Business Plan

L&S Insurance Solutions, Inc.

Table of Contents

(SectionⅠ — Ⅲ are done by Lossion Deng, while Section Ⅳ — Ⅶ are done by Sherry Boe)

Ⅰ. Executive Summary

Ⅱ. Company Summary

Ⅲ. Products

Ⅳ. Market Analysis Summary

Ⅴ. Strategy and Implementation Summary

Ⅵ. Management Summary

Ⅶ. Financial Plan

1

Ⅰ. Executive Summary

L&S Insurance Solutions, Inc. intents to explore a new insurance field in Beijing. On the basis of current insurance policy in China, which dictates that the citizens who have legally paid their endowment insurance for 15 years before their retirement can be guaranteed with a pension which covers their basic needs after their retirement, our business is going to make a fortune.

According to the current insurance regulation in Beijing, the unemployed cannot pay their insurance in Beijing if their registered residence is out of Beijing. In addition, some small companies do not provide insurance services for their employees due to the unsoundness of their management system. This is when L&S Insurance Solutions, Inc. comes into play. LSIS (short for L&S Insurance Solutions, the same hereinafter) aims to assist these people pay their insurance, especially endowment insurance.

LSIS possesses well-trained team of experienced owners who know Beijing’s insurance policy well and will use their knowledge to help people solve their insurance odds. LSIS provides their clients with agency insurance service, as well as related service consultation and follow-up service to ensure that their insurance is sufficiently valid to guarantee a satisfying retirement life.

The company will initially operate with a centralized office, as our company is a new field in present market and most people may require on-the-scene confirmation of the company’s existence. Thus, a fixed, licensed office can provide a regular consultation location so that clients could either select spot consultation in our office or on-line consultation on our blog. The owners have provided ¥50,000. After the first year, our own website might be established, depending on the capitals at that time.

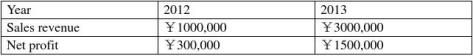

As LSIS will pay close attention to the latest possible change in government policy, and will adjust our service timely when operating our company, sales revenue is expected from ¥1000,000 in 2012 to ¥3000,000 in 2013. We will see the net profit grow from ¥300,000 to ¥1500,000 during the same period.

LSIS’s objectives for the first year of operations are:

· Provide service to at least 1,000 clients, and reach a satisfaction rate of 99%. · Become profitable from the third month of operations.

· The blog visits exceed 100,000 people.

Ⅱ. Company Summary

L&S Insurance Solutions, Inc., a Beijing company, provides insurance agent service and insurance consultation. The major investors of LSIS are Sherry Boe (50%) and 2

Lossion Deng (50%), who cumulatively own 100% of the company stock. The start-up loss of the company is ¥50,000.

Start-up Summary

The start-up expenses consist of:

Legal expenses for obtaining license and permits, totaling ¥1,000

Flyers and advertisements, totaling ¥2,000

Office supplies, ¥4,000

The rent with 15 m2 for 6 months, ¥12,000

Other start-up expenses including business cards (¥500) and phone expenses (¥500) Salary payment for 3 months (insurance included) ¥30,000

Funding for the company comes from the two owners’ investments. The two owners, Sherry Boe and Lossion Deng, contributed ¥50,000.

Ⅲ. Products

LSIS will provide its clients with qualified and customized insurance agent service. This will be achieved by contracting with clients and then assisting them to pay their insurance in the name of LSIS. LSIS will provide service of free consolation on our blog and during office hours, which is from 9am to 6pm.

LSIS will benefit from charging the royalty by 10 percent of the insurance amount.

The categories of insurance agent service include:

· Endowment insurance

· Maternity insurance

· Accident insurance

· Medical insurance

· Unemployment insurance

Ⅳ. Market Analysis Summary

The city of Beijing has implemented this policy many years ago, dictating that the unregistered Beijing residents who are not currently employed in any registered business is not entitled to be insured. In addition, many small businesses fail to insure their employees due to reasons of all kinds. As a result, a host of people in Beijing are in great need for insurance, especially for endowment insurance.

3

A recent census shows a 6.8% growth last year in the number of uninsured people in Beijing, resulting in a total of 25,000 uninsured people in 2011. Among them 15,000 are unemployed.

Target audience(s)

LSIS primarily targeted at the unemployed and the uninsured employees, typically in small companies.

The initial target audiences primarily lie in three groups of people:

· The former employees of a bankrupted company where Ms. Deng used to do her internship.

· Friends of our current teachers.

· Alumni

In the second stage, we will concentrate on expanding the target audience by the marketing strategy, as discussed in the next section.

Ⅴ. Strategy and Implementation Summary

The marketing strategy of LSIS will focus on procuring new clients through three methods.

· Put up online advertisement in social network site, e.g. renren social website, xinnangweibo (the Chinese twitter), etc.

· Hand out professional flyers in business districts, e.g. Guomao, the world trade center in Beijing; Zhongguancun, the most influential science and technological zone in Beijing. According to the statistics released by the official website of investment in Beijing, an average of 11 businesses go bankrupted on a monthly basis in Zhongguancun.

· Send emails to the people on our email contact list to illustrate the business of our company. Collectively the two owners have more than 600 people on the contact list, 40% of whom are potential clients.

Implementation Strategy

LSIS exercises a clear and efficient division of labor. Ms. Boe takes the responsibility of company management and operation, which includes contracting, banking and finance, office supplies purchasing, recruitment and on-job training. Ms. Deng is responsible for opening the market, advertisement and business service.

4

The business is done online or in person.

Ⅵ. Management Summary

LSIS is owned by Sherry Boe and Lossion Deng. Ms. Boe acts as the COO and CFO of the company. She holds a Bachelor’s Degree in English from Beijing University of Chinese Medicine. Ms. Boe minored in finance and accounting, and attended in advanced business management courses for two semesters.

Ms. Deng acts as the CEO of the company. She also holds a Bachelor’s Degree in English from Beijing University of Chinese Medicine. She minored in marketing management and has a deep understanding in the field of insurance. What is more, Ms. Deng did a 3-month internship in sales department. She also participated in the on-job training of social insurance of talent center, and was in charge of the file management in the talent center for 3 months.

It is expected that Ms. Boe and Ms. Deng will collectively handle the company’s operation until additional staff are hired. The new staff, expected to be 5 to 10 people, are to receive on-job training and to do part-time job, both of which are arranged at weekends.

The two owners will receive salaries of ¥6,000 per month once sales revenue have exceeded ¥100,000. The part-time employees will be paid ¥150 per hour. On weekdays Ms. Boe and Ms. Deng will each have one secretary, who will receive salaries of ¥3,5 00 per month.

Ⅶ. Financial Plan

The start-up capital comes from the owners and the loan. With successful management, the company will see its net revenue steadily increase in two years. LSIS will maintain a healthy gross margin, which combined with reasonable operating expenses, will provide enough cash to finance further growth.

Here are the projected sales and profit calculations for the first two years of operation:

5

-

5BusinessPlanSampleword

ProgramSupportedbyWaltonInternationalHongKongBusinessPlanAugust2020xxIhereb…

-

My business plan

MybusinessplanEverygraduatefacesaquestionwhenhestartshiscareerWanttobeasmal…

-

Businessplan 德语商业计划书范例

BusinessplanvorlageWRMGmbHImFolgendenfindenSieeineformatierteWordvorlagefrI…

-

Business Plan商业计划书-模板

BusinessPlan商业计划书一现有客户资源情况个人客户情况1为示例公司客户情况1为示例二潜在客户情况三如果加入XX公司请大致…

-

My Business Plan综合英语作文

综合英语MyBusinessPlanMybusinessplanistostartaKTVanditsnamewillbecall…

-

Business Economics 商业经济学essay范文

BusinessEconomics经济学的橘色目录介绍1供给和需求是如何影响汇率的外币吗2了解各种贸易壁垒制度的有效性这些实体实施…

-

外国教授建议的Business Plan Outline

BusinessPlanOutlineforTFSUTCCStudentsMayJune20xx50920xxCEOIExecutiveSummary…

-

业务计划评估指南Business Plan Assessment Guide

总则制定该指南是为了确保在整个开发周期中IPMT和PDT能够全面考虑业务和项目的所有环节IPMT和PDT团队应当用这些问题为决策评…

-

5BusinessPlanSampleword

ProgramSupportedbyWaltonInternationalHongKongBusinessPlanAugust2020xxIhereb…

-

My business plan

MybusinessplanEverygraduatefacesaquestionwhenhestartshiscareerWanttobeasmal…

-

14 Business Proposal 商务建议书

BusinessProposal商务建议书建议书是指单位或个人对某项事业或工作有所研究和思考进而向有关领导政府企事业单位专业团体提…