付款业务,突破了信用卡分期付款指定产品或商户的局限,用户只要单笔刷卡消费500元或以上,即可不限商品、不限商户地分6期、12期、18期、24期免息分期偿还,无需支付利息,仅需支付极少的手续费,真正实现了“随时随地、样样能分”。

预借现金,是信用卡的又一基本功能,为客户资金周转及应付突发事件提供了支持。但出于风险控制考虑,国内发卡银行给予客户的预借现金额度普遍偏低,并不能完全满足客户的现金使用需求。为解决这一问题,广发对优质客户进行提现额度提升,最高可达刷卡消费额的100%,使客户更进一步体验到信用卡的便利性。

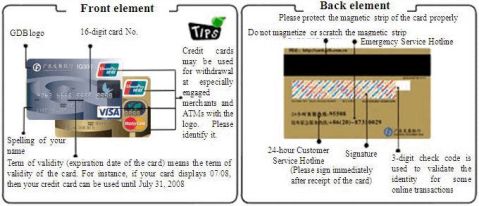

Tips for card use用卡常识

Protect the magnetic strip of bankcard

The magnetic strip of the bankcardbankcard records and stores your data. If the data on the strip diminish, change or lose, such terminal equipment as POS and ATM may not be able to read the correct card information when you use the card and may cause transaction failure. Therefore, you had better put the bankcardbankcard in wallets with thick leather and do not place it too close to the magnetic button. Never put it in bags with mixed and disorderly items to prevent the magnetic strip being torn, scraped, twisted or broken by sharp items. Meanwhile, you had better not put a number of bankcardbankcards together. Never put two bankcardbankcards together with their backs towards each other which may cause the magnetic strips to rub and collide against each other. Put the bankcard as far away from such electric appliances as electromagnetism stove, microwave oven, TV and refrigerator as possible. Also, do not place the bankcard together with the cell phone, computer, lap top, magnet, Wenquxing, e-commerce and other magnetic items. If your bankcard is damaged, the correct handling is to cut the card, mail by registered mail or deliver it to the card issuing bank. Mark the card with ―card damaged‖ so that a new credit card will be issued.

How to keep the credit card

An exquisite GDB Card not only brings convenience to your life, but also symbolizes your identity. How to properly keep your credit card is the first step for you to become a fashionable Cardholder. While going out, do not put all bankcards in the same bag. In public places where the overcoat must be left, do not put wallets containing credit cards into the pocket of such overcoat and do not put them in the car or locker either. Carry them with you. Any loss may cause big problems. Credit cards which are not used temporarily must be put into locked drawers or cabinets. Never put them randomly to prevent them from being used by others. You will be responsible for improper keeping of the card which may cause loss of your money. To prevent the bankcard from loss and being used by others, it is suggested that you put your bankcard, password and ID card separately. Never show off your credit cards. Never tell others your credit card No. and expiration date to prevent them from being used by those who have ulterior motives. Do not lend your card to others. Otherwise, it is extremely likely that your card be retained by the bank, be

suspended from payment, incur loss, or even cause debt disputes. Also, do remember to copy the card No. and the service hotline of the issuing bank separately and keep them properly so that you can contact the card issuing bank as soon as possible in case of accidents to prevent loss

Enough credit line is the best limit

The credit line of the credit card is related to your credit status. A real credit card has the function of credit

consumption and obtaining the loan. If you have a stable job or high academic credentials, or hold a certain post, we may give you a high credit line. If you want to apply for or increase the credit line, you must provide the personal asset certification such as property certification, share holding certification, deposit certification, deposit of security money, which may help in increasing your credit line. However, please note that the excessive credit line which you are unlikely to use may cause trouble to you. Once the credit card or card No. is stolen, it leaves a big opportunity to the lawless person. Therefore, ―Enough credit lineline is the best limit!‖. If you have an excessive credit line at present, please contact us to lower your credit line. After the limit is lowered, if you have any large-amount

consumption, you may still contact us before such consumption or before going abroad to apply for increasing your credit line.

Usage in hotels

Booking hotel rooms is different from the general consumption. The hotel usually will require you to provide the credit card No. as the evidence for room reservation and will give you the reservation No. for check-in confirmation purpose. If you want to cancel the reservation, do remember to ask for the cancellation No. from the hotel as the reservation canceling evidence. Otherwise, the hotel shall have the right to charge the cost for the reserved room for one day according to the international practices. When you check in, the hotel will require you to swipe the card for a blank bill first. A lot of domestic hotels will ask for the pre-authorization from the card issuing bank via POS or manually. If the hotel requires signature, you may sign on the back of the card receipt. When you check out, the hotel will fill in the card receipt with all the accommodation-related costs. Please sign the card receipt for confirmation only after you have verify that all such costs are correct. If you want to use cash or for some reason need to change the bill during check-out, please ask for returning the original bill and destroy it. If the hotel has obtained the pre-authorization from the card issuing bank, ask the hotel to cancel it in order to protect your interests and rights.

How to prevent cards being retained by ATMUsage in hotels

When you conduct any transaction in the ATM, your bankcard may be retained by the machine due to improper

operation, damaged magnetic card or ATM failure, which may cause you trouble. Therefore, please confirm whether the magnetic strip of your card is damaged or whether your card has expired. If yes, please contact the card issuing bank to replace with a new card. Do not use the card, or it may be retained. The credit card will be retained if the number of wrong password inputs exceeds the specified limit (normally 3 times). Therefore, keep your password properly and memorize it. If you forget to take out your card after you finish operation on the ATM, the card will be retained in 30 seconds. Therefore, do remember to take out your card in time after the transaction is over. Once your card is retained, keep the receipt for card retaining. Carry your valid certification and contact the relevant outletoutlet of the bank in time to get back the card. Meanwhile, apply for changing the password of the card.

“Slim” your bankcards

As the government and banks make efforts in promoting the use of cards in consumption, more and more people are holding bankcards. Some people are like collectors of bankcards, because their wallets contain a number of various cards. When asked why, they will tell you these cards have different purposes: withdrawing money from ATM,

withholding housing loans, withholding water and electricity fees, salary payment…. It seems each card is necessary. As a result, the packet becomes heavier and heavier. Superficially, multiple cards bring you convenience. Actually, it is not good for managing your personal funds. First of all, holding bankcards of different banks may cause scattering

of your funds. Secondly, you have to hurry back and forth in different banks in case of account checking, card replacement and loss reporting, which wastes a lot of time and energy. Moreover, too many credit cards not only increase the annual fees, but also increase the risk of your excessive consumption and loss of the credit card. So it is time to ―slim‖ your cards in order to protect the rights and interests of you and the bank! First, sort out the bankcards of different purposes. Try to integrate the functions of multiple cards. For example, when you apply for the credit card, you may select the salary payment bank so that you can use the salary card for automatic repayment, which saves a lot of efforts. Leave the withholding of water, electricity and coal fees to the bank which handles the housing loan so that you understand your monthly fixed expenses fully at just one glance of the bank statement! Secondly, of your cards issued by different banks, you may select one that best suits you based on your actual conditions after

comprehensive comparison. If you go abroad often, then a dual-currency credit card will be your best choice. If your job seldom requires traveling, then apply for a bankcard with multiple functions and considerate services. If you are a ―net potato‖ who likes to stay indoors and fixes everything on the net, then a bankcard with comprehensive online banking functions is just customized for you! Finally, if some of your cards are ―sleeping cards‖ which are no longer used, go to the bank to cancel them in time. In this way, your bankcards are thoroughly ―slimmed‖, and only 2-3 cards with comprehensive functions are customized for you, which not only increases your efficiency in managing your personal funds, but also makes you worriless about fees charged on the bankcards.

Service hotlines for GDB Card

GDB Card 24-hour customer service hotline: 95508

GDB Platinum Card VIP service line: 800-830-8848

GDB Platinum Card 24-hour Emergency Service hotline: 020-34198221

GDB business and finance contact person VIP hotline: 020-87311462 020-87311463

GDB Business Card holder 24-hour customer service hotline: 4008195508

In addition, we may also contact you via the following No.s in order to provide you with good service:

020-28295508, 021-61195508, 020-83995508 二.广发卡重点功能介绍

1、人民币信用卡

按品牌不同分VISA卡和MasterCard卡,在国内用卡环境中二者差别不大,客户可根据个人喜好进行选择。

(1)国内首张标准信用卡,预设信用额,提供―先消费后还款‖服务,消费免息还款期最长可达50天,刷卡签账时无需输入密码。

(2)申请手续简单快捷,无须担保人,无须备用金。

(3)还款方式灵活,可全额还清,亦可选择最低还款额,尽享循环信用,理财更自如。

(4)报失即时生效,失卡零风险,最大限度地保障持卡人利益。

(5)在广州等城市可办理本、外币同城跨行转账缴款,资金在2个工作日内到账。

(6)刷卡消费可免费累计积分,凭此换领或按超值价换购精美礼品。

(7)凭广发卡在本行特约优惠商户消费、专享折扣或优惠服务。

(8)带有―银联‖标识,全国通行。

Introduction to Key Functions

RMB Credit Card

According to the brands, they can be divided into VISA cards and Master cards. In the domestic card-using environment, the differences between the two cards are not distinct. Customers can choose according to individual taste.

1.With the preset credit line,the first standard credit card in the country provides the service of―first consumption then repayment‖with the interest-free repayment period for the consumption up to 50 days. The cardholder is not required to enter the password when signing the bill after swiping the card.2. The application formalities are simple, fast, and convenient.No guarantor and funds of disbursement is required.3.The repayment form is flexible. The cardholder can repay in full,or repay the lowest repayment amount, enjoying the circulative credit,and managing the money more freely.4. The loss reporting comes into force instantly,so there is no risk in case of loss of the credit card,and the interests of the cardholders can be guaranteed to the largest extent.5.In cities such as Guangzhou,card holders can transfer money into an inter-bank account or make inter-bank payments in the same city with the domestic currency or a foreign currency, and the fund can be received in two working days.6.Reward points can be accumulated on consumption by swiping the card. With the scores, the cardholder can get exquisite gifts with the scores free of

additional charge or buy products at favorable prices.7. A holder of the GDB Card is entitled to discounts or

preferential services on consumption in special favorite merchants of our bank.8.With the logo of China UnionPay, the card can be used all over the country.

International credit cards

According to the brands, they can be divided into VISA cards and Master cards. Customers can choose

according to individual taste.

--A holder of the GDB international VISA card can use the card for consumption in more than 22 million favorite

merchants with the VISA logo, and can withdraw local currencies at any time from more than 700,000 ATMs with the VISA or PLUS logo and more than 21 million banks as members of the VISA organization and their counters.

-- A holder of the GDB international Master card can use the card for consumption in more than 29,600,000 favorite merchants with the Master-Card logo, withdraw money from cash withdrawal points with the Master-Card logo,and withdraw local currencies at any time from more than 800,000 ATMs.

1. The international can be used all over the world, and the holders can enjoy the service of ―overseas consumption and repayment with RMB‖.2.24-hour global emergency support service is provided to holders of the international card,including urgent change of card, urgent fund withdrawal, loss reporting,direction on ATM public announcement, medical consultation, and other guidance service.3.In case of consumption in Hong Kong area with the HKD card, the settlement is made with HKD, thus exchange loss can be avoided.4.The half-year international card (VISA card) is the best choice for short-term overseas travels and business trips.5.The objectives of the GDB Foreign Currency Platinum Card are the well-known figures of all circles with high consuming capacity and a lot of chances to go abroad.

Holders of the platinum cards are entitled to especially-designed honorable and individualized services, which show the noble identity of the cardholders.

2、国际信用卡

按品牌不同分VISA卡和MasterCard卡,客户可根据个人喜好进行选择。

-广发国际VISA卡可在2200多万家有VISA标志的特约商户消费,70多万台有VISA或PLUS标志的自动柜员机及2100多万家VISA会员银行及属下专随时提取当地货币。

-广发国际MasterCard卡可在2960多万家有Master-Card标志的特约商户消费和现钞提款点提款,在80多万台自动员机随时提取当地货币。

(1)具有人民币卡的所有突显优势。

(2)国际卡全球通用,并可享受―境外消费,人民币还款‖服务。

(3)为国际卡提供24小时全球应急支援服务,包括:紧急换卡、紧急提款、报失、ATM公布导向、医疗咨询及其他指引服务。

(4)用港币卡在香港地区消费以港币结算,避免汇兑损失。

(5)半年期国际卡(VISA卡)是短期出国旅游和公干的最佳选择。

(6)―广发外汇白金卡‖发卡目标对象为消费能力强、出境机会多的各界知名人士。

白金卡持卡人可享受专门设计的尊贵而个性化的服务,尽显持卡人崇高身份。

一、广发卡简介

1.品牌诠释

广发卡是广东发展银行于19xx年发行的国内第一张真正意义上的信用卡,也是第一张实现盈利的信用卡。广发卡一直秉持―给您更多,为您看更远‖的服务理念,以客户需求为导向,以创新和市场细分领跑于中国信用卡市场。截至20xx年9月,发卡量已突破700万张,形成了鲜明的―质‖和―量‖同步发展的―广发卡模式‖,成为信用卡领域知名品牌。广发卡先后获得 ―世界/中国最值得信赖的十佳银行卡‖ 、―银联标准信用卡市场拓展奖‖、―亚太最佳客户服务奖‖等殊荣。 Description of the Brand

GDB Card is the first credit card in its true sense in the country issued by GDB in 1995, and also the first credit card

that made profits. GDB Card has always adhered to the service philosophy of "providing more to you, and seeing further for you", and has been taking the lead in innovation and market subdivision directed by customer requirements in the credit card market of China. Until Sep. 2008, the number of issued credit cards has topped seven million. A distinctive "GDB Card Mode" with synchronous development of quality and quantity has been formed, and GDB Card has become a famous brand in the credit card field. GDB Card has successively won special honors such as one of the "Top 10 Most Credible BankCards in the World/China", the "Market Development Award of China UnionPay Standard Credit Card", and the "Best Customer Service Award in Asia-Pacific".

2.功能简介

广发信用卡是国内首张标准信用卡。卡片按照国际标准预设信用额,先消费,后还款,无须预存款,可使用信用额度进行透支消费、提现交易。透支消费享有的免息期最长可达50日,只须在银行规定的还款到期日前全额还款,即可享受到从交易发生日起至还款到期日为止的免息待遇。还款方式灵活,可全额还清,亦可选择最低还款额,尽享循环信用,理财更自如。

全国联网、世界通行

广发卡可在国内有―中国银联‖标识或与本行联网的10万多家商户消费及在37000多台自动柜员机上提取现金。广发外币卡和双币卡更可在全球300多个国家和地区使用;广发人民币卡可在境外有―中国银联‖标识的商户消费及在自动柜员机上提取当地货币。

消费优惠计划

定期推出―积分奖励计划‖和―商户优惠计划‖,让分分消费均有回报,同时享受到专有的折扣优惠,每逢节日,更奉上精彩优惠专案,令阁下双重获利。

邮购免息分期付款服务

广发卡以实惠的价格为您提供优质的产品,更为客户提供最长12个月的免息分期付款,几千元的产品,每月只需付款几百元即可享有,让您的梦想提早实现。

瞬时通

开通―瞬时通‖,用卡交易即时短信通知,用卡安全倍添放心。

全额挂失前48小时失卡保障

银行为客户提供的用卡安全保障,客户在一定范围内无须承担挂失前48小时内的信用卡被盗用损失,保障金额高达信用额全额!点击这里了解《广发卡挂失前48小时失卡保障功能》。

24小时优质客户服务

为广发卡客户专设24小时全年不间断的服务热线95508或+(86)20-87310029,提供更快捷及更贴心的服务。在线服务内容包括:广发卡业务介绍、账单查询、客户优惠信息、广发卡开通、信用额度调整、在线即时挂失、资料修改、积分礼品换领等,只需拨通电话即可妥善处理客户对广发卡的各种用卡需要。

便捷商旅服务

只需致电24小时服务热线800-820-6666,报出广发卡卡号,即可预订酒店,更可刷卡购机票,免费送票上门,并享有众多折扣优惠。

2.Brief Introduction of Functions

GDB Credit Card is the first standard credit card in the country. The credit line is preset for the card according to international standards. The cardholders consume first and then repay the fund. No pre-deposit is required.

Overdrawn consumption and cash withdrawal are available according to the credit line. The interest-free period for overdrawn consumption can be up to 50 days. In case a cardholder repays in full before the maturity date according to the stipulations of our bank, he/she is entitled to the interest-free treatment from the date of the transaction to the maturity date. The repayment form is flexible. The cardholder can repay in full, or repay the lowest repayment amount, enjoying the circulative credit, and managing the money more freely.

Nationwide Network, Universal around the World

A GDB Card holder can use the card for consumption in more than 100,000 domestic merchants with the logo of China UnionPay or connected to the same network as that of our bank and withdraw cashes from more than 37,000 ATMs. GDB foreign-currency cards and dual-currency cards can be used in more than 300 countries and areas in the world; GDB RMB card holders can use the card for consumption in overseas merchants with the logo of China UnionPay and can withdraw local currencies from ATMs.

Preferential Program for Consumption

"Reward Point Program" and "Preferential Program of Merchants" are regularly launched. Each sum of consumption is rewarded. In addition, cardholders are entitled to special discounts. Every festival, special wonderful and preferential program is offered, doubly benefiting Your Excellency.

Interest-Free Installment Payment Service for Mail-Orders

GDB Card provides high-quality products to customers at economic prices, and provides to customers the

interest-free installment payment service of up to 12 months. You can pay RMB several hundreds only for owning a product valued at RMB several thousands, so your dream can come true in advance.

Instant Notice

With the "immediate notice" function, transactions with the cards are notified instantly with short messages, thus improving the safety in the use of cards, and making customers rest assured.

Full-Amount Security Guarantee against Card Loss 48 Hours before Loss Reporting

It is the security guarantee provided by our bank to the customers during the use of the cards. A customer does not need to bear the loss within 48 hours before the loss reporting in a certain scope in case the credit card is stolen, and the guaranteed amount is up to the full amount of the credit line. Click here to know details of the GDB Card Security Guarantee Function against Card Loss 48 Hours before Loss Reporting.

24-Hour High-Quality Customer Service

and faster and more considerate services can be provided. On-line services include introduction of GDB Card services, inquiry about bills, information about preferential treatment to customers, startup of a GDB Card,

adjustment of the credit line, on-line instant loss reporting, modification of data, and claim of gifts with reward points, etc. A customer only needs to dial the telephone No.s, and various requirements in the use of the GDB Cards can be properly handled.

Convenient and Fast Services for Traveling Merchants

A customer can book a room in a hotel or buy air tickets by swiping the card. He/she simply needs to dial the 24-hour service hotline 800-820-6666 and tell the operator the No. of the GDB Card. The air tickets can be sent to the customer free of charge. In addition, he/she is entitled to numerous discounts.

3.辉煌历程 ? 20xx年6月12日,广东发展银行与中国银联合作推出了我国第一张以文字为主题的信用卡产品——广发文字

信用卡。作为一份特殊的藏品,首张广发文字卡已于当日正式入藏中国文字博物馆,届时将与众多珍贵的文字文物一起对外展示。

? 20xx年3月7日,在南都周刊首届金信奖评选中,广发真情卡获最佳女性信用卡;广发希望卡获最佳慈善信

用卡;广发白金卡获最值得珍藏信用卡,共三项大奖。

20xx年2月19日,在时代周报组织的营销圣典活动中,广发希望卡荣获―2008十大营销事件‖。

20xx年1月18日,广发爱狗卡获得第二届华夏理财总评榜金蝉奖年度最具创意设计信用卡奖项。 ? ?

? 20xx年1月8日、9日,广东发展银行京、沪媒体年度答谢晚宴分别在北京万达索菲特酒店和上海喜来登由

由酒店隆重举行。晚宴中,林文和副行长宣布广发信用卡发行量将近800万张。

20xx年1月8日,广发卡荣获20xx年度银行卡同业建设成果奖——―银联标准信用卡市场拓展奖‖。

20xx年1月8日,由深圳特区报主办的第二届深圳金融风云榜荣誉榜中,希望卡荣获―最佳公益慈善奖‖。 On Mar. 7, 2009, in the first session of Golden Credit Card Award of Southern Metropolis Weekly, Lady ? ? ?

Card was appraised as the Best Lady's Credit Card, GDB Hope Card was appraised as the Best Charity Credit Card, and GDB Platinum Card was appraised as the Most Collectable Credit Card. GDB won totally three awards of credits cards.

? On Feb. 19, 2009, in the grand ceremony of marketing organized by Time Weekly, the GDB Hope Card

won the title as one of the "Top 10 Marketing Event in 2008".

On Jan. 18, 2009, the GDB Pet Card won the Award of Credit Card of the Most Creative Design of the Year in the 2nd session of Golden Cicada Award of General Appraisal of China Financing.

On Jan. 8 and 9, 2009, two annual banquets for expressing gratitude to Beijing and Shanghai media were ceremoniously held respectively in Beijing Sofitel Wanda Hotel and Sheraton Shanghai Hotel & Residences by GDB. In the banquets, Mr. Raymond Lim, the vice president, declared that the number of issued GDB credit cards exceeded eight million. ? ?

? On Jan. 8, 2009, GDB Card won the BankCard Industry Construction Achievement Award in Year 2008 –

China UnionPay Standard Credit Card Market Development Award.

On Jan. 8, 2009, in the 2nd session of the honor list of Shenzhen financial billboard sponsored by

Shenzhen Special Zone Daily, the Hope Card won the "Best Charity Award". ?

二、广发卡业务知识

主要卡有:

1) 聪明卡

2) QQ卡:A金卡B普通卡。类型:广发QQ爱车卡、广发QQ都市精英卡、QQ QZONE卡

如广发聪明卡领卡及开通

3) 希望卡

4) 南航明珠卡

5) 标准卡

6) 广发卡

7) 车主卡

8) 真情卡

次要卡:

1) 网易卡

1.1广发聪明卡介绍

全新广发聪明卡特有IQ300聪明预存优惠,让您享有超高额返还奖励,加上IQ300聪明消费、分期及循环积分优惠,让您积分翻倍抵消费,回馈源源不绝。拥有全新广发聪明卡,您才称得上拥有IQ300的聪明消费智慧。

卡片开通指引

请在收到聪明卡后马上在卡片背面签上您的名字,签名须与申请表上签名一致。请确认卡片正面您的姓名拼写无误,如有误差,请马上致电95508联系更正。

若您在收到用户指南一周内尚未收到相应信用卡或领卡通知,请致电95508查询。

卡片开通

请在收到信用卡后详细阅读卡片启用函 关于卡片开通的相关指引,并请尽快开通您的卡片。

设置客户电话服务密码

为方便您使用广发卡自助电话服务系统,请根据卡片启用函中相关指引,设定6位数客户电话服务密码。

卡片保管

1、信用卡应视同现金善加保管。

2、信用卡应与有效证件分开放置,以防同时丢失。

3、信用卡应当与对应密码信分开放置,以防同时丢失。

4、失效卡片应当从中间剪开两半、破坏磁条后自行销毁,以免造成混淆与出现风险。

1.2 Receiving and Activating a GDB IQ300 Card

Description of the GDB IQ300 Card

With the brand-new GDB IQ300 Card providing the IQ300 preferential treatment for deposits, you can enjoy the super-high reward. With the IQ300 preferential treatment for consumption, installment, and circulatory accumulation of reward points, your reward points can be used for offsetting the consumption in a multiplying way. The reward is endless. You deserve to be regarded as having the smart consumption wisdom of IQ300 only by possessing the brand-new GDB IQ300 Card.

Instructions for Card Activation

Please sign your name on the back of the IQ300 Card upon receipt of it. The signature must comply with the

signature on the application form. Make sure your name on the front of the card is correct. In case of any error, dial 95508 immediately for correction.

If you have not received the corresponding credit card or the card-receiving notice within one week upon receipt of the User Guide, please dial 95508 for inquiry.

Activation of the Card

Please carefully read relevant instructions on the activation of the credit card in the card activation letter upon receipt of the card and activate your card as soon as possible.

Setting the Password for Customer Telephone Service

Please set a 6-digit password for the customer telephone service according to relevant instructions in the card activation letter for your easy use of the telephone self-service system for GDB cards.

Card Keeping

1. A credit card shall be properly kept as cashes.

2. A credit card shall be kept separately with valid certificates so that they will not be lost at the same time.

3. A credit card shall be kept separately with the corresponding password letter so that they will not be lost at

the same time.

4. An invalid card shall be destroyed by cutting it into two from the middle and destroying the magnetic strip, so

as to avoid any confusion

2.广发QQ卡领卡及开通

3. 希望卡领卡及开通

1)介绍:本着―取之于社会,用之于社会‖慈善精神,广东发展银行在中国青少年发展基金会设立―广发希望慈善基金‖,并将长期关注贫困家庭孩子的健康和教育。在此基础上,广东发展银行发行第一张全国范围的慈善信用卡―广发希望卡‖与广大的广发持卡人一起,共同募集资金,去资助需要帮助的孩子。

2)灵活捐赠方式:您可以拨打广发卡客服热线95508通过以下三种形式来实现捐赠:

1、―一次性捐赠‖,金额任选:10元、50元、100元或200元。

2、―每月定额捐赠‖,金额任选:10元、50元、100元或200元。

3、―每月定额定向捐赠‖,―您在圆梦行动-资助贫困大学生‖或―捐建组合教室‖两个项目中只能选定一个项目进行捐赠,金额任选:10元、50元、100元或200元。

捐赠的款项将通过您的广发希望卡账户捐赠到广发希望慈善基金。若您要取消或修改定额捐赠,请拨打广发卡客服热线95508办理

Card receipt and opening

Hope Introduce

With the charity spirit of ―take it from society, use it in society‖, Guangdong Development Bank sets up the ―GDB Hope Charity Fund‖ in China Youth Developing Foundations and will keep paying attention to the health and

education of children from poor families. On this basis, Guangdong Development Bank issues the first nationwide charity credit card, i.e. GDB Hope Card, to jointly raise funds with the cardholders of GDB to help those children in need.

GDB Hope Charity Fund and GDB Hope Card are the long-term, firm and persistent commitment of Guangdong Development Bank in the charity undertakings.

Flexible donation Customize love

You may dial 95508, the customer service hotline for GDB Card, to make your donation by one of the following three means.

1. One-off donation. The amount is optional: 10, 50, 100 or 200 RMB.

2. Monthly fixed-amount donation. The amount is optional: 10, 50, 100 or 200 RMB.

3. Monthly fixed-amount and oriented donation. You may choose either ―Your dream-come-true action: help

poor college students‖ or ―Donate combined classroom‖ to make donation. The amount is optional: 10, 50, 100 or 200 RMB.

The amount donated will be sent to the GDB Hope Charity Fund from your GDB Hope Card account. If you want to cancel or change the fixed-amount donation, please dial 95508, the customer service hotline for GDB Card. Flexible donation Show your love

Your daily consumption via the card automatically accumulates your love. When your reward point reaches 10000, Guangdong Development Bank will automatically withhold cash to make donation to the GDB Hope Charity Fund. You may use your reward points for donation or keep them for exchange of gifts.

Keep the card properly for safe use

Read the following notes to ensure the safe use of your card

Instructions for card opening

Please sign your name on the back of the Hope Card upon receipt of it. The signature must comply with the signature on the application form. Make sure your name on the front of the card is correct. If there is any mistake, dial 95508 immediately for correction.

If you have not received the corresponding credit card or the card receipt notice within one week upon receipt of this manual, please dial 95508 for inquiry

Card opening

Please read the instructions in the card opening letter upon receipt of the credit card and open your card as soon as possible.

Set the customer telephone service password

Please set a 6-digit customer telephone service password according to the instructions in the card opening letter for your easy use of the self-service telephone system for GDB Card.

Tips for card swiping

1. Make sure the card is within your vision

2. Your consumption is confirmed by signature. No password or identity certification is required.

3. Please check the transaction amount before you sign the bill. You may refuse to sign if there is any mistake.

4. You signature must comply with that on the card back.

5. Do not sign on any blank bill for the sake of protecting your rights and interests.

6. Please keep the transaction bill properly for account checking purpose.

7. Use your card only by yourself. Do not lend it to others.

8. Some cities may require the identification certification. Please follow the local instructions.

9. Drawing money with the credit card is convenient and swift.

4. 南航明珠卡领卡及开通

1、南航明珠信用卡介绍

由广东发展银行和中国南方航空股份有限公司联合推出,为您提供优越的航空服务及金融理财服务,让您随时享受愉快的空中旅程!

南航明珠信用卡是国际标准的信用卡,品牌分为MasterCard(万事达卡)和VISA(威士),其中MasterCard品牌设有常规卡和特型卡,一卡双币,全球通行,众多贴心特色功能(刷卡消费自动兑换飞行里程,高额航空意外保险,全额挂失前48小时失卡保障,―样样行‖免息分期付款等),优质生活,即将从这里起飞!

Introduction to the Sky Pearl Credit Card

The credit card is jointly launched by GDB and China Southern Airlines Corporation. It provides superior airline services and wealth management service to you, so that you can enjoy a happy air trip at any time.

The Sky Pearl Credit Card is an international standard credit card, including MasterCard card and VISA card. In which, the MasterCard card includes common card and special-shape card. The dual-currency cards are internationally recognized. With numerous considerate features (automatic accumulation of air mileage on

consumption by swiping the card, large-amount airline accident insurance, full-amount security guarantee within 48

hours before the reporting of card loss, and EPP interest-free payment in installments), you can enjoy the quality life from now!

(1)了解南航明珠信用卡

(2)南航明珠信用卡特型卡介绍

特型卡属南航明珠万事达卡的配套卡,仅随南航明珠万事卡常规卡配套发出,不单独发行。持卡人申请任一款特型卡,须已经持有或同时申请南航明珠万事达卡常规卡,特型卡与常规卡失效期相同。

2. Introduction to the special-shape Sky Pearl Credit Card

The special-shape card is a companion card of Sky Pearl MasterCard Credit Card. It is issued together with the common Sky Pearl MasterCard Credit Card, and is not separately issued. For applying for a special-shape card of any type, the cardholder shall have or simultaneously apply for the common Sky Pearl MasterCard Credit Card. The expiry date of the special-shape card is the same as that of the common card

5.广发卡领卡及开通

广发双币卡是国际标准的信用卡,一卡双币,全球通行。

广发信用卡拥有众多贴心特色功能(失卡保障、―样样行‖免息分期付款、邮购分期付款、透支提现等)满足您的优越生活的需求。

Introduction to GDB Cards

GDB GF Dual-currency Cards are international standard credit cards with dual currency for one card acceptable globally.

GDB Credit Cards have many intimate features (lost card protection, "EPP" interest-free installments, mail order installments, overdrawn withdrawal, etc.) to meet your daily needs of superior life.

卡片开通指引

请在收到广发卡后马上在卡片背面签上您的名字,签名须与申请表上签名一致。请确认卡片正面您的姓名拼写无误,如有误差,请马上致电95508联系更正。

若您在收到本手册一周内尚未收到相应信用卡或领卡通知,请致电95508查询。

卡片开通

请在收到信用卡后详细阅读卡片启用函 关于卡片开通的相关指引,并请尽快开通您的卡片。

设置客户电话服务密码

为方便您使用广发卡自助电话服务系统,请根据卡片启用函中相关指引,设定6位数客户电话服务密码。

卡片保管

1、信用卡应视同现金善加保管。

2、信用卡应与有效证件分开放置,以防同时丢失。

3、信用卡应当与对应密码信分开放置,以防同时丢失。

4、失效卡片应当从中间剪开两半、破坏磁条后自行销毁,以免造成混淆与出现风险。

Guideline for Card Activation

Please immediately sign on the back of the card after receipt of your GDB Card on condition that such signature shall be consistent with the one on your application form. Make sure your name on the right side of the card is spelled correctly. In case of any error, please immediately telephone 95508 to correct it.

If you do not receive a credit card or a corresponding notice of card receipt within one week upon receipt of this manual, please call 95508 for queries

Card Activation

Please carefully read the card instructions for the relevant guidelines for card opening after the receipt of the credit card, and please activate your card as soon as possible.

Customer Telephone Service Password Setting

To facilitate your use of GDB card self-service telephone service system, please set a six-digit customer telephone service password according to the relevant guidelines in the card instructions.

6. 广发标准卡领卡及开通

广发标准卡是国际标准的信用卡,双币卡一卡双币,全球通行,人民币卡可在境内外有银联标识的特约商户及自动柜员机使用。

广发标准卡拥有众多贴心特色功能(全额挂失前48小时失卡保障、自选免费保险赠送、超低的最低还款额、超长的免息还款期、―样样行‖免息分期付款、邮购分期付款、透支提现计积分等),满足您的优越生活需求。

Introduction to GDB Cards

GDB Standard Cards are international standard credit cards with dual currency for one card acceptable globally. Their RMB cards may be used in domestic and overseas franchised businesses and automated teller machines with a UnionPay logo.

GDB Standard Cards have many intimate features (lost card protection 48 hours before the loss of the card is reported in full amount, free insurance selected by the cardholder, minimum repayment amount, long interest-free repayment period, "EPP" interest-free installment payments, mail order installments, and reward point accumulation for overdrawn withdrawal, etc.) to meet your needs of superior life.

7. 广发车主卡领卡及开通

广发车主卡是国际标准的信用卡,一卡双币,全球通行。

广发车主卡,专为私家车主的您度身定造,为您和您的座驾提供全方位优惠和服务(失卡保障、100公里免费道路救援服务、自选加油优惠、高额意外险赠送、―样样行‖免息分期付款)。自在生活,自由理财,一切由您随心驾驶

8. 广发真情卡介绍

国内首张女性专属信用卡,透明卡版设计,受到高品味时尚女性的青睐。

广发真情卡是国际标准的信用卡,双币卡一卡双币,全球通行;人民币卡可在境内外有银联标识的特约商户及自动柜员机使用。

广发真情卡拥有众多贴心特色功能(全额挂失前48小时失卡保障,自选商户类型三倍积分,自选保险赠送,―样样行‖免息分期付款等),让您体验更优越的消费感觉。

三、使用指南

4.南航明珠卡使用指南

聪明选择,里程增值(里程奖励计划)

除乘坐南航航班可以累积里程外,每笔刷卡消费均自动兑换里程:白金卡每7元人民币或1美元兑换1公里里程;金卡、普通卡每14元人民币或2美元兑换1公里里程。额外里程奖励让阁下的奖励飞行来得更快,体验奖励飞行来得更快,体验奖励升舱或奖励机票的尊贵之旅。生日当月,刷卡消费更可尊享2倍里程累积。

5.广发卡使用指南

用卡双保险,安全更放心

广发卡为您提供双重用卡安全保障,当您的信用卡账户余额发生变动时,您将收到瞬时通即时短信通知,及时提醒您检查信用卡的状态。同时配合全额挂失前48小时失卡保障,在一定范围内补偿信用卡被盗用损失,让您的用卡更添保障。

瞬时通

为确保资金安全,您每笔满300元的交易,均可享受免费短信提醒,即时获知账户变动情况,用卡更安心。如果您需要所有交易的短信提醒服务,只需致电95508开通即可,费用也仅仅是每月3元。

瞬时通短信将通过端口1065800895508(移动用户)或10655020288(联通用户)发送,短信内容为―贵卡末四位xxxx于xx日xx时xx分消费RMBxxx元,………‖,请您留意。

全额挂失前48小时失卡保障

全额挂失前48小时失卡保障是银行为持卡人提供的用卡安全服务,持卡人的信用卡丢失或失窃后,在挂失前48小时内的被盗用损失可向银行申请补偿金。

保障范围

广发信用卡持卡人以乘客身份乘坐中国南方航空公司班机,将自动享有随卡附赠的航空意外保险,同行家属亦获赠高额航空意外保险,让您在旅途中倍感关怀,专享贴心保障!

保障金额

每卡最高保障金额与信用额度相等。

保障生效日

新开卡客户消费即享此项保障,连续6个月没有发生交易的信用卡将被自动取消该项功能。

瞬时通服务及失卡保障服务申请方法详见本手册信用卡管理部分。

轻松刷卡,体验优越

广发卡为您提供先消费后还款的信用卡消费方式,给您带来更方便轻松的消费体验,优越生活从广发真情卡开始。 先消费、后还款,无需预存现金

广发卡,先消费,后还款,无需预存现金即可以刷卡消费,并享受免息还款期,更可选择每月仅偿还当月10%欠款的还款方式,让你用得开心,还得轻松。

商旅预订服务

广发卡为您提供商旅预订服务,您只需拨打广发卡免费商旅服务专线800-819-9819,即可预先预订机票、酒店,更有免费送票服务。

全国联网,世界通行

广发卡可在―中国银联‖、VISA‖ 或―MasterCard‖相应标志的特约商户消费和现钞提款点提款。

广发卡更可在国际互联网络上使用。

Dual insurance for the use of cards to assure you of security

GDB Cards provide you with dual assurance for your use of cards. When the balance of your credit card account is changed, you will receive an SMS notice from Instant SMS, which will promptly reminder you to check the status of your credit card. Combined with lost card protection 48 hours before the loss of the card is reported in full, the loss arising from unauthorized use of the credit card will be reimbursed to a certain extent so that your card is better protected.

Instant SMS

To ensure that the funds are safe, when you spend at least 300 yuan per transaction, you will be provided with a free SMS reminder so that you can understand the change of your account in real time and you can rest assured of your use of cards. If you need to remind all transactions through SMS reminder services, call 95508 to apply for it. In this case, the charges will be 3 yuan per month only.

Instant SMS messages will be sent through 1065800895508 (China Mobile users) or 10,655,020,288 (China Unicom users) with the content reading "the final four places of your card xxxx realizes an expenditure of xxx yuan at xx hours on the xx day ...". Please pay attention to that.

Lost card protection 48 hours before the lost of the card is reported in full

Lost card protection 48 hours before the loss of the card is reported in full is a card safety service provided by the bank for cardholders. After the cardholder's credit card is lost or stolen, such cardholder may apply to the bank for a compensation for the loss arising from the unauthorized use of the card within 48 hours before the loss of the card is reported.

Scope of Protection:

When GDB Credit Card holders travel as passengers on the flight of Southern Airlines, they will be automatically presented with aviation accident insurance and their accompanying family members will also be presented with

large-amount aviation accident insurance, so that you feel you are cared for on the way and can especially enjoy an intimate guarantee!

Amount of protection:

The maximum amount of protection for each card is equal to its credit limit

Effective date of protection

Newly opened card customers enjoy such protection upon consumption. If a credit card is not used for any transaction for 6 succeeding months, such function will be automatically cancelled.

For the methods for the application for Instant SMS services and the lost card protection services, please see the credit card management part of this manual.

Swipe a card easily to experience the superiority

GDB Cards provide you with a credit card consumption manner with repayment after consumption to bring you a relaxed and convenient shopping experience, so that your excellent life starts with GDB Lady's Cards.

Repayment after consumption requires no cash to be deposited in advance

GDB Cards provide you with a credit card consumption manner with repayment after consumption, so that though no cash is required to be deposited in advance, you can swipe your card for spending and enjoy an interest-free

repayment period, and you may even choose to repay only 10% of the monthly arrears every month so that you can use it happily and make a repayment with ease.

Business Travel Booking Service

GDB provide you with business travel booking service, so call the free business travel service hotline of GDB Card 800-819-9819, you can book flights and hotels and be provided with free ticket delivery service

National Network and World Access

GDB Card holders can spend at franchised businesses or draw at cash withdrawal points, with corresponding logos such as "China UnionPay", ―VISA" or "MasterCard".

GDB Cards also can be used on the Internet.

Special cards cannot be used on automatic teller machines (ATM), automatic deposit machines and other plug-in terminals owing to their unique shape and their feature of no convex card number, nor can they in manually pressing businesses. In case of such cases, we sincerely remind you to transact with common cards.

Lost card protection 48 hours before the lost of the card is reported in full

Lost card protection 48 hours before the loss of the card is reported in full is a card safety service provided by the bank for cardholders. After the cardholder's credit card is lost or stolen, such cardholder may apply to the bank for a compensation for the loss arising from the unauthorized use of the card within 48 hours before the loss of the card is reported.

GDB cards also can be used on the Internet.

Swipe the card easily, and confirm carefully

Keep the card properly for safety

To protect the security of your card, please note the following.

Card Swiping Tips:

1. Please ensure that your card is in your sight.

2. Confirm your consumer spending by signing it; no password or identity certificate is required to be shown.

3. Please check the transaction amount before you sign and confirm the bill. In case of any mistake, you can

refuse to sign it.

4. Your signature must be the same as the one on the back of the card.

5. In order to ensure your rights and interests, do not sign a blank bill.

6. Please keep the transaction bill well in order to check the accounts.

7. The card is available to the cardholder only, so please do not lend it to others.

8. If you are required to produce your identity certificate in some cities, please follow local instructions for

specific operations.

Credit card withdrawals are convenient and quick

1. Domestic Withdrawal

(1) Withdrawal is available in any of our outlets and RMB cards may be used to withdraw RMB; dual-currency

cards may be used to withdraw RMB and USD. When the withdrawal currency and the card settlement

currency are not the same, the conversion shall be based on the exchange rate quotation on that date. All GDB cards may be used to withdraw RMB at our ATMs or domestic ATMs networked with our bank.

(2) Domestic overdraft of foreign currency doesn’t apply to dual-currency cards.

(3) No service charge is needed for any withdrawal of your own deposits in the same city.

2. Foreign Withdrawal

In other countries, this card can be used for withdrawal at ATMs with "UnionPay", "VISA" or "MasterCard" or in an appropriate financial institution, but it is limited to withdrawal of local currency and the conversion shall be based on the exchange rate of "UnionPay"," VISA "or" MasterCard" on the date of transaction entry.

3. General Withdrawal Steps

(1) Counter Services

(2) ATM service

Wonderful life,Preferential treatment at shops

GDB Hope Card introduces all wonderful recreation and consumption places in the city for you. You may enjoy

discounts and preferential treatment at more than one thousand especially engaged businesses. We have bound the carefully selected best treatment into book forms for your enquiry and share.Preferential treatment is endless. Please visit .cn for details.

Dainties

With all the gourmet food we carefully selected for you, as well as the respectful treatment, you may feel the special treatment offered by GDB Sincere Card. You may use Hope Card at more than 300 restaurants in China. Note: Please visit .cn for the list of shops that offer preferential treatment.

Fashionable garments

GDB Hope Card provides you with fashionable, classical and exquisite garment brands, plus the value-added preferential treatment, enabling you to keep up with the tide and show your charm. You may use Sincere Card at more than 300 garment shops in China.

Tide zone

We have collected good recreation places in the city and offer all kinds of preferential treatment for you to make your life more colorful. You may use the Sincere Card at more than 600 recreation sites in the country. Please visit .cn for the list of such sites.

Wise choice,Value added from reward points

When you use the GDB Hope Card, you are accumulating reward points. When the reward points reach a certain level, you may use them to exchange for more than one hundred gifts.

Standard for exchange of reward points

RMB1 yuan consumed =1 reward point

1 HKD consumed =1 reward point (HKD)

1 US dollar =8 reward points (USD)

Reward point inquiry

Bill inquiry: You may check the consumption reward points and the total reward points for transactions completed every month.

Online banking inquiry: You may log in .cn, the personal online banking, select the credit card service and check the available reward points through the credit card account.

Telephone inquiry: You may dial 95508, select the service language, press 5, then press 1 to check the reward points.

Reward point inquiry and exchange for gifts

Notes for exchange for gifts with reward points

Reward points are not applicable to users who enjoy the low deduction rate or zero deduction rate and special shops, e.g. real estate, wholesale, automobile sales, lottery, public utilities, securities payment, medical institutions,

government organs, charity and non-profit organization, some online trading, legal service, tuition fee, telephone rate, insurance premium and any withholding business. Reward points are not applicable to overdraft in banks and other service charges, annual fees, deposit/loan interest, overdue fee, transfer transaction, self-paid amount in reward point exchange, instant notice, late fee, etc. Reward points are calculated based on the account of the cardholder. Reward points in more than one card held by one person may be combined.

Select freely Enjoy superiority

The Universal interest-free installment has no restriction on commodities or users and is available anytime,

anywhere. The Versatile interest-free installment provides you with the most ideal installment method! Once a single consumption via the GDB Card by you reaches 500 yuan, you may dial 95508 to register the interest-free installment. The number of installment is 3, 6, 12, 18 and 24 respectively. You may select it at your discretion. Take Mr. Chen as an example. He consumes with the amount of ¥600 yuan and registers the 6-installment payment. To enjoy the free-interest advanced consumption, all he has to do is just to pay an extra of 3.9 yuan as the service charge. Money management becomes more easy.

Calculation method for service charge: service charge for each installment (each month is one installment) = amount consumed via the card x service charge rate.

Service charge rate: 0.65% for 3, 6 and 12 installments; 0.7% for 18 installments; 0.72% for 24 installments. Telephone inquiry: You may dial 95508, select the service language, press 5, then press 1 to check the reward points.

Registration

Notes:

1. This service is not applicable to the transactions via Corporate Card, Business Card and Transfer Card, or the

foreign exchange transaction.

2. The transaction via the additional card may be registered by the main cardholder.

Automatic repayment with GDB Licaitong savings card

As long as you have the Licaitong savings card of GDB, you can register to activate the service of repayment by automatic transfer. You can bind your Licaitong card and GDB credit card. Then the debt in your GDB credit card will be automatically deducted from your Licaitong account on the due repayment date every month, so that you can repay in a relaxed way.

Activation mode

Call 95508 directly to apply for the service.

Kindly reminder

1. No service charge is needed.

2. 2.You can choose either Full-amount Repayment or Minimum Repayment every month.

3. 3.Please make sure that you have enough deposit in your Licaitong account two days before the due

repayment date. 您只需拥有我行理财通储蓄卡,即可登记开通自动转账还款服务, 将您的理财通卡与广发卡绑定,从此每月在您还款到期日当天广发卡欠款将自动从理财通账户中扣缴,让您还款无忧!

温馨提示

1、免收手续费。

2、可自由选择每月全额还款或最低还款额还款。

3、请在还款到期日前两天确保您的理财通账户有足额存款。

Self-service repayment in convenience stores (Lakala convenience payment outlets)

You can repay to GDB credit card by cross-bank transfer with the UnionPay savings card of any bank through self-service terminals in any of the 20,000 convenience stores and supermarkets with the logo of Lakala in the country. Guimiantong cross-bank agency business at the counter

Customers in the following cities can go to the outlets of commercial banks supporting the Guimiantong cross-bank deposit and withdrawal service to repay to credit cards with cash.

如您在以下地区,可前往已开通 “柜面通”跨行存取款业务的商业银行网点,向广发卡存入现金还款。

Kindly reminder

1.Payment of cards issued in other places is temporarily not supported.

2.No service charge is needed.

3.The money will be transferred within 2–3 working days and the line of credit will officially be increased after transfer.

4.The service is only for cash repayment of RMB cards or RMB account of dual-currency cards.

1、推广期间免收手续费。

2、款项在2-3个工作日内入账,入账成功后所恢复额度方可正常使用。

3、暂不支持异地卡还款。

4、本业务支持广发人民币卡或双币卡人民币户口还款。

Repayment by automatic transfer/purchase of foreign exchange with GDB Licaitong savings card

If you have opened foreign currency demand settlement accounts of GDB, you can register to activate the automatic transfer repayment service to bind your foreign currency accounts with your GDB credit card. Afterwards every month the foreign currency debts of your cards of GDB will be automatically withheld from your foreign currency accounts on the day when your repayment is due, making you worry-free!

You can also choose to activate the service of automatic purchases of foreign exchange repayment to bind your RMB Licaitong savings accounts with GDB credit card, then every month the RMB deposit in your Licaitong accounts will automatically purchase foreign exchange to repay your foreign currency debts to GDB, making you worry-free! Activation mode: You can apply for handling by directly calling 95508.

Kindly reminder

1.No service charge is needed.

2.You are free to choose monthly repayment in full or repayment of minimum amount.

3.Please ensure that your Licaitong accounts have enough deposit two days before the due date of repayment.

4.Exchange rates for purchasing foreign currency are subject to the "selling price of convertible foreign exchange and spot cash" announced by GDB two days before the date when your repayment is due. Please visit our website .cn for inquiry.

如您已在我行开立外币活期结算账户,您即可登记开通自动转账还款服务, 将您的外币账户与广发卡绑定,此后每月在您还款到期日当天广发卡外币欠款将自动从外币账户中扣缴,让您还款无忧!

您也可选择开通自动购汇还款服务,将您的人民币理财通储蓄账户与广发卡绑定,每月在您还款到期日当天您理财通账户中的人民币存款将自动购汇偿还广发卡外币欠款,让您从此无忧!

开通方式

直接致电95508即可申请办理

温馨提示

1、免收手续费。

2、可自由选择每月全额还款或最低还款额还款。

3、请在还款到期日前两天确保您的理财通账户有足额存款。

4、购汇汇率以您还款到期日前两天我行公布的“现汇现钞卖出价”为准,具体可登录我行网站.cn查询。

-

【银行】20xx中国银行业发展报告

20xx中国银行业发展报告20xx0702轻金融来源中国银行业杂志20xx年第6期作者中国银行业协会行业发展研究委员会20xx年面…

-

20xx银行业发展报告

的存贷汇业务绝不是每家机构千篇一律的经营模式三更加重视国际化20xx年以来通过深化体制机制改革中国银行业获得良好发展不但完全摆脱了…

-

中国银行业协会发布《中国银行业发展报告(20xx)》

中国银行业协会发布中国银行业发展报告20xx6月30日中国银行业协会在京发布中国银行业发展报告20xx报告由中国银行业协会行业发展…

-

20xx-20xx年中国银行业发展报告内容提要

中国银行业发展报告20xx20xx内容提要编制此报告的目的在于帮助社会各界更加全面深入地了解中国银行业的经营情况和发展趋势共有16…

-

银行支持地方经济发展报告

银行支持地方经济社会发展自评报告市政府金融办我行自接到市金融机构支持地方经济社会发展考核激励暂行办法的通知后高度重视自评工作及时组…

-

银行最新项目贷款调查报告格式

银行最新项目贷款调查报告格式授信方案一授信方式1授信业务融资品种固定资产项目贷款配套流动资金贷款或相关开证保函授信2金额若是增量授…

-

银行同业授信调查报告

银行同业授信调查报告经办分行部门投资银行部主办人电话协办人电话传真申请人全称银行股份有限公司申请人信用评级申请品种及金额申请期限1…

-

民生银行授信调查报告

包商银行锡林郭勒分行养殖圈批量业务调查报告商圈类一养殖行业概况1基本情况锡盟是国家和自治区重要的畜产品基地其牲畜拥有量位居全国地区…

-

银行授信调查报告

管理资料下载大全关于xxxxxx公司xxxx万综合授信额度调查报告呈报单位客户经理呈报日期联系电话一客户基本情况1客户经济性质注册…

-

光大银行授信调查报告

第七章授信调查第一节总则第一条授信调查是指客户经理对申请人或目标客户进行全面调查收集有关信息和资料对客户和授信业务进行分析和评估对…

-

XX农村商业银行信贷服务春耕备耕总结报告

省联社XX办事处:XX农村商业银行站在服务大局的思想高度,按照银监会指导意见精神和省联社的具体要求,全力做好20xx年春耕备耕信贷…